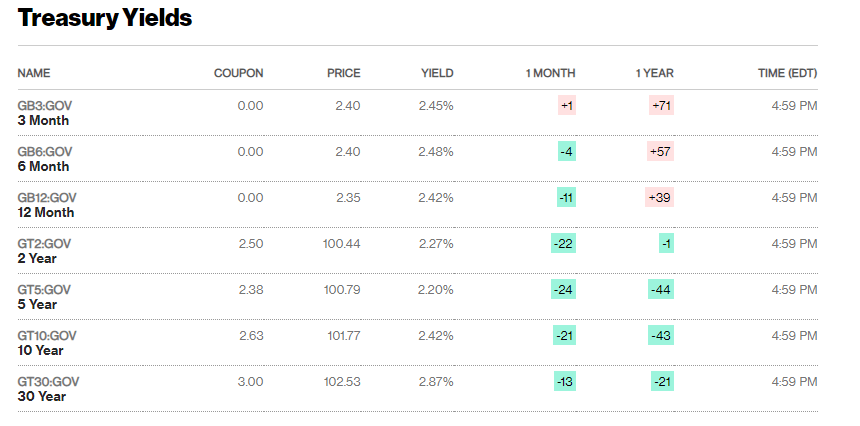

Summary: The Dollar and risk appetite stabilised as US bond yields rebounded off lows seen yesterday. Market sentiment was hit hard late last week due to global recession fears spurred by anaemic manufacturing PMI’s from the developing nations. The benchmark US 10-year treasury yield rebounded off 15-month lows to 2.42% from 2.4%. This lifted the Dollar higher against its lower yielding rivals despite a weaker than expected US Consumer Confidence read. Housing Starts, Building Permits and the Case-Shiller Home Price Index also missed forecasts in the world’s largest economy. The Dollar Index (USD/DXY), a measure of the Dollar against a basket of currencies, rallied 0.25% to 96.807 (96.54). A fall in Germany’s consumer climate weighed on the Euro, which fell 0.4% to 1.1270 (1.1314 yesterday). Risk currencies, the Australian Dollar, Canadian Dollar and Norwegian Kroner lifted modestly against the Greenback. USD/JPY climbed 0.45% to 110.55 (110.00 yesterday).

- EUR/USD – The Single Currency, the most liquid of the Dollar’s Rivals fell following the release of weaker-than-expected German GFK Consumer Confidence data (10.4 vs 10.8). The Euro slipped to 1.1260 lows this morning before stabilising at 1.1268.

- USD/JPY – The Dollar lifted to an overnight high of 110.69 following its slump over the weekend to 109.74 and 110.00 yesterday. USD/JPY, sensitive to movements in the US 10-year yield reacted to higher levels overnight at 2.42% from 2.40% yesterday. In contrast, Japan’s 10-year JGB yield was up one basis point to -0.08%.

- AUD/USD – The Australian Dollar extended gains to 0.7140 (0.7105), lifted by the market’s improved risk appetite.

- GBP/USD – the British Pound closed little-changed at 1.3207 from 1.3197 after trading in a 1.3158-1.3261 range, par for the course. Sterling strengthened on reports that more UK lawmakers are leaning toward supporting PM May’s Brexit deal.

On the Lookout: The Dollar’s rally was due to improved risk sentiment and a stabilisation of treasury yields. Markets shrugged off the data releases yesterday, all the US data missed forecasts. Consumer Confidence declined for the fourth time in 5 months. The New York based Conference Board Index fell to 124.1 March from 131.4 the previous month. US Housing Starts slipped to 1.16 million units from 1.23 million in March while Building Permits eased slightly.

Today sees the RBNZ Official Cash Rate decision and Official Statement (12 noon, Sydney). The RBNZ is expected to stand pat on interest rates. ECB President Mario Draghi speaks at an ECB Conference in Frankfurt. The UK releases its Realised Sales data for March. In North America, Canada and the US report on their respective Trade Balances. US Current Account (March) is also due today.

Trading Perspective: Expect further stabilisation of markets today in Asia. However, weaker US economic reports continue to trickle in.

The US 3-month to 10-year yield curve remains inverted. Not a good sign for any sustained Dollar recovery. Market positioning remains long of US Dollar bets against most of the major currencies.

- EUR/USD – the Euro should stabilise around current level and continue to trade around 1.1300. Expect the immediate support at 1.1260 to hold with 1.1300 immediate resistance for today. The latest COT report saw speculative Euro shorts at multi-year highs. Look to buy dips with a likely range today of 1.3160-1.3210. Business Insider reported today that China signed an order worth USD 34 billion (EUR 30 billion) of (European) Airbus 300 aircraft after is suspended licenses for (US) Boeing 737 Max aircraft. While no one knows the details of the finance of this deal, the demand for the European currency will be there.

- USD/JPY – The Dollar should stabilise against the Yen in Asia today with immediate support at 110.10 holding. Immediate resistance can be found at 110.70 followed by 111.00. Look for a likely range of 110.10-80 today, prefer to sell rallies as the market remains short of JPY bets.

- GBP/USD – Sterling continues to trade within a wider 1.30-1.34 range while UK politics muddle Brexit’s end-game. The latest COT report saw a 62% reduction of GBP shorts. Speculative GBP shorts stood at -GBP 13,774 bets against the previous week’s -GBP 36,696. This should provide more two-way trading in the Pound, in typical volatile fashion. Immediate resistance lies at 1.3260 followed by 1.3310. Immediate support can be found at 1.3160 and 1.3110. Look to trade a range close to last night’s 1.3160-1.3260. Stay neutral.

- AUD/USD – The Australian Dollar closed just below its overnight high at 0.7140 (0.7148). Immediate resistance can be found at 0.7150 followed by 0.7180. There is immediate support on the day at 0.7110 followed by 0.7080. The Aussie Battler could see further gains particularly if the US Dollar sees more selling. Look to buy dips in a likely 0.7120-0.7170 range today.

Happy trading all.