Summary: Markets prepared for an all-out trade war as the US officially increased tariffs on US$200 billion of Chinese imports. Ongoing trade talks in Washington DC between the two protagonists provided no break-through. The Dollar ended generally lower against the majors on Friday following softer-than-forecast US April CPI. Core inflation cooled in April to 0.1% against an expected 0.2%. The Euro extended its rally to 1.1235 (1.1213) after Germany’s Trade Surplus beat forecasts. Haven darlings, the Yen and Swiss Franc stayed bid. USD/CHF (Dollar/Swiss) slumped to 1.0115 (1.0155) while USD/JPY closed little changed, at 109.78. The Dollar Index (USD/DXY) slipped anew to 97.323 (97.486 Friday). The Dollar rose against the Offshore Chinese Yuan (USD/CNH) to 6.8530 (6.6380) and most Emerging Market Currencies. The Australian Dollar ended marginally higher at 0.6990 from 0.6985. Canada’s economy added 106,500 jobs in April, the largest gain since the country started tracking employment in 1976. Which boosted the Loonie. USD/CAD tumbled to 1.3425 (1.3475 Friday).

US stock futures plummeted in early Asia after rallying on Friday. The DOW opened at 25,785 from its Friday close of 25,968. S&P 500 Futures were down at 2,865 from 2,885.

- USD/JPY – The Japanese Yen kept its bid tone against the Greenback after finishing little-changed on Friday at 109.79. USD/JPY slid in early Asia to 109.72 before settling. Most of Japan Inc return from their Golden Week break today.

- EUR/USD – extended gains after rallying in the past 8 out of ten sessions to 1.1235 (1.1215 Friday). Better-than-forecast German Trade Surplus supported the Single Currency. EUR/USD traded to a high of 1.1250 which remains strong resistance. The Single Currency opens at 1.1235.

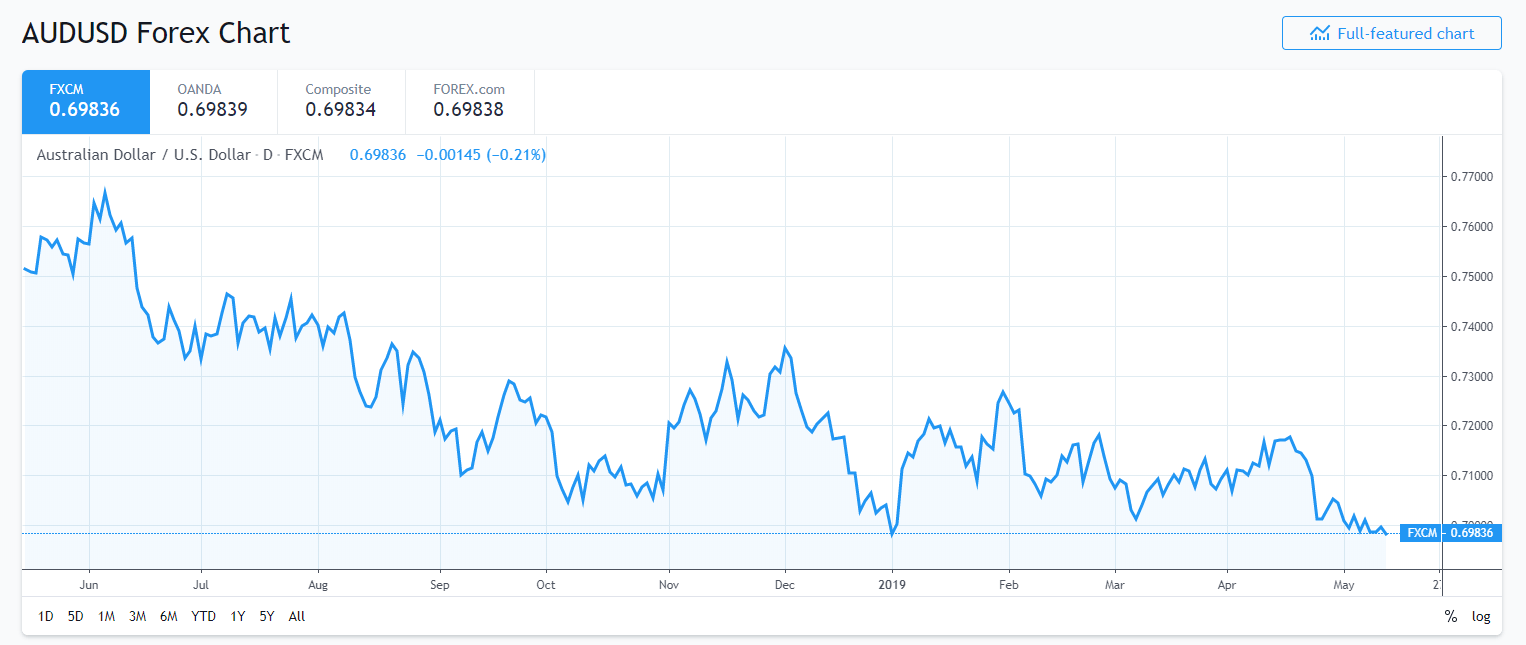

- AUD/USD – The Aussie held its ground despite overwhelming bearish sentiment from the markets risk-off stance and the RBA’s recent downgrade in economic forecasts. AUD/USD closed at 0.6995, slipping to 0.6986 this morning, and currently settling at 0.6990.

On the Lookout: Today’s economic data are few. All eyes will be on any fresh trade developments from China after it’s defiant response to the imposition of fresh US trade tariffs. Expect more volatile conditions in all markets ahead. Keep an eye on the USD/CNH movements today.

Japan’s large corporations return after their Golden Week break which may see buying support for USD/JPY at current levels. USD/JPY was trading at 111.60 when the Golden Week holidays began.

Australian Housing Finance for March will be released at 11.30 am Sydney time. RBA Deputy Governor Guy Debelle speaks in Sydney later today.

The week ahead sees China’s Trifecta of Industrial Production, Retail Sales and Fixed Asset Investment, as well as US Headline and Core Retail Sales are due on Wednesday. Australian Employment, and Eurozone Headline and Core CPI reports follow on Thursday.

Trading Perspective: The Dollar slid despite deteriorating trade negotiations between China and the US. Both are on the verge of an all-out trade war. Which would see all countries lose out, including the US. Haven currencies continue to attract capital while Emerging Market currencies will stay soft.

Against the majors, the Dollar is losing its sparkle. Even the risk associated Aussie is holding its ground. Market positioning may have much to do with this. We examine the latest currency positioning reports upon their release tomorrow. We can expect more choppy markets ahead.

- USD/JPY – While the Dollar remains offered against the Yen, the return today of Japan Inc from Golden Week holidays make for more two-way trade. USD/JPY has immediate support today at 109.50 followed by 109.20 and then 108.80 (strong). Immediate resistance can be found at 110.00 and 110.30. USD/JPY was trading at 111.60 when the Golden Week holidays began. Japanese importers will look to buy USD on dips. Likely range today 109.60-110.10. Prefer to buy dips at current levels.

- EUR/USD – The Euro held its ground and continued to climb higher. Euro area data has mostly beat forecasts. Speculative market positioning has been short Euro bets at multi-year highs for some weeks now. EUR/USD opens at 1.1238 with immediate resistance found at 1.1250 (overnight highs). The next resistance level can be found at 1.1280. Immediate support lies at 1.1220 and 1.1200. Strong support lies at 1.1180. Look for a continuation of its uptrend with a likely range today of 1.1220-1.1270. Prefer to buy dips.

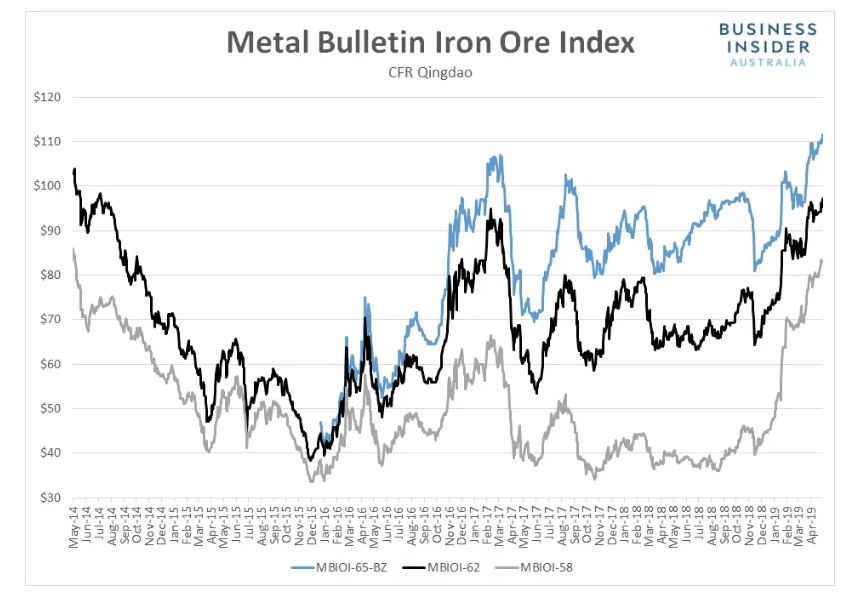

- AUD/USD – The Australian Dollar held its ground despite growing trade tensions between the US and China. Today’s Australian Business Insider reported Iron Ore prices climbed to fresh multi-year highs. Today RBA Deputy Governor Guy Debelle is due to speak at a panel discussion hosted by the Australian central bank. AUD/USD has immediate support at 0.6985 followed by 0.6965. Immediate resistance lies at 0.7000 and 0.7025. The speculative market is short of Aussie bets which will keep the currency supported. Look to buy dips in a likely range of 0.6985 and 0.7025. Prefer to buy dips.

Have a good week ahead. Happy trading all.