Fall out in trade talks and China’s promise for retaliation has influenced cautious investor sentiment resulting in risk off price action across global market today. Investors wait for further updates before placing major bets.

Fall out in trade talks and China’s promise for retaliation has influenced cautious investor sentiment resulting in risk off price action across global market today. Investors wait for further updates before placing major bets.

Summary: Trading session began for the week on dovish note as headlines from weekend hinted at fallout between China and U.S. on their two day trade talks towards end of the last week. US blamed China on trying to renegotiate some of the previously agreed conditions as reason for fall out between two parties and urged US business to look for sources outside China or inside U.S. as alternatives to avoid becoming victims of ongoing tariff war. Meanwhile China has promised to retaliate for hike in tariff which came into effect last Friday. This has caused risk appetite in the market to take a nose dive resulting in bears gaining control of overall market price action. While China is yet to announce on its retaliatory measures against US, major global bonds, benchmark indices and equities across key markets in both Asia and Europe fell sharply today. Risk averse sentiment is boosting demand for USD in the global market causing USD denominated currency pairs to suffer loss in forex market across both Asian and European market hours.

Precious Metals: While safe haven demand remains prevalent in the global market, precious metals are suffering owing to hike in US Greenback’s value. Precious metals are denominated in US Greenback and given the decline in forex market, both major global currencies and emerging market currencies are suffering sharp declines today making exchange rates higher. This has caused investors to hold back from placing bets in precious metals resulting in today’s dovish price action.

Crude Oil: While crude oil price suffered at start of the day on escalating trade tensions between China and U.S.A, the price action saw sharp upward swing erasing all early declines. OPEC enforced production and supply cut and Trump’s decision to stop granting waiver for Iranian crude oil already provided support to crude oil bulls. Further, latest reports on attacks in Saudi Arabia’s crude oil shipments in middle east has caused supply woes to raise higher boosting crude oil price in the global market today.

AUD/USD: The Australian Dollar lost its hold over 0.70 handle gained in late Friday’s trading session as increased trade war woes over fallout between China and U.S.A had created a risk averse investor sentiment. Further, disappointing Australian macro data worsened sentiment surrounding AUD while USD gained on risk averse activity in forex market putting pressure on AUD bulls resulting in bearish price action today.

On The Lookout: All focus is now towards Sino-U.S. trade war, as bi-lateral trade talks failed last week with China promising retaliatory actions. US President Donald Trump has threatened that China would face further loss in case China retaliates. China is yet to clarify on retaliatory measures but it looks highly likely for China to respond against U.S. which has caused risk appetite to drain from the market. Major markets are set to see yet another week of sharp declines and dovish price actions. A move by China is likely to trigger declines in global equities worth billions and this has got investors and analysts on the edge. Also on European markets, ahead of upcoming elections all eyes are on Brexit proceedings. UK and Ireland have managed to come to agreement on some important issues, but many remain yet to be addressed as internal political power struggle in UK has left citizens to suffer from lack of further progress in Brexit. On the release front, there are no major releases in US calendar today while both US and Canadian calendars show speech from several central bank members which are deemed as second tier data and are likely to have some level of influence on price volatility in American market hours.

Trading Perspective: Wall Street is likely to see sharp declines as updates US tariffs on Chinese products have come into effect and US companies have to end up paying tariffs worth several hundred millions given their reliance on Chinese imports. Escalating trade war tensions are also likely to play major role in influencing bearish price action in Wall Street today.

US Market: US index futures trading in international market saw sharp declines ahead of Wall Street opening. This suggests that major equities and benchmark indices are up for sharp loss one trading activity begins in US Wall Street later today. China has declared that it will never surrender to US threats causing tensions to rise in market with what looks like a dovish week ahead for US Wall Street.

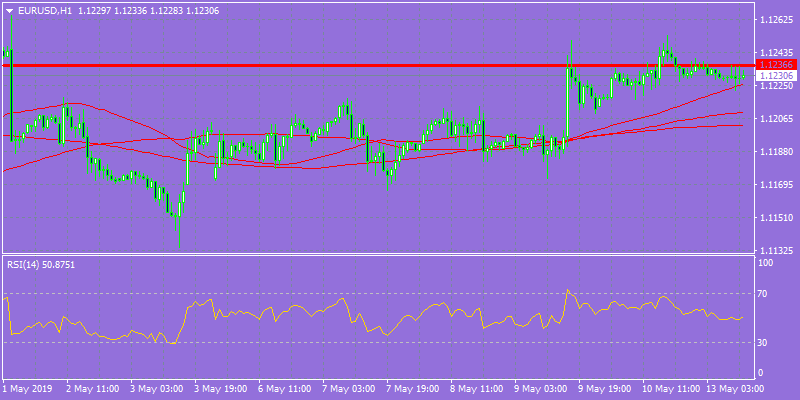

EUR/USD: The pair remains range bound below mid-1.12 handle as trading session resumes for the week. While Brexit woes and escalating Sino-U.S. trade war woes put pressure on market bulls, EURO is yet to decline below 1.1200 handle which hints at strong resistance put forth by EURO bulls against USD which has been growing stronger across the day. Amid relatively silent macro calendar, the pair is likely to remain range bound with bearish bias prevalent in price action for rest of the day.

EUR/USD: The pair remains range bound below mid-1.12 handle as trading session resumes for the week. While Brexit woes and escalating Sino-U.S. trade war woes put pressure on market bulls, EURO is yet to decline below 1.1200 handle which hints at strong resistance put forth by EURO bulls against USD which has been growing stronger across the day. Amid relatively silent macro calendar, the pair is likely to remain range bound with bearish bias prevalent in price action for rest of the day.

USD/CAD: The pair got a sharp upward boost solidifying its hold over 1.34 handle but USD bulls failed to capitalise on momentum gained earlier in the day resulted in muted gains. Rebound in crude oil price later in the day caused the pair to pare some gains made early in the day post which crude oil backed Canadian Loonie has managed to hold fort against USD resulting in range bound price action with bias favoring USD as risk averse mood continues to underpin USD bulls in the global market. The pair is likely to continue this momentum until further headlines from China and change in price of crude oil gives USD bulls an edge over CAD.