Berlin-based fintech Bitwala has rebranded to Nuri as it launches a redesigned web and mobile app.

As part of its development and growth strategy, the firm is rebrading with the aim of broadening its appeal by becoming more inclusive to people at different stages of life.

The mobile bank account enables customers to manage their day-to-day finances and easily invest in digital assets, with more investment solutions in the pipeline.

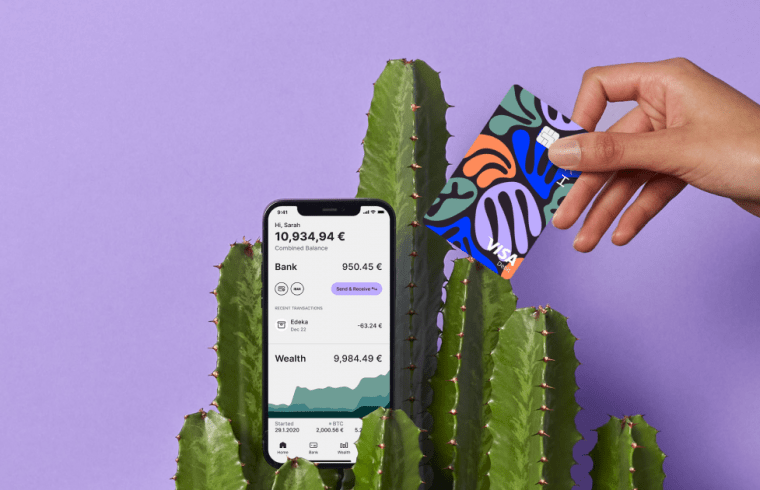

Besides the name and visual identity, Nuri’s mobile and web app have been redesigned to appeal to a wider audience and create a foundation for the launch of further innovative products in the near future.

The new “Home” section offers an overview of the current status of one’s finances as well as simple and direct access to the most important daily relevant information & actions (for example account balance and card settings).

The new “Bank” section opens up a more intuitive bank account experience for customers to manage daily finances easily and conveniently.

With the newly designed, free VISA debit card, customers can pay and withdraw money anywhere in the world – as often as they want, without any fees. Existing customers can continue using their Bitwala debit card or order a new Nuri debit card for free.

Kristina Walcker-Mayer, CEO at Nuri formerly known as Bitwala, commented: “With Bitwala, we have bridged the gap between the old and new worlds of finance, empowering hundreds of thousands of people to benefit from new financial innovations and the world of cryptocurrencies – but this was just the beginning. Blockchain technology will continue to create entirely new, better financial products than we can even imagine today.

“Making such products & services accessible to even more people requires a brand and user experience that is inclusive and appeals to a diverse audience. Our new Nuri brand and revamped customer experience are the foundation for additional innovative products and features we will offer our customers in the coming months and years.”

Philipp Beer, Nuri’s Chief Growth Officer, said: “The old banking world is gradually being replaced by new players offering mobile and digital-first banking. But even with new interfaces and a better customer experience, they remain stuck in the old reality.

“Zero or even negative interest rates bring little return on savings, remittances still often remain slow and expensive, and let’s not even talk about investments in novel asset classes like Bitcoin. With Nuri, we are combining existing banking infrastructure with innovative technologies like blockchain and decentralized finance to give everyone out there easy access to the new reality of banking.”

The huge growth in demand for crypto products has fueled Nuri’s expansion in recent months, reaching operational profitability just two years after launching its banking service.

In the first quarter of 2021, the fintech added about 50,000 new customers and increased its customers’ deposits by 400 percent. In the last six months, its workforce has grown by more than 50 percent.