Global market today sees positive price action for first trading session this week amid divided sentiment surrounding outcome of trade talks between US and China as investors await update on further progress before placing major bets.

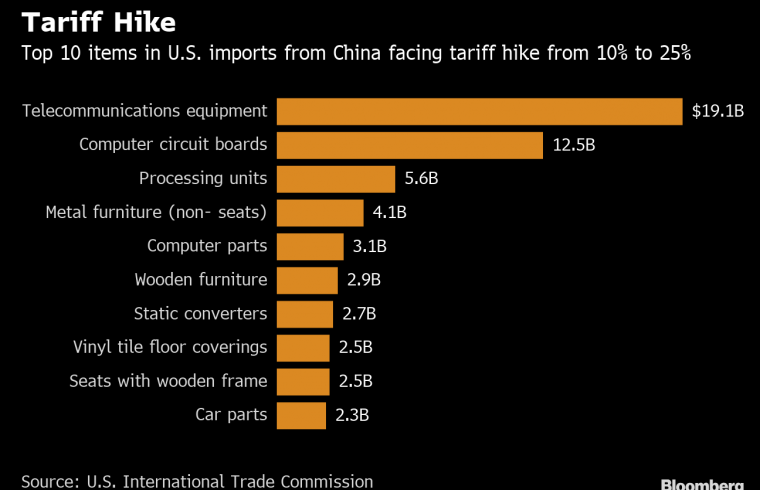

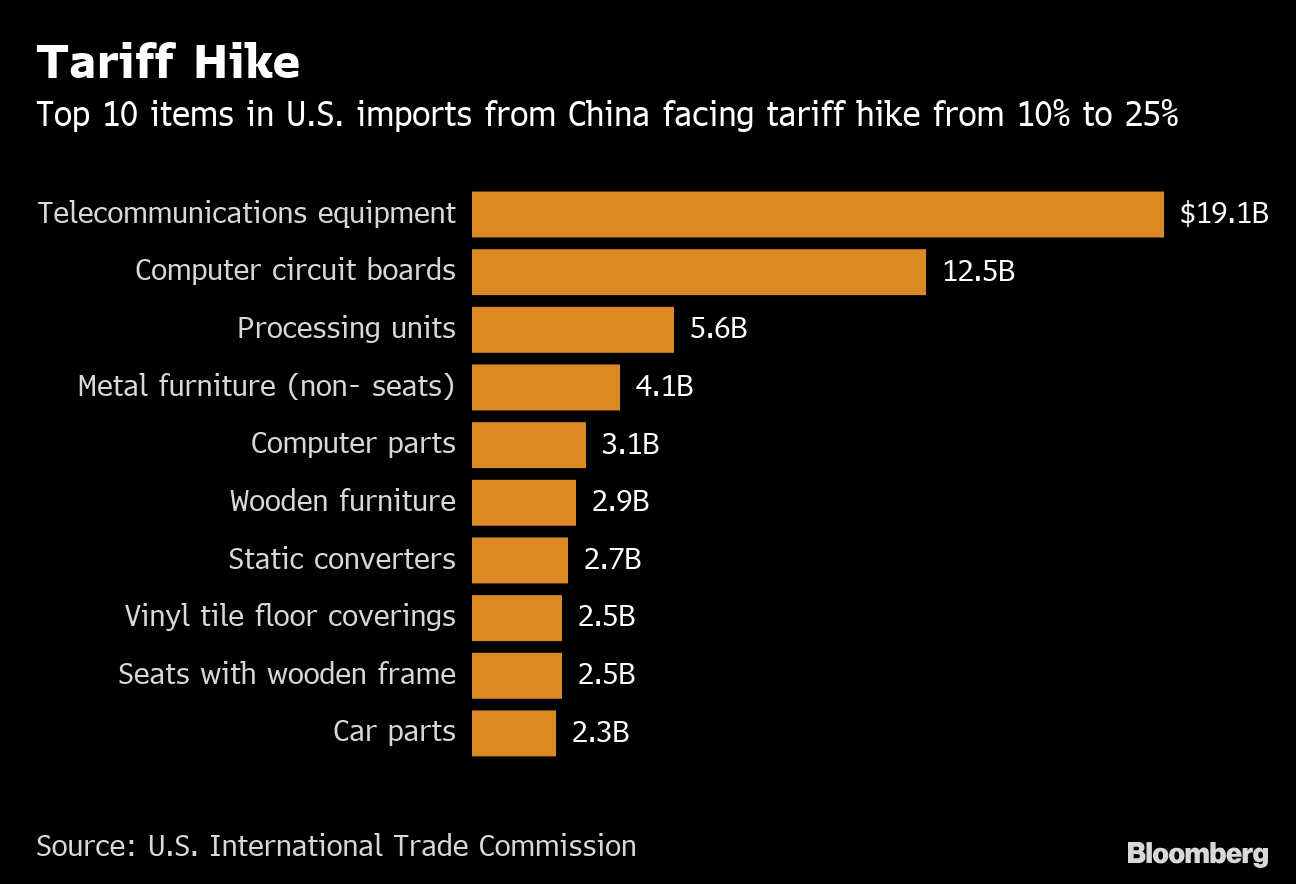

Summary: US Wall Street last night saw major benchmark indices, equities and bond yields fall as risk averse sentiment lingered while two-day trade talks between two nations began. However, Pacific-Asian market hours saw major markets across Asian and Australia pick up momentum and trade positive on Trump’s tweets which stated that he received a beautiful letter from Chinese President Xi Jinping which has raised hopes for possibility of trade deal between two parties. Comments from US representatives stating that talks with continue on Friday also raised hopes for possibility of salvaging a trade deal between both nations. However, tariff change from 10% to 25% for goods worth 200 billion USD came into effect today which caused traders to do some short covering activity erasing significant portion of gains from early trading session albeit Asian markets seeing most major indices and equities close in green. European market saw most major indices and equities capitalise on positive cues from Asian market and trade positive on hopes that a trade deal would be signed by both parties. Prevalent risk on investor sentiment was also visible from positive price action in Forex market during both Asian and European market hours.

Precious Metals: Both gold and silver are trading positive in the global market today. While investor sentiment shows positive tone as visible from risk on trading activity for first time this week, safe haven assets have also began to see an increased demand. US decision to hike tariff’s despite trade talks being in progress and comments from China promising retaliation for same has caused investors to slowly horde safe haven assets while price is low in case trade talks today go south as trading session closes for the week.

Crude Oil: Crude oil price is trading positive in the global market with benchmark indices on both sides of Atlantic seeing considerable levels of gains as headlines hint at new hope for possibility of trade deal. But price has slid down from intra-day highs as US tariffs on Chinese goods have come into effect. A positive outcome during talks tonight will give the price a sharp push to the upside while talks going south will lead to spot US crude oil price falling to or below $60 handle per barrel.

AUD/USD: The pair scaled 0.70 handle during Pacific-Asian market hours on Trump tweet induced trade optimism. However, gains from early trading session were lost once US tariffs on Chinese goods came into effect. Hopes for positive resolution of ongoing trade talks between China and US continues to provide some level of strength to market bulls keeping the pair above 0.70 handle across European market hours

On The Lookout: The main focus of investors is now on traders trade talks between China and U.S.A. Trade related negotiations between two parties began yesterday and while US President Trump has expressed optimism on possible positive outcome, traders remain wary as US went forward with hiking tariff on Chinese goods today for which China has promised to retaliate. The only way for bulls to retain control of momentum is if talks between two parties end today with trade deal agreed between both parties. However, talks going south is likely to result in China retaliating for US hiking tariffs that could cause a sharp meltdown in global financial market in short term. Aside from Sino-U.S. trade talks, investor focus also remains on Brexit progress and today’s macro data updates. Prevalent risk on investor sentiment is likely to rule the market until further updates post today’s talks hit the market. Meanwhile investors await today US CPI update and Canadian employment change update for short term profit opportunities.

Trading Perspective: US Wall Street is likely to see subdued price action with slight positive bias and short term traders influenced by macro data updates will dominate early half of trading session while medium term bets influenced by directional cues from trade talk progress will dominate market as trading session closes for the week.

US Market: US benchmark index futures trading in the international market saw dovish price action as hike in US tariffs on Chinese goods came into effect today despite talks under progress between two parties. Further, promise of retaliation from China has also soured the market mood and unless there is update on trade deal between two parties at end of talks today, US market is likely to suffer sharp losses today.

EUR/USD: The common currency is trading with positive bias against US Greenback amid optimism surrounding Sino-U.S. trade talks and expectations for positive outcome later today. Positive German trade data and UK macro data also added support to EURO. Investors now await US macro data updates for short term profit opportunities as trading session comes to close for the week.

USD/CAD: The Canadian Loonie gained strength in Pacific-Asian market hours as Trump’s tweet raised hopes for positive outcome in trade talks between China and U.S. This also bolstered crude oil bulls resulting in positive price action in global market providing commodity linked currency with fundamental support. Traders now await US macro data updates for short term profit opportunities as trading session comes to close for the week.