By Giles Coghlan, Chief Currency Analyst, HYCM

Even if you’ve been following cryptocurrencies closely this year, you probably haven’t heard a great deal about Tezos. This is rather odd as Tezos is a project that’s been around for quite some time and shares many features with some of the other cryptos in the top 15 that you’ve probably heard a lot about this year.

A Brief History

The Tezos whitepaper was published in 2014. The project is a proof-of-stake, smart contract blockchain with a focus on on-chain governance. This allows the Tezos blockchain to be self-amending, thus mitigating the risk of chain splits when there are internal disagreements like we have seen with Bitcoin several times over the years and once with Ethereum (both do their own governance off-chain).

Tezos broke records back in 2017 for holding, at the time, the largest ICO (initial coin offering) in history. The project raised $240 million, much more than its initial target of $20 million. What ensued was more than a year of an acrimonious dispute between DLS (Distributed Ledger Solutions), the company responsible for developing the code, and the Swiss foundation that was created to hold the initial token offering and manage the funds raised. This led to a delay in launching the project itself, as well as to the distribution of Tezos tokens, or Tezzies (XTZ), among ICO participants. Several class-action lawsuits were subsequently filed against the project by investors who were displeased with how the launch had been managed.

Despite these early teething problems, the team behind the Tezos project did fulfil their commitments, launching the Tezos Mainnet in September of 2018. It is now a fully operational proof-of-stake blockchain where holders delegate their coins for a passive income, new coins and NFTs are minted, smart contracts are run, and where governance takes place on-chain, with token holders voting on Tezos Improvement Proposals (TZIPs) in order to continue upgrading the network. To date, the project has performed seven upgrades to the core code that have improved its consensus mechanism, gas costs and scalability.

ICO Investors Still Not in Profit

Despite all of the above, and 2021 that has seen it appreciating by 266% and breaking to new all-time highs three times this year, Tezos remains extremely undervalued compared to the rest of the market and is currently languishing in 33rd place in the crypto market cap rankings.

One of the most intriguing facts about this token is that the investors who bought the ICO back in 2017 with their ETH and BTC, are still in the red because the price of XTZ has failed to keep pace with the growth of ETH, BTC, and indeed much of the rest of the space. According to the ICO price, while they may be in profit considering the US dollar value of the investment they made in 2017, they are still at a loss considering the current market price of the ETH and BTC that went into the ICO.

The Charts

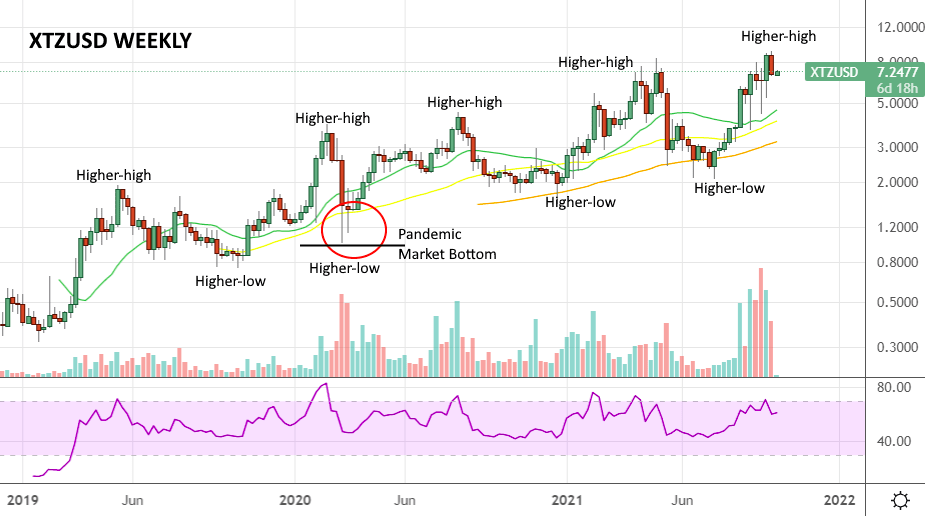

As you can see from the weekly chart below featuring the entire exchange-traded history of Tezos, the price action describes a series of higher-lows and higher-highs that go back to 2019. None of the exuberant booms and busts we have seen elsewhere.

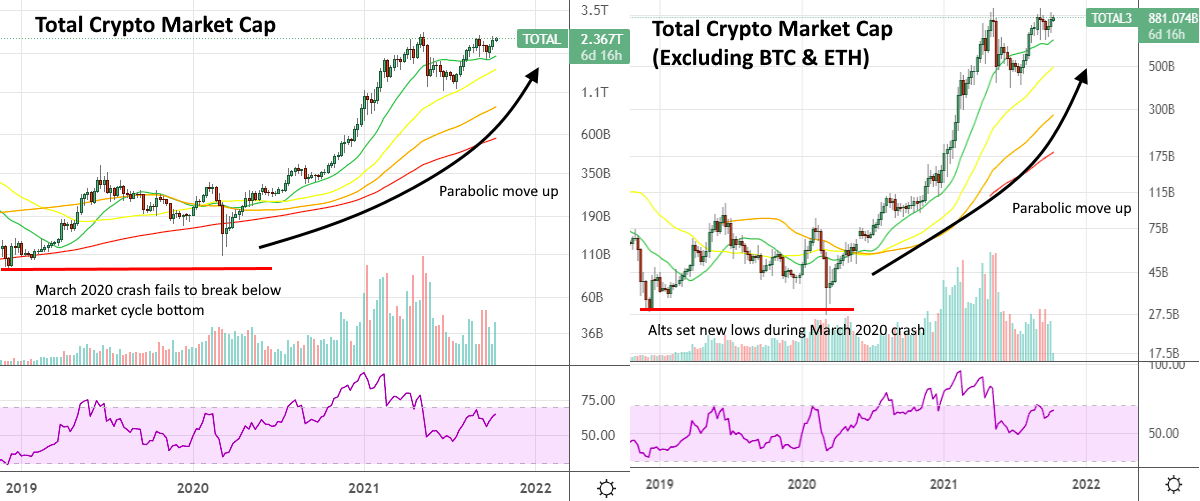

Also, you will recall that in 2019 there was no clarity in the crypto market as far as a directional trend. Crypto started moving up after the December 2018 bottom; however, it stalled in the summer of 2019, and would not reach those levels again until the summer of 2020, after the Corona Crash.

The crash of March 2020, took the entire crypto market down to within reach of that 2018 bottom. When you exclude bitcoin and ether, much of the rest of the “altcoin” market did in fact hit new weekly lower-lows in March 2020.

Going back to the Tezos weekly chart from the same period, it reflects none of the above drama. On XTZUSD, the Corona Crash barely stands out. It’s just a healthy weekly higher-low relative to October of 2019. The entire chart history of the asset appears like a steady grind higher, with volatile swings both above and below the mean but never breaking the trend.

Some crypto commentators have joked that Tezos has performed like a stablecoin over this current market cycle. And if you consider the enormous gains the entire market has made this year, this is almost the truth. If we take its two major rivals in the smart contract segment, Ethereum (ETH) and Cardano (ADA), ETH is up around 400% on the year and ADA is up more than 1000% in the same period.

Some Points to Consider

-Bitcoin, Ether, and much of the rest of the “altcoin” market have gone on parabolic runs in 2020. Tezos hasn’t.

-Fundamentally, there is no reason for Tezos to be lagging behind the rest of the crypto market at this point in the cycle.

Particularly since:

-Much of the competition in the crypto market this year has centred on Gen 3 projects (Bitcoin = Gen 1, Ethereum = Gen 2). What all these projects have in common is they are directly competing with Ethereum in the smart contract segment.

-While Ethereum started off as proof-of-work and is currently transitioning to proof-of-stake, these newer projects come out of the box with proof-of-stake consensus mechanisms.

-They aim to solve Ethereum’s fee problems by being orders of magnitude cheaper and more energy-efficient to run, while massively increasing the number of transactions that can be processed per second.

Also:

-Decentralised governance is becoming a bigger part of the broader crypto conversation in the latter half of this bull cycle.

-The Cardano blockchain, which has only just launched smart contract functionality, has been built with similar goals (on-chain governance, scalability, decentralisation, low fees etc.)

-Tezos has been quietly doing all of the above since it launched and has been signing one high-profile partnership after another (Societe Generale, Groupe Casino, Ubisoft, McLaren Racing.)

Finally:

-For Tezos to reach Cardano’s current market cap (which would be enormously ambitious but not out of the question), it would have to grow more than 11x from its current price. That would be a +$80 Tezzie. It is currently trading at around $7.30.

At HYCM clients can trade popular cryptocurrencies CFDs such as Cardano (ADAUSD) and Tezos (XTZUSD), as well as other asset classes.

Note: Cryptocurrencies are not available for trading under HYCM (Europe) Ltd and Henyep Capital Markets (UK) Ltd.

About HYCM

HYCM is the global brand name of Henyep Capital Markets (UK) Limited, HYCM (Europe) Ltd, Henyep Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under Henyep Capital Markets Group, a global corporation founded in 1977, operating in Asia, Europe, and the Middle East.

High Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.