Asian stocks finished mixed after yesterday’s sell-off amid fears of US recession and weak macro data as Japanese’s January month all industry activity index lagged behind at +0.2% forecast to -0.2%. In Japan, the Nikkei225 main index rebounded 2.15 percent after hitting yesterday’s five-week low, to 21,428, the Hang Seng benchmark in Hong Kong finished 0.15 percent lower at 28,485. The Shanghai Composite finished 1.51 percent lower at 2,997 and in Singapore, the FTSE Straits Times index gained 0.27 percent at 3,192. The Aussie ASX200 fell 1.1% yesterday with growing concerns of a global economic slowdown and some perceived signs for a potential US recession. While those concerns still linger, the ASX200 index managed to lift 4 points or 0.07% to 6130.6.

In commodities markets, Light Crude Oil got some bids after the correction move yesterday and trades at 59.42. Brent oil also traded higher to $67.60/barrel. Gold retraced back to $1316 after hitting the high at $1323 during the Asian session. XAUUSD’s immediate resistance stands at the previous high at $1323 while more offers will be found at the 1330 zone. The precious metal may find support at $1313 where the 100-day moving average crosses and the low from yesterday, ahead of testing the 200-day simple moving average down to $1307. The yield on the benchmark 10-year Treasury note was lower at 2.388%, while the yield on the 2-year Treasury note and the 3-month yield were also lower at 2.233% at 2.454%, respectively.

A cautious start for equities in the early European session mirroring the mixed sentiment seen in US equity futures, with investors digesting the FED forecasts and watching the developments surrounding Brexit, DAX30 giving up 0.29 percent to 11,313, CAC40 is 0.03 percent higher at 5,262 while FTSE100 in London is 0.06 higher at 7,182.

On the Lookout: The Germany Gfk Consumer Confidence Survey below forecasts (10.8) in April: Actual (10.4). In America’s macro calendar, we have the April GfK consumer confidence in Germany, March confidence and production outlook indicator in France along with final 4Q GDP and February finance loans for housing in the UK. In the US, there’ll be the February housing starts and building permits, January FHFA house price index and S&P CoreLogic HPI data, and March Richmond Fed manufacturing index and Conference Board confidence indicators.

In Central Bank Calendar today, we have the Fed’s Rosengren and Evans who are both due to speak in the morning in Hong Kong while the BOE’s Broadbent and Fed’s Harker and Daly are also due to speak during the day.

Interest rates Market expectations: For the Fed, markets don’t expect any further rate hike in 2019, down from two rate hikes previously, and now see only one hike in 2020. Traders keep pricing in the first ECB rate hike at some point in H2 2020.

Trading Perspective: In forex markets, risk sentiment should reflect a slightly positive mood at the start of the European session, but cautious tones are likely to prevail throughout. AUDUSD is trading higher at 0. the Kiwi, (NZDUSD) trading higher at 0.6898 on repositioning ahead of the RBNZ monetary policy decision this week. The US dollar index is adding 6pips and now is trading at 0.9608.

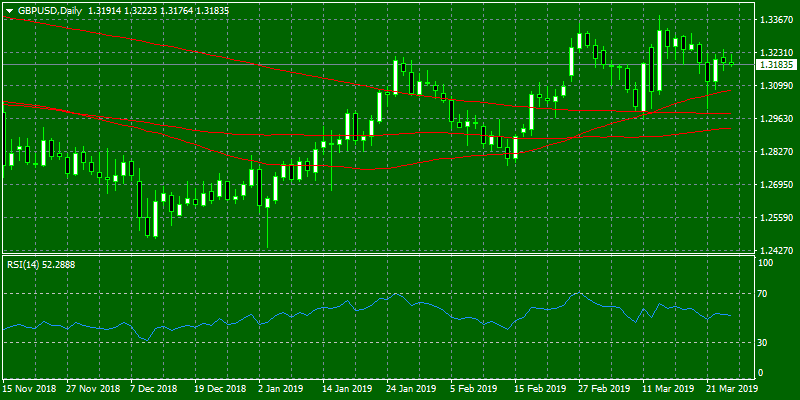

GBPUSD is trading in a narrow trading range between the 100 & 200-hour moving average. The short term technical picture is neutral for Sterling, and on the downside, major support will be found at 1.3057 where it crosses the 50-day moving average while more protection can be found at the 200-day moving average around 1.2982. On the flip side, major resistance can be found at 1.3167 where the 50-hourly moving average stands and then at 1.3232 the cross point of the 100 and 200-hourly moving averages while 1.3382, the yearly high, will be met with strong supply.

In GBP futures markets traders trimmed their open interest positions by almost 2K contracts on Monday from the previous day. In the same line, volume shrunk for the second consecutive session, this time by around 21.3K contracts.

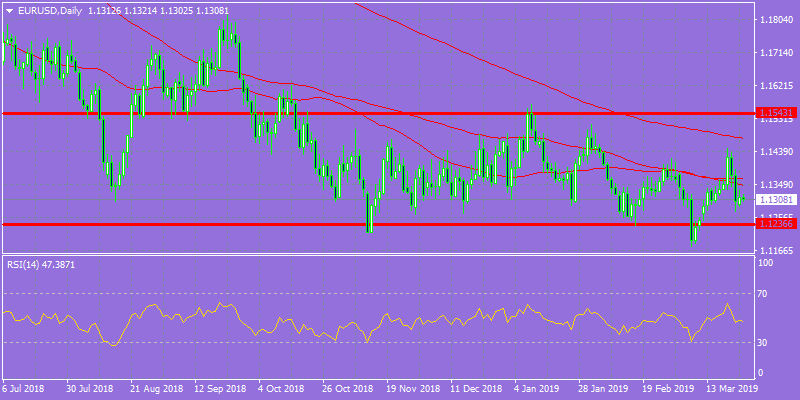

EURUSD is holding the 1.13 level but failed to make any significant move to the upside, capped at the 1.1330 zone. Euro will find immediate resistance at the 200-hour moving average at 1.1338 and is looking to break above in order to establish a new bullish trend targeting the yearly high at 1.1570. The low from Friday session at 1.1276 provides solid support, and further protection can be met at the horizontal support line at 1.1236.

On the Euro political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist and right-wing option among voters.

In Euro future markets, trades rose by just 881 contracts at the beginning of the week from Friday’s final 484,855 contracts, according to preliminary figures from CME Group. On the other hand, volume reversed three consecutive daily builds and dropped markedly by nearly 119K contracts.

USDJPY trades at 110.12 in a very quiet session as the pairs trades in just 20 pips range, next major support for the pair stands at 110 round figure. Immediate resistance for the pair stands at 110.45 the 50-day moving average and then at the 111 round mark followed by 111.19 where the 100-day moving average stands.

Open interest in JPY futures markets decreased by almost 800 contracts on Monday, while volume extended the choppy performance and dropped by around 54.4K contracts.