Asian stocks finished in red on Monday after fears of US recession resurface, and weak macro data as Japanese January month all industry activity index lagged behind at +0.2% forecast to -0.2%. The yield on the U.S. 10-year Treasury note dipped about 1.6 basis points below the yield on the three-month Bill, an inversion that has investors worried a recession could be hit in the near future. In Japan, the Nikkei225 main index hit a five-week low after tumble 3.01 percent to 20,977, the Hang Seng benchmark in Hong Kong finished 2.03 percent lower at 28,523. The Shanghai Composite finished 1.97 percent lower at 3,043 and in Singapore, the FTSE Straits Times index lost 1.16 percent at 3,175. The Aussie stockmarket also slumped by 1.1 percent, making it its second-biggest tumble of the year. This seemed to be triggered partly by fears of a global slowdown and heavy falls across global markets on Friday. The index gained 0.3% the previous week.

In commodities markets, Light Crude Oil finally today corrects to 58.75; Brent oil also trading lower to $66.90/barrel, started the week with a gap down, as Venezuela and Iran impacting oil supply and cuts set to continue at the June meeting for OPEC, and oil has been steadily bid in recent days. Gold is gaining momentum as investors worries increase, the precious metal is trading at 1316 targeting the recent high at $1320. XAUUSD immediate resistance stands at the previous high at $1321 while more offers will be found at 1330 zone. The precious metal may find support at $1302 where the 50-day moving average crosses and the low from yesterday, ahead of testing the 100-day simple moving average down to $1271.

A soft start for equities in early European session mirroring the negative sentiment seen in US equity futures, with investors digesting the FED forecasts and watching the developments surrounding Brexit, DAX30 is giving up 0.10 percent to 11,374, CAC40 is down, 0.06 percent at 5,266 while FTSE100 in London is 0.11 lower at 7,199.

On the Lookout: The Chicago Fed C. Evans said the US economy remains healthy and strong, noting that the current monetary policy stance is neither accommodative nor restrictive and that the Fed is ready to act in case inflation undershoots. Yield curves have shown a slightly higher chance of recession

In America’s macro calendar we have the Chicago Fed national activity index and Dallas Fed manufacturing business index, slated for release at 12:30GMT and 14:30GMT respectively. Later, New Zealand’s trade report for the month of February will be published at 21:45GMT.

During the week we have the following key events: Tuesday: the April GfK consumer confidence in Germany, March confidence and production outlook indicator in France along with final 4Q GDP and February finance loans for housing in the UK. In the US, there’ll be the February housing starts and building permits, January FHFA house price index and S&P CoreLogic HPI data, and March Richmond Fed manufacturing index and Conference Board confidence indicators.

On Wednesday the release of China’s February industrial profits, France’s February PPI and March consumer confidence, the UK’s March CBI retailing sales data, along with the latest weekly mortgage applications, January trade balance and 4Q current account balance all in the US.

On Thursday the Trade talks between the US and China will recommence with Trade Representative Lighthizer and Treasury Secretary Mnuchin visiting China. We will get preliminary March CPI for Germany and Spain, March confidence indicators for the Euro-area and final 4Q GDP print in the US along with latest weekly initial jobless and continuing claims, February pending home sales and March’s Kansas City Fed manufacturing activity index. Late in the evening, we will get Japan’s unemployment rate, February industrial production, and retail sales data.

On Friday the highlight of the day is likely to be the preliminary March CPI releases in France, Italy, and the Euro-area along with the release of January Core PCE data in the US and final 4Q GDP in the UK and Spain. Besides, we will also be getting France’s February YTD budget balance and Feb consumer spending data, Germany’s March employment report, Italy’s February PPI and the UK’s February consumer credit, money supply, and mortgage approvals data. In the US, we will get the February personal income, personal spending, and new home sales data along with March Chicago purchasing manager index and final March University of Michigan survey results.

In Central Bank Calendar, we have: On Tuesday the Fed’s Rosengren and Evans are both due to speak in the morning in Hong Kong while the BOE’s Broadbent and Fed’s Harker and Daly are also due to speak during the day.

Wednesday will be a busy day for ECB speakers with President Draghi, Vice-President Guindos and governing council members Nowotny, Praet, Lautenschlaeger, Mersch and Villeroy all due to speak during the day at different events in Frankfurt, Vienna, and Geneva.

On Thursday, we have the speeches of ECB’s Guindos and Villeroy, and Fed’s Clarida, Quarles, Williams, and Bullard all due to speak. On Friday, ECB’s Coeure and Fed’s Quarles are also due to speak.

Interest rates Market expectations: For the Fed, markets don’t expect any further rate hike in 2019, down from two rate hikes previously, and now see only one hike in 2020. Traders keep pricing in the first ECB rate hike at some point in H2 2020.

Trading Perspective: In forex markets, AUDUSD is under selling pressure at 0.7080 after the spike last week above 71.65, on the dovish US Fed and an unexpected dip in the Aussie unemployment rate, which fell to 4.9% in February – the lowest level since June 2011. The Kiwi, (NZDUSD) trading higher at 0.6880 on repositioning ahead of the RBNZ monetary policy decision this week. US dollar index adding 30 pips and breaks above 0.96.

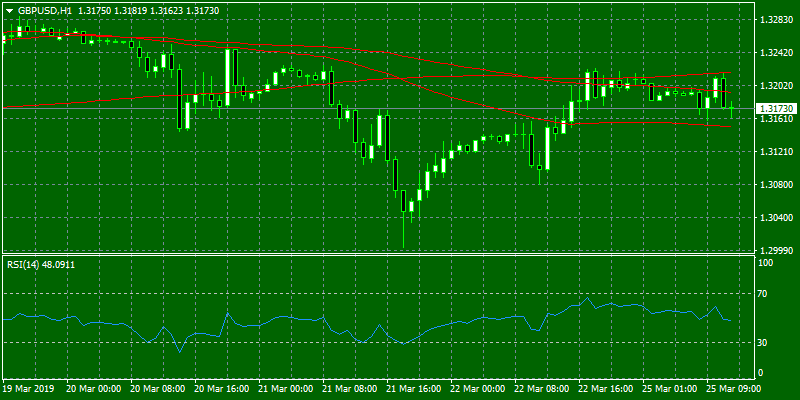

GBPUSD managed to keep its recovery mode intact after the European Union agreed to give May two weeks’ Brexit extension. The short term technical picture is neutral for Sterling, and on the downside, major support will be found at 1.3057 where it crosses the 50-day moving average while more protection can be found at the 200-day moving average around 1.2982. On the flip side, major resistance can be found at 1.3167 where the 50-hourly moving average stands and then at 1.3232 the cross point of 100 and 200 hourly moving averages while at 1.3382, the yearly high will be met with strong supply.

In GBP futures markets, the open interest increased by just 181 contracts on Friday from the previous day. On the other hand, volume reversed two consecutive builds and shrunk by more than 47K contracts.

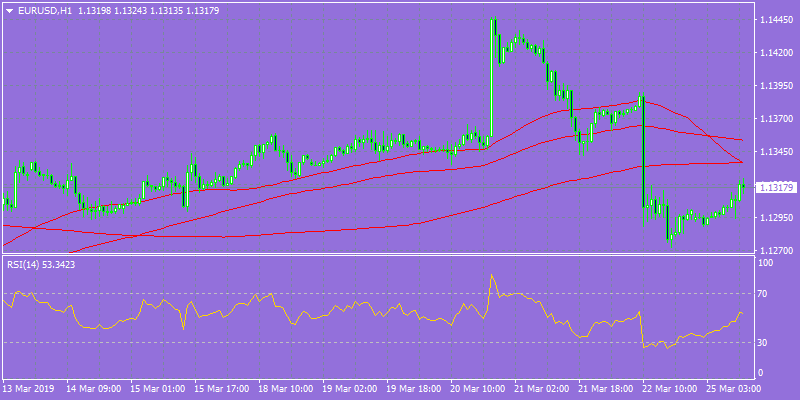

EURUSD regained the 1.13 level after previous week losses and as of the time of writing the pair is trading 0.14 percent higher at 1.1317. Euro will find immediate resistance at the 200-day moving average at 1.1481 and is looking to break above in order to establish a new bullish trend targeting the yearly high at 1.1570. The low from Friday session at 1.1276 provides solid support, and further protection can be met at the horizontal support line at 1.1236.

On the Euro political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist and right-wing option among voters.

In Euro future markets, traders scaled back their open interest positions by just 459 contracts on Friday, recording the third drop in a row. Volume, instead, rose for the third consecutive session, this time by nearly 44K contracts.

USDJPY rebounds from Friday losses up to 110,25, next major support for the pair stands at 110 round figure. Immediate resistance for the pair stands at 111 round mark followed by 111.28 where the 100-day moving average stands.

Open interest in JPY futures markets increased by around 1.2K contracts on Friday. In the same line, volume increased by almost 66K contracts, reverting the previous drop.