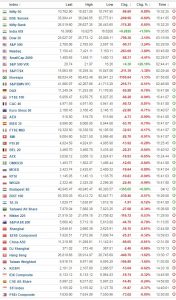

Summary: Global equity market which started the week on positive note over headlines from weekend on trade truce between China & U.S.A for next 90 days have taken a bearish tone as trading session progressed into the week. Positive influence from news that had major impact on market fizzled out shortly owing to multiple factors such as lack of clarity of trade truce and flattening Treasury yield curve which sparked recession warning. Aside from geo-political issues major markets faced their own issues which had impact on price action of equities as well.

Central banks across the globe have acknowledged signs of economic slowdown in major markets and this comes in the heel of one of the most fast pace growth in equity market history as visible from highly bullish equity performance during 2017 post which markets across the globe began to suffer as US President Donald Trump began waging trade war on multiple front. As US Greenback’s value increased in broad market supported by safe haven demand from ongoing trade wars boosted by multiple rate hike from US Fed emerging markets also suffered slowdown in economy due to major goods and commodities being priced in USD and higher exchange rate hurt business progress.

- The US Dollar index (USD/DXY) has managed to retain upper hand despite slide in T.Yield as FOMC member Williams reassured that rate hike would go as planned regardless of change to forward guidance despite gloomy comments from Fed Chair Powell during his speech last week.

- Slide in T.Yield resulted in fear of slowdown in US Economy which combined with dovish cues from Asian and European markets pushed US Equities on sharp fall overnight. Dow Jones Industrial Average Index lost over 700 points during slide in yesterday’s trading session.

- Hopes of positive outcome post 90-day Sino-U.S. trade truce continues to dwindle as no positive signs of progress or additional details were released post the weekend headlines.

- Fear of slowdown in global economy and cues from Wall Street’s overnight decline has influenced bearish price action across Asian and European equity markets.

On the Lookout:

- Brexit – Brexit legal advice from the Attorney General is scheduled to release today as PM May suffered another road block in her attempt to gain support to her Brexit deal as her government is now held in contempt of Parliament over its refusal to release legal advice and attempts to hide the same. This move also resulted in a new amendment being passed to give UK parliament more power over Brexit if PM May’s deal fails to gain vote of approval.

- Protest in France – In a televised address, PM Edouard Philippe announced that Fuel tax raise which led to weeks of violent protests in France has now been postponed for six months. He also said that the next planned raise in the so-called carbon tax on vehicle fuel which had been due to come in on 1 January and planned increases in gas and electricity prices this winter would be halted, and that a toughening of the rules for vehicle emissions tests would also be postponed to allow consultations across the country to see what accompanying measures might be introduced to ease the burden for the worst-off.

- Crude Oil – Oil prices declined 1% today, weighed down by raising US inventories and a plunge in global stock markets amid concerns over an economic slowdown ahead of OPEC summit scheduled to occur this weekend. Oil prices were pressured by a weekly report from the American Petroleum Institute (API) that said U.S. crude inventories raised by 5.4 million barrels in the week to Nov. 30, to 448 million barrels, in a sign that U.S. oil markets are in a growing glut.

- Economic Data Release & Events – U.S. stock markets will be closed today in observance of a national day of mourning for President George H. W. Bush. UK market sees the release of BOE FPC Minutes & Services PMI while Canadian market sees release of BOC interest rate decision and rate statement.

Trading Perspective:

- AUD/USD – The AUD/USD pair held on the dismal Aussie macro data-led weakness and remained heavily offered near weekly lows which were further aggravated by strong demand for US Greenback in broad market supported by hawkish comment from FOMC member Williams and bearish rout in equity market. It would now be interesting to see if the pair is able to find any buying interest at lower levels or the ongoing slide marks the end of the recent up-move amid fading optimism over the US-China trade truce.

- USD/JPY – The USD/JPY pair caught some bids on early Asian market hours and managed to recover a part of the previous session’s sharp fall to two-week lows that saw the pair slip over 100 pips owing to bearish influence from T.Yield curve inversion, positive comments from Fed Williams helped limit downside move. However bearish rout in Wall Street & other major global equity markets continue to underpin demand for Japanese Yen.

- EUR/USD – The EUR/USD pair erases entire losses and looks to regain the 1.1350 barrier in early European market hours despite the risk-off action seen on the European equity markets and broad based USD demand as liquidity is expected to be thin in US market hours owing to market holiday while EURO bulls are also supported by upbeat Eurozone macro data giving the pair a temporary upward boost in price action.