By Giles Coghlan, Chief Currency Analyst, HYCM

The past couple of years have highlighted the fragility of our supply chains and while, – Omicron notwithstanding – we’ve managed to collectively mitigate the risks of bad outcomes and have gone some way to restoring at least a semblance of normality, our supply chains are still reeling.

A Perfect Storm in Coffee

The human and economic costs of the pandemic have been enormous, with inflation on the rise and goods still not finding their way to where they’re needed most. For some, the canary in the coal mine has been the soft commodities that have a host of extraneous factors in their production. When combined with the disruptions owing to Coronavirus, these products reveal just how lean our global supply networks were coming into the pandemic.

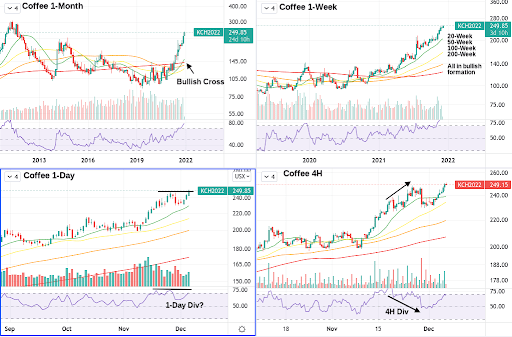

Back in July when we covered coffee at length, it had just broken to 7-year highs off fears that an adverse growing season would see global supplies tightening. Towards the end of the month, coffee futures shot up by 20% as production was threatened by unseasonably cold weather in Brazil, the world’s largest producer of arabica beans. This news caused the price to shoot to its highest level since October 2014.

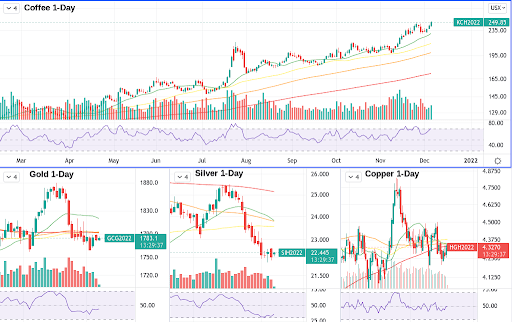

The world had also been dealing with a shortage of shipping containers that had contributed to generally elevated commodity prices, but the combination of supply chain difficulties and poor harvests have caused coffee prices to remain firm despite the broader commodity correction that followed. For example, gold, silver, crude oil, and copper are all currently trading below their respective 200-day moving averages while coffee futures are trading around 44% above the 200-day (red line).

After a brief cooling-off period between July and September, coffee prices have surged by another 20% to their highest level since September 2011.

The current supply squeeze, which has arisen from the combination of a bad crop and post-pandemic supply chain disruptions, has taken the price beyond the 2014 spike when a very wet December, followed by Brazil’s worst drought in a decade, led to a 5.4% downturn in production.

The current price is now just 20% away from 2011’s high that, much like the present situation, resulted from more than just inclement growing conditions and was part of wider price inflation following the policy response to the 2008 financial crisis.

Global Shipping Worsening a Bad Situation

The present disruptions in global shipping are exacerbating the problem by preventing supply from other destinations like Vietnam and Columbia that would otherwise alleviate the shortage in Brazilian beans. Inflated prices also come with other pitfalls.

Recently, Bloomberg covered Ethiopian and South American suppliers that have been defaulting on contracts with international buyers that were booked at lower prices. The article also highlights an interesting case of commercial participants holding near-record net shorts on the commodity, which could be a catalyst for an even further melt-up in prices as those short positions begin to be covered.

Finally, just as inflation has not proven to be transitory, the shortfall in quality coffee beans may also prove to be a more persistent phenomenon. 2021’s poor crop conditions mean that 2022 will not prove to be an opportunity for coffee producers to build stocks as they tend to do on an “on-year” “off-year” basis. Furthermore, the La Nina weather front that hammered coffee crops this past year is now expected to carry on through to the spring of 2022.

The Technicals

The chart is overbought by every measure and at every timeframe, including the monthly. Historically, you’d expect a mean reversion at around this point. The record shorts mentioned above appear to have been speculating that prices overshot earlier this year. Despite all this, the chart does bear some of the hallmarks of a strong and intact bullish trend, including strong volumes and price remaining above all major moving averages at a variety of timeframes.

There are some slightly concerning RSI divergences showing up on the 4-hour timeframe, and one possibly forming on the daily, though these are absent on the weekly and monthly, which would lend them more weight. The daily chart is one to watch as the present break to new multi-year highs is currently diverging from the RSI, which is still registering as a lower-high relative to November’s price action. Ideally, the bulls want to see a bit more follow-through from here, taking the RSI beyond 74 in order to quell any concerns that the rally may be running out of steam.

Coffee CFD is available to trade with the established and multi-regulated global broker, HYCM, as well as 300+ other instruments in commodities, forex, indices, stocks, and more.