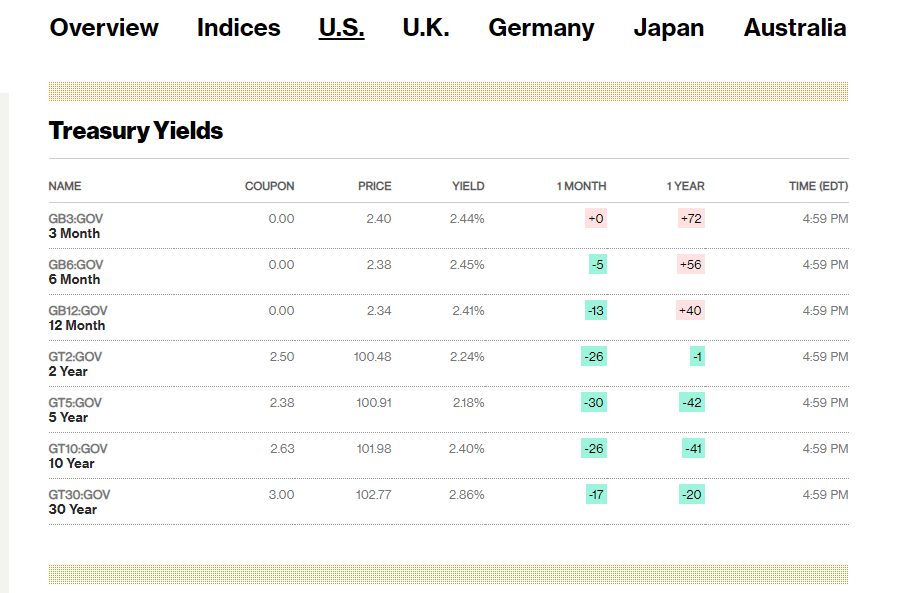

Summary: US bond yields slumped anew, the benchmark 10-year briefly falling under 2.4%, the first time since December 2017. Purchases of US Treasuries across the board saw the 2-year drop 7 basis points to 2.25%. For the second day in a row, the US yield curve inverted with the 10-year yield (2.4%) lower than the 3-month bill rate (2.44%). Fears of a recession due to the US yield curve inversion were allayed by a stronger-than-expected German business confidence survey. In the US, Robert Mueller’s investigation found that President Trump’s campaign conspired with Russia in the 2016 presidential election. This is a big win for Trump and his supporters, and buoyed equities.

The Euro rallied 0.15% to 1.1315 from 1.1297. Against the Yen, the Dollar recovered following yesterday’s slide to close at 110.00 after hitting 109.70 yesterday. Sterling was little-changed at 1.3212 while the Aussie rose 0.44% to 0.7107 (0.7079). Turkey’s Lira bounced back 3.3% to 5.5640 after its over 5% slump yesterday, leading most EM currencies higher. The Thai Baht extended gains, up 0.6% against the Greenback to 31.55 following yesterday’s Thai election results.

Wall Street stocks pared losses. The DOW finished up 0.07% at 25561. The S&P 500 ended 0.05% lower at 2804.00.

- The US 10-Year Bond Yield closed at 4%, down from 2.44% yesterday. Rival global ten-year yields were also down but not to the extent of those in the US. Germany’s 10-year Bund yield ended one basis point lower at -0.03%. The low level of the benchmark US bond yield will keep both the US Dollar and stocks under pressure.

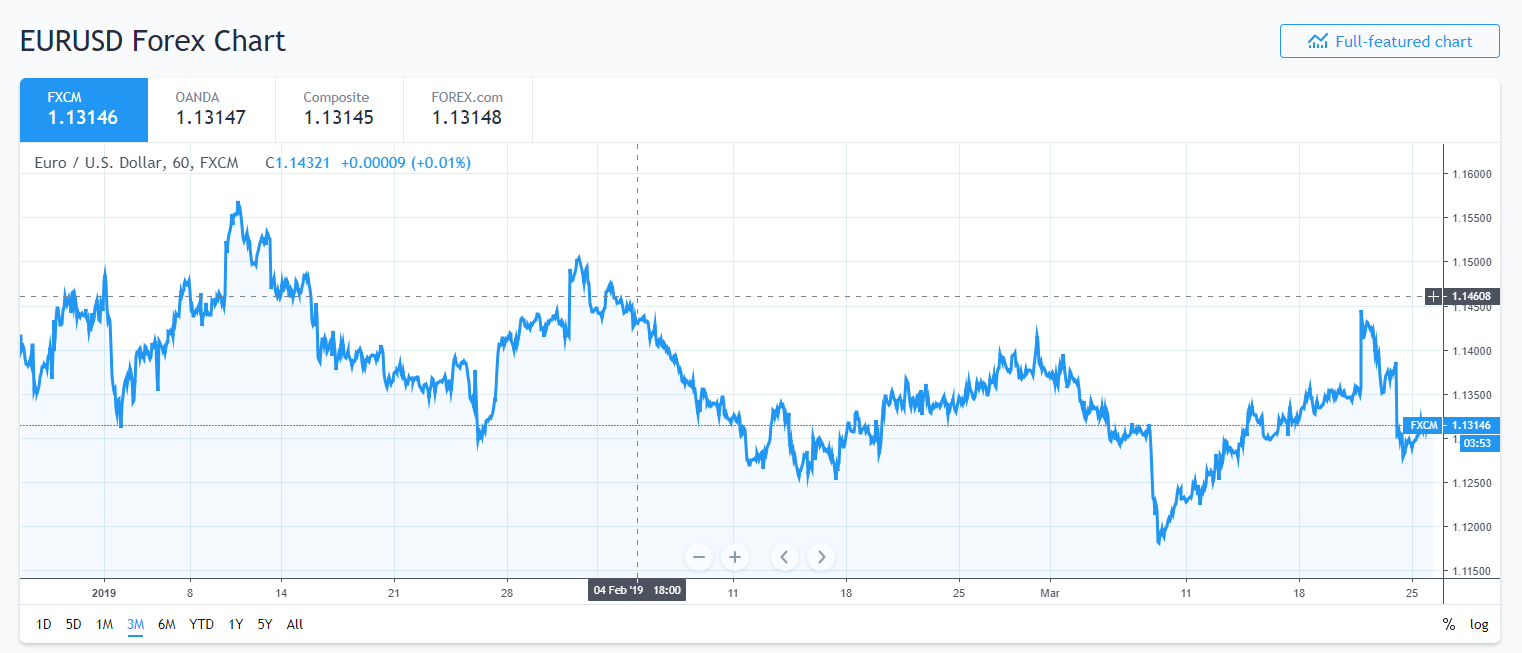

- EUR/USD – The Single currency recovered to 1.1315 on the back of better-than-expected German Business Climate, up at 99.6 from 98.5 and a forecast 98.7. The report ended 6 consecutive months of decline. EUR/USD will stabilise at current levels with short Euro market positioning support.

- USD/JPY – The Dollar-Yen recovered somewhat after plummeting on a combination of risk-off mode and lower US bond yields. USD/JPY finished up 0.10% at 110.02 (109.92 yesterday). Rallies today will be limited to the overnight highs of 110.24.

- GBP/USD – The Pound was little-changed at 1.3194. PM May looks likely to secure an extension to the March 29 deadline to May 22.

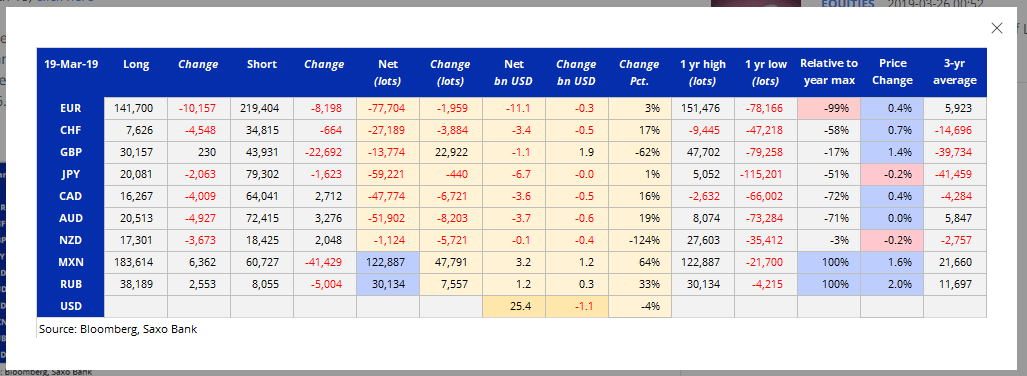

- AUD/USD – The Aussie rallied 0.4% to 0.7107 on a generally weaker Greenback and stronger EM currencies. The latest Commitment of Traders report (week ended March 19) saw an increase in speculative Aussie short bets.

On the Lookout: Markets will focus on the economic data releases today to get a clearer view of the global economy. The day begins with New Zealand’s Trade Balance with an improvement expected from last month’s deficit of -NZD 914 million. Japan, whose economy has also slowed, sees the BOJ report on its assessment of the economy and inflation in the BOJ Summary of Opinions due this morning. The BOJ also releases its Tokyo Core Annual CPI report. Germany’s Consumer Climate report is the main data out of Europe. The US has a big data day with Building Permits, Housing Starts and it’s Shiller Composite 20-year House Price Index. The US Conference Board’s Consumer Confidence Index ends the day’s data releases.

On the China-US trade front, both countries are expected to strike a deal in April. US Treasury Secretary Steve Mnuchin and US Trade Representative Robert Lighthizer are headed to Beijing on Thursday for further talks with Chinese officials, CNBC reported.

Trading Perspective: The fall in US bond yields were not matched by its global peers. Without yield support, the Dollar is unable to rally. The Fed’s more dovish tone will continue to weigh on the Greenback.

Market positioning, currently long USD bets against most Major currencies, puts further pressure on the Greenback. The latest CFTC Commitment of Traders report (week ended March 19) saw speculators add to long USD bets against the Euro, Yen and Canadian and Australian Dollar. The British Pound was the only major currency where shorts were cut. According to Saxo Bank, which publishes the chart, short Sterling bets were cut by a massive 62% to a 9-month low. Once again, it’s the breakdowns in the different currencies that provide interest for traders.

- EUR/USD – The Euro touched near 3-week lows on Friday to 1.12733 weighed by weaker Euro area PMI’s. Germany bore the brunt of the softer manufacturing PMI’s. Yesterday, German Business Climate rose for the first time after 6 consecutive monthly falls. German 10-year Bund yields were one basis point down to -0.03%. The US 10-year was four basis points lower at 2.40%. The latest COT report (week ended March 19) saw speculative EUR shorts increased to -EUR 77,704 bets from -EUR 75,745. These are the biggest shorts since October 2016. A warning sign to the speculative shorts who continue to look for a lower Euro. Immediate resistance lies at 1.1330 followed by 1.1360. Immediate support can be found at 1.1290 followed by 1.1270. Look to buy dips today.

- USD/JPY – the Dollar slumped against the Yen to near 2-month lows at 109.709 before rallying to settle at 110.02. Improved risk sentiment buoyed the US currency to a high of 110.24. The fall in the US 10-year yield will keep this currency pair heavy. Japan’s 10-year JGB yield was one basis point lower to -0.09%. The latest COT report saw a modest increase in short speculative JPY bets to -JPY 59,221 contracts. Immediate resistance at 110.20/30 should hold. Immediate support can be found at 109.70/80 followed by 109.30. Look to sell any rallies to 109.20 today.

- AUD/USD – the Australian Dollar rallied to 0.7117 overnight before easing to 0.7107. Market sentiment remains bearish on the Aussie and the positioning reflects that. Net speculative Aussie Dollar shorts saw the biggest increase among the major currencies, totalling -AUD 51,902 contracts from -AUD 43,699. Immediate resistance for AUD/USD is found at 0.7120 followed by 0.7150. The Aussie has immediate support at 0.7080 followed by 0.7040. Look to buy dips in the Australian Dollar, it should head higher.

Happy trading all.