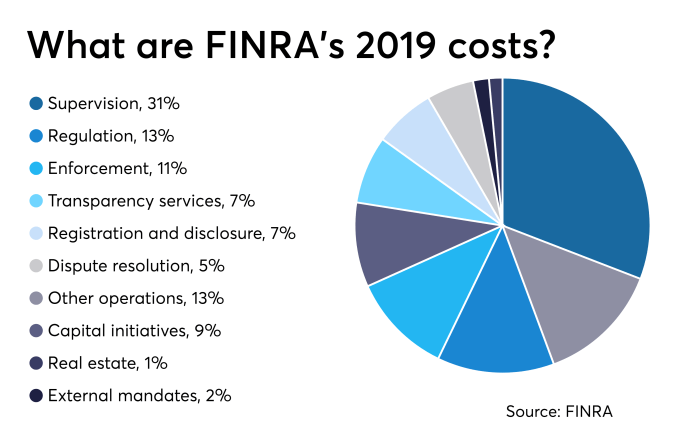

The 2019 budget for FINRA, the Financial Industry Regulatory Authority, is out and it spells out the priorities for the agency.

“As a not-for-profit, self-regulatory organization whose operations are funded by industry fees—without the support of any taxpayer dollars—FINRA must prudently manage its finances to ensure it can appropriately fund its mission. FINRA’s regulatory responsibilities remain extensive and complex, and continue to expand as the SEC relies more heavily on FINRA to supervise broker-dealers.” FINRA said in introducing the budget.

FINRA noted that revenue is expected to be flat while expenses were supposed to increase by 3.7%.

“As described in the Budget Summary, 2019 operating revenue of $846.9 million is projected to be flat compared to 2018. Revenue from regulatory fees—including fees that are primarily assessed according to firms’ gross revenue and trading volume, and firms’ total number of registered representatives—are projected to increase. However, user fees, which comprise approximately one-third of operating revenue, are expected to decrease, primarily driven by lower registration fees, changes in transparency services’ trade volume in the over-the counter market and declining testing exam volume.

“Operating expenses, meanwhile, are projected to increase 3.7 percent in 2019, due primarily to increases in compensation- and technology-related expenses. Since 2015, increases in overall operating expenses have stayed largely in line with inflation, at an annual rate of about 1.6 percent. Last year we carefully managed our expenses to align with our budget, and we will continue to focus on doing so without compromising our ability to fulfill our mission.”

Capital initiatives also are projected to stay the same.

“Capital initiative spending varies from year to year based on the need to enhance regulatory and related technology capabilities. We anticipate capital initiatives of $97.3 million for 2019, in line with spending over the last five years. The increased spending in 2015 and 2016 was largely due to a decision to migrate FINRA’s Market Regulation technology environment from a data center structure to a cloud-based architecture, in addition to the one-time integration of Cboe surveillance patterns and other regulatory tools into the FINRA environment as part of FINRA providing certain services to Cboe.” FINRA noted.

FINRA’s budget priorities are: Ensure Financial Transparency, Manage Expenses Responsibly, Maintain Reasonable Member Fee Levels, Use Fines to Promote Compliance and Improve Markets, and Sustain Appropriate Reserves.

FINRA noted that as a non-profit the goal was to break even, “As a not-for-profit organization, we target break-even cash flows that allow us to appropriately fund our mission of protecting investors and promoting market integrity while facilitating vibrant capital markets. Operating expenses are primarily funded through operating revenues. We rely on our financial reserves (discussed below) to support our mission, and draw upon the principal as needed.”

FINRA is a self-regulatory organization; it was formed in 2007 when the regulatory arms of the NYSE and the NASD merged.