by Giles Coghlan, Chief Currency Analyst, HYCM

As President Nixon’s Treasury Secretary, John. B. Connally famously announced to his stunned counterparts at the 1971 G-10 meetings: “The dollar is our currency, but it’s your problem.” Connally was one of the architects of the “Nixon Shock”, which would be the final nail in the coffin of the Bretton Woods Agreement. Connally was also a passenger in the car and was seriously wounded when President Kennedy was assassinated.

At the present moment, we’ve seen a highly aggressive Federal Reserve lead most global central banks on a tightening cycle that has effectively curbed demand, brought down risk assets, and greatly strengthened the US dollar. The DXY is currently trading at around 1.06 after breaching the 1.09 level on July 14, which was also the day the dollar briefly achieved parity with the euro. The DXY is up almost 20% on the year, and EURUSD is down some 17% for the same period.

Everyone’s Problem

A strong dollar is actually everyone’s problem at the moment. For developing economies with largely dollar-denominated debt, this means both their debts and repayments increase, making it even harder to service those debts with a local currency that is falling by comparison. We’ve seen this recently with the civil unrest in Sri Lanka, which recently defaulted on its debt for the first time in its history.

A strong dollar can also make inflation worse, particularly when it comes to resources like oil that are priced in dollars, for many of the same reasons as above. But a strengthening dollar also hurts the trade balance of the United States because it renders US exports uncompetitive.

It’s also causing massive problems for the Eurozone. Europe is now being forced to follow the Fed’s lead and also raise its own interest rates in order to strengthen the euro; this is in the interest of mitigating some of the increased costs of imported goods, particularly energy. The ECB’s recent 50 basis point hike – Europe’s first hike in eleven years – puts significant strain on its more heavily indebted members, like Italy, and raises serious questions about their ability to pay that debt.

The Charts

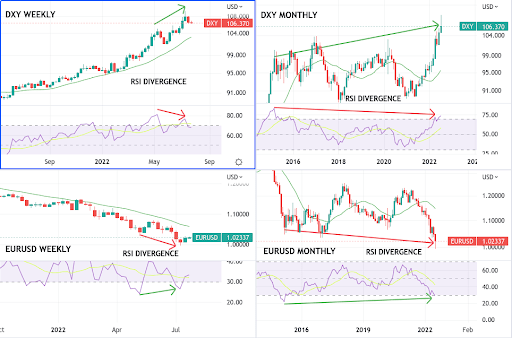

Is US dollar strength the shape of things to come, or is the dollar close to peaking? Currently, we see the DXY at the top of an uninterrupted uptrend going all the way back to May of last year. For EURUSD it’s the reverse, for obvious reasons. Both have broken all respective support and resistance going back to 2002.

For the above reasons, technically, the DXY isn’t a chart that’s screaming “buy” at the moment, nor is the EURUSD screaming “sell”, even though the daily RSIs of both have cooled off in this recent bout of profit-taking. Despite this, RSI levels remain extreme on both the weekly and monthly timeframes.

And it’s when we zoom out to these longer-term timeframes that we notice the start of what could be a lack of follow-through from these levels. Both DXY and EURUSD are beginning to register divergences between RSI and the price action. These divergences show up on both weekly and monthly timeframes for both symbols.

Now, RSI divergences are notoriously unreliable if you want to pin the precise turning point of a market. This is because assets can be overbought for long stretches of time during bull markets, and oversold for long stretches during bear markets. However, when these signals start appearing on the weekly and monthly timeframes, they carry much more weight. When you start to see persistently higher prices not reflected in a higher weekly or monthly RSI, it can be an indication that the move is getting a little stretched.

Weekly RSI divergences recently signalled the top in the S&P 500, the Nasdaq, as well as many of the top crypto assets. More to the point, they also signalled the December 2020 top in EURUSD and bottom in the DXY, so these signals are worth noting at the very least.

A wide range of currency pairs and indices, as well as instruments in other asset classes, are available for trading with HYCM broker.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd, HYCM Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.