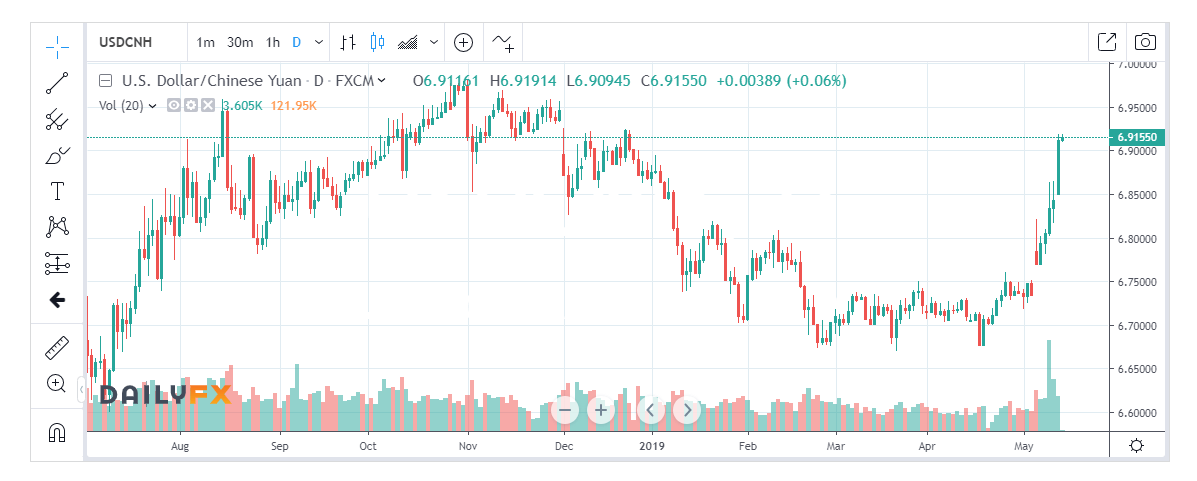

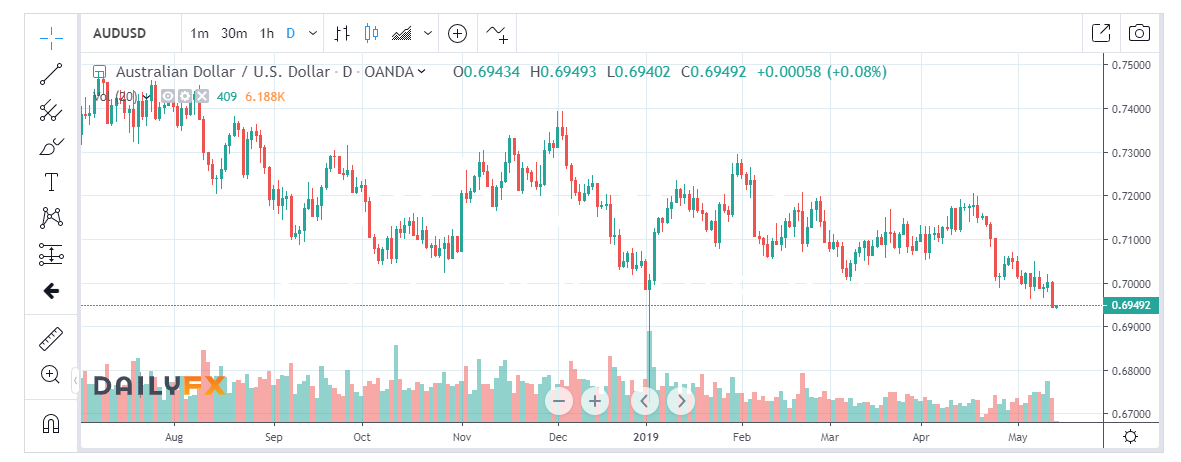

Summary: China struck back at the US after trade talks in Washington failed and the battle between the two nations intensified. Beijing announced fresh tariffs of up to 25% on US$ 60 billion of US goods. On Friday the US announced a tariff hike on US$ 200 billion on imports from China. The Offshore Chinese Yuan sank to it lowest since December 2018 at 6.9177 (6.8580 yesterday) against the Dollar. Risk currencies, Aussie (-0.71% to 0.6945), Canadian Loonie (-0.49% to 1.3480), Kiwi (-0.32% to 0.6570) weakened. Flight-to-safety lifted havens Yen (+0.53% to 109.30) and Swiss Franc (+0.45% to 1.0067). The Euro closed flat at 1.1225. Sterling slipped further to 1.2957 (1.2998) as the UK Parliament struggled to reach any agreement on Brexit. Emerging Market currencies were lower against the US Dollar. Turkey’s Lira tumbled 1.72% to 6.0600.

Wall Street Stocks tumbled. The DOW fell over 600 points at one stage, ending 2.56% down at 25,285. (25,968). The S&P 500 slumped 2.7% to 2,806. In Asian trade, the Shanghai Composite Index sank 1.21%. US treasuries rose, bond yields dropped. The benchmark US 10-year yield fell to 2.4% (2.47%). Two-year bond yields slumped 8 basis points to 2.19%.

Australia’s New Home Loans for March plummeted 2.5% against a forecast rise of 2.2%.

- AUD/USD – The Australian Battler got poleaxed given its trade relationship with China, risk status, and the big fall in the value of new Home Loans. AUD/USD slid to 0.69409, from 0.6995 yesterday, down 0.71%, the low since January. AUD/USD opens at 0.6945.

- USD/JPY – The Dollar extended its losses against the haven-sought Japanese Yen. Trading was more subdued and two-way given the USD buying demand from Japanese importers. USD/JPY closed at 109.30 from 109.80, down 0.55%. Overnight low for USD/JPY was 109.019, lows not seen since February.

- EUR/USD – The Euro finished little-changed at 1.1225 (1.1235 yesterday). The Single Currency is caught in the crossfire of the trade war between China and the US. EUR/USD is supported because of Europe’s balance of payments surplus. On the other hand, the US has its own trade issues with Europe which are still being negotiated.

On the Lookout: Today’s Asian reaction to overnight market moves will be significant. Can the Asian stocks stabilise and halt the rot? In previous years this was the case. But an all-out trade war is a different ball game. Economic data releases will take on further significance.

Yesterday’s fall in the value of Australia’s New Home Loans will add pressure for the RBA to cut rates in July. Further data will determine. Today sees Australia’s NAB Business Conditions and Confidence Index Australia’s Wage Price Index is released on Wednesday. Japanese Bank Lending, Current Account and Economic Watchers Sentiment reports are due this morning. European data starts off with Germany’s ZEW Economic Sentiment and Final CPI as well as Eurozone Industrial Production (April). The UK releases its Employment report, Average Earnings, Claimant Count Change, Jobless rate.

On the trade front, President Trump indicated that he would speak to his counterpart, Xi Jinping during the G20. US Treasury Secretary Mnuchin said that trade talks with China were ongoing.

The latest Commitment of Traders/CFTC report (week ended May 10) saw a further build-up of total net speculative US Dollar long bets.

Trading Perspective: Veteran currency analyst Kathy Lien from Bk Asset Management in New York points out an observation which is accurate and worth noting. That given the sharp falls in stocks and bond yields, currency market reaction is relatively “tepid”. Lien is also spot on as she observes that many of the currency pairs started their moves last month. USD/JPY has fallen from 111.60 to its current 109.45. The Australian Dollar slid from 0.7050 to 0.6945. The same is true for the Kiwi and Loonie. An all-out trade war will have impact US growth with the economy’s ability to handle this questionable.

Last, but not least is speculative market positioning. Speculators have held long Dollar bets against the Euro (multi-year highs), Australian Dollar and Sterling. In the case of USD/JPY while the market bets were short of JPY, the absence of Japan Inc from Golden Week has seen a distinct lack of buying from Japanese importers who are now present in the markets.

- AUD/USD – The Battler faced intense pressure given its risk status and proximity to China. The fall in EM currencies also weighs on the Aussie. The Australian Battler fell to an overnight low of 0.69409, not seen since the January flash crash. The Aussie faces further tests with today’s NAB Business Conditions expected to weaken. Aussie short bets will provide downside support which lies at the overnight lows of 0.6940. The next support level is found at 0.6920. Immediate resistance can be found at 0.6980 and 0.7000. Net speculative Aussie shorts were trimmed to -AUD 57,000 contracts from -AUD 59,000. Hardly a dent. Look to buy dips with a likely range today of 0.6930-0.7000.

- USD/JPY – The Dollar’s fall against the Yen hit an overnight low of 109.02 before bouncing to settle at 109.30 in New York. USD/JPY has immediate support at 109.10 followed by 108.80 which is strong. Immediate resistance can be found at 109.80 followed by 110.20. The latest COT/CFTC report saw speculative short JPY bets pared to -JPY 91,700 contracts from -JPY 99,600. With Japanese importers expected to provide buying support, expect a likely range today of 109-110. Tin helmets on, trade the range.

- EUR/USD – The Euro closed little-changed at 1.1225 from 1.1235 yesterday. Trading was subdued compared to the other more risk sensitive currencies. The latest COT/CFTC report for the week ended May 10 saw a modest increase in speculative short Euro bets to -EUR 106,100 contracts from the previous week’s -EUR 105,500. Which are at new multi-year highs. Today sees further Euro-area data releases. If they are better-than-forecast the EUR/USD could soar as shorts will scramble to cover. EUR/USD has immediate resistance at 1.1260 (overnight high 1.1263) followed by 1.1300. Immediate support can be found at 1.1200 and 1.1180. Look to buy dips with today’s likely range 1.1215-1.1295.

Tin helmets on, welcome back volatility! Happy trading all.