Summary: The Dollar plummeted against the Yen but rallied versus the Euro following another round of disappointing economic data from the Eurozone. USD/JPY finished down 0.85% at 109.95, near two-month lows. The Euro slumped to 1.1273, before settling at 1.1300 against the Greenback, down 0.67%. Stocks and global bond yields sank as investors fretted about a potential recession in the coming 12-18 months. Euro-area March Flash Manufacturing PMI’s underwhelmed with Germany bearing the brunt of the global manufacturing slowdown. US March Flash PMI’s also fell with both indicators missing forecasts, although not to the extent of the Eurozone. The Dollar rose against the resource currencies, Aussie, Kiwi and Loonie. Sterling climbed 0.8% to 1.3210. after EU leaders gave PM May a 2-week reprieve (to April 12) to decide a new way for Britain to leave the EU. The Greenback soared 5.25% against the Turkish Lira (+5.25%), climbing against most EM currencies. The Thai Baht finished little-changed after the country’s first democratic election in 8 years saw the ruling military junta re-elected with 90% of the count in.

The US DOW fell 1.58% while the S&P 500 closed 1.73% lower at 2,806 (2855 Friday). The yield on the benchmark US 10-year bond sank to 2.44% from 2.54%.

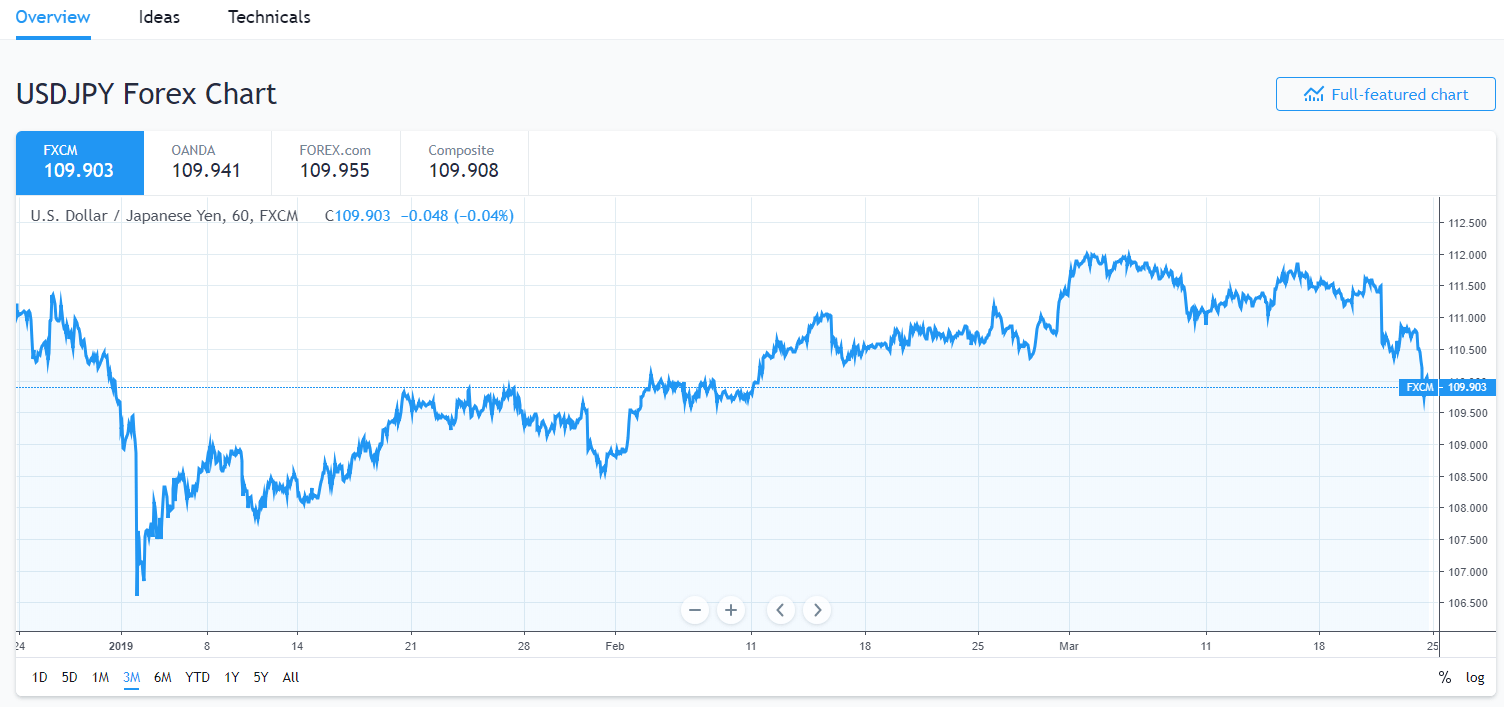

- USD/JPY – plummeted to 109.742, near two-month lows, settling to close at 109.95 in New York. The benchmark US 10-year yield sank 10 basis points to 2.44%, near lows not seen since January 2018. Japan’s 10-year JGB yield fell to -0.08% from -0.05% Friday.

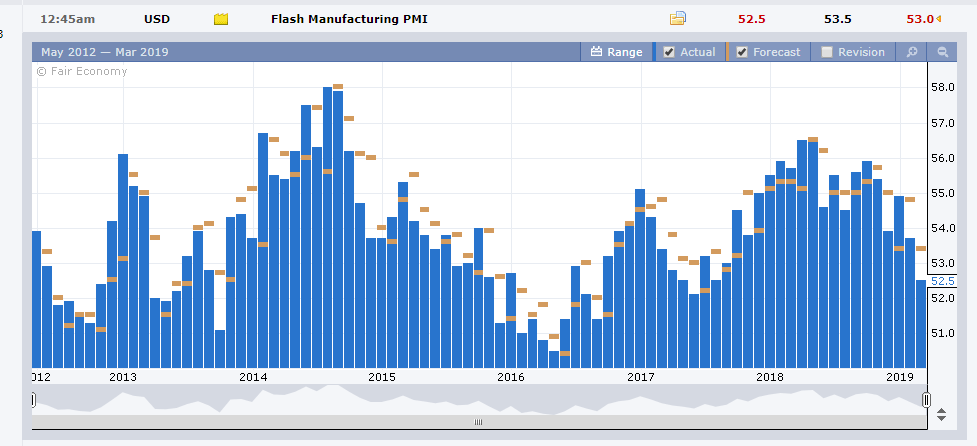

- EUR/USD – the Euro slumped after Euro area manufacturing PMI’s fell lower than forecast. Germany’s manufacturing slowdown further evidenced decelerating GDP growth. EUR/USD finished at 1.1300 from 1.1435 Friday.

- AUD/USD – The Aussie finished 0.44% lower against the Greenback at 0.7080, leading all resource currencies lower. The fall in Emerging Market currencies also pressurised the Aussie.

On the Lookout: Another busy week of data and events await markets ahead. The China-US trade negotiations will be closely monitored after President Trump said that a deal with China “is getting very close.”

Fedspeak starts today with Chicago Fed President and FOMC member Richard Evans speaking at a Credit Suisse Asian investment conference in Hongkong. Fed FOMC members, Quarles, George, Clarida, Rosengren, Harker, Daley and Bullard speak at various locations through the week.

German IFO Business Climate (March) kicks us off later today. US Building Permits and Housing Starts are released tomorrow. The big numbers for the US are Wednesday’s Conference Board’s Consumer Confidence report and Final Q4 GDP on Thursday (both Sydney time). The US also reports its Current Account and Trade Balance on Thursday. The RBNZ’s interest rate decision and policy rate statement is on Wednesday. The ECB’s Mario Draghi and Peter Praet are speaking at an ECB Conference in Frankfurt on Wednesday. Friday rounds up with UK GDP and Current account, Canadian GDP, US Core PCE Price Index, Personal Spending and Chicago PMI data. A huge week ahead and potential market mover.

Indonesia’s flagship airline Garuda has asked Boeing to cancel a USD 5 billion order for 49 Boeing 737 Max Air jets. US banking giant, JP Morgan warned that Boeing’s 737 Max crisis could drag down the whole US economy. What’s Boeing’s losses could only be European Airbus’s gain. Hmmm…

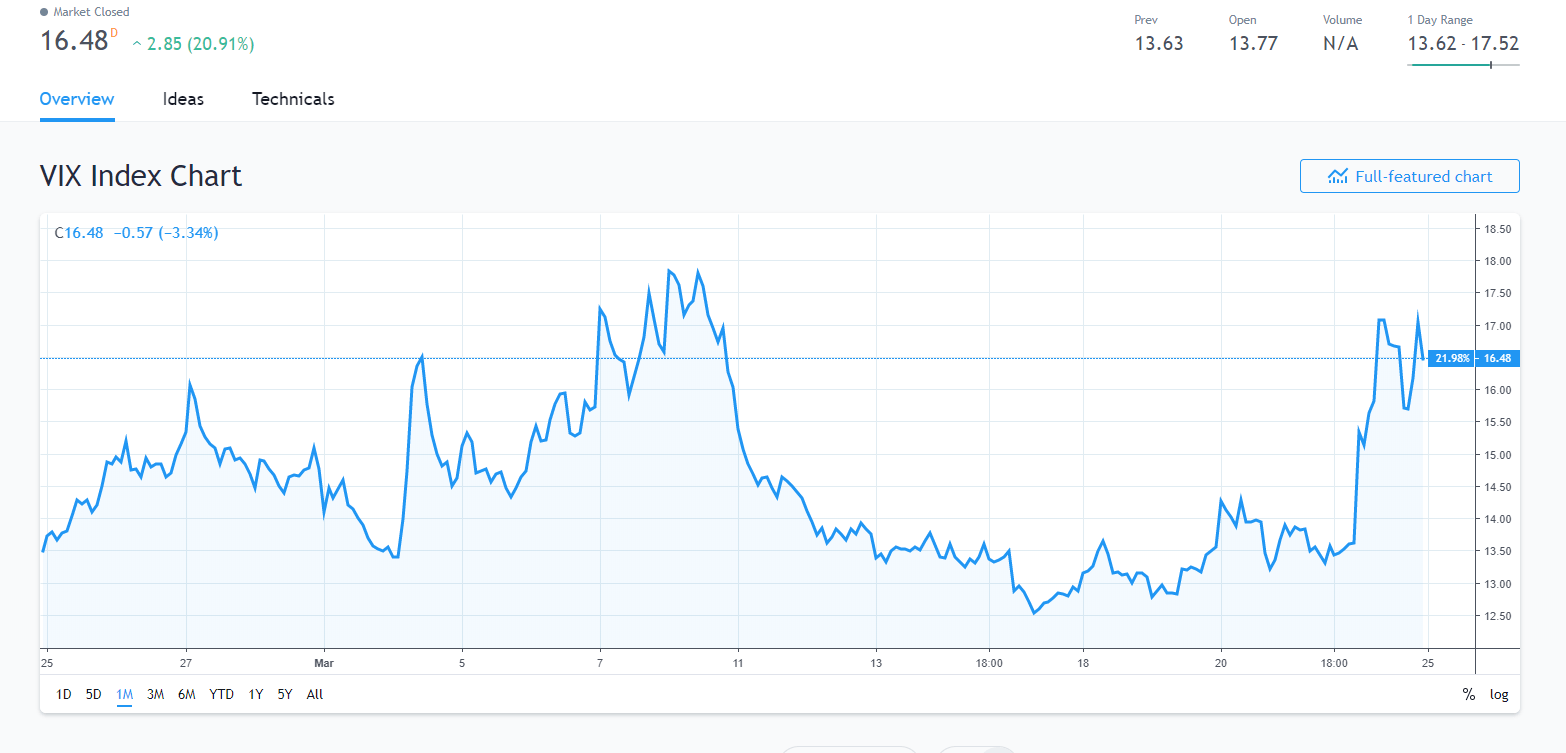

Trading Perspective: Volatility has returned to all currencies and it looks likely to remain. Prior to this, it was mainly the Pound. The CBOE VIX Index soared 21% to close higher at 16.48 (13.20 Friday). The Dollar Index (USD/DXY) rallied to 96.545 at the close, up 0.21% mainly due to the Euro’s fall.

Yield differentials between the US and its Global Peers are still much in the Greenback’s favour. And while the Fed has indicated no more rate hikes, it has not signalled any easing. The slump in Euro area manufacturing PMI’s will impact GDP and this no doubt will be under the scrutiny of the ECB. Japan’s economy is also slowing, the Yen’s rally was really a risk-off move. Mario Draghi and Peter Praet lead ECB speakers this week. While Fedspeak will give traders a better clue to US policymakers thinking. Bear in mind that the market positioning is long US Dollar bets. Although other Global yields fell on Friday, they did not match the 10-basis point fall in the benchmark US ten-year bond. The Dollar’s rally against the Euro and Resource currencies over the weekend could well be fleeting.

- EUR/USD – The Euro slumped, retreating to a low at 1.1273 before settling at 1.1300. Immediate support lies at 1.1270 followed by 1.1240. Immediate resistance for today can be found at 1.1320 followed by 1.1350. The latest COT report released tomorrow will give traders a glimpse of market positioning in the Euro. Despite the setback, prefer to buy Euro on dips.

- USD/JPY – The Dollar looks poised for further losses against the Yen given current market conditions. A positive break in the China-US trade talks may brighten up the risk-off mood but that is yet to be seen. Like Brexit, kicking the can down the road will not help improve risk appetite. Market positioning is also long USD bets in this currency. Immediate support lies at 109.70 followed by 109.40. Immediate resistance can be found at 110.20 and 110.50. Look to sell any bounces back to 110.30.

- GBP/USD – Sterling should continue its volatile trade between 1.30 and 1.34. The next Parliament Vote on Brexit has been tentatively planned at the end of the week (30 April). The EU’s patience in wearing thin with the UK while the UK’s patience is wearing thin with PM May. Business Insider reported that over 5 million people have signed a petition to get Brexit cancelled, the largest petition in UK history. GBP/US has immediate resistance at 1.3230 followed by 1.3260. Immediate support lies at 1.3180 and 1.3140. The Pound remains a trade the range currency with 1.3100-1.3300 possible.

- AUD/USD – The Aussie Battler fell back under the weight of the market’s risk-off sentiment and weaker EM currencies. AUD/USD has immediate support at 0.7070 followed by 0.7040. Immediate resistance can be found at 0.7120 and 0.7160. At the end of the day, short Aussie market positioning and a weaker US Dollar will support the Battler. Look to buy dips with a likely range today of 0.7060-0.7120.

Have a good week ahead all, happy trading.