Summary: The Dollar Index, a popular gauge of the Greenback’s value against a basket of 5 major currencies closed little changed (97.55) ahead of the conclusion of this week’s Fed policy meeting. While the US central bank is not expected to change policy, policymakers will signal rate cuts are coming. The Euro trimmed gains to close at 1.1220, up 0.13%. European Central Bank policymakers begin their meeting in Portugal today. Mario Draghi and BOE Head Mark Carney are due to speak in a panel discussion. The Bank of England is expected to consider tightening monetary policy in its meeting (Thursday). No major changes will be expected though until Brexit talks have finished. Sterling slid 0.35% to 1.2535, January 2019 lows as Boris Johnson, expected to push Britain to a no-deal Brexit, was likely to succeed former PM Theresa May. The Dollar closed flat against the Yen at 108.53 for the second day running after trading in a tight range. The Aussie slipped 0.19% to 0.6852. RBA minutes from their latest meeting are released later today. Bond yields and stocks steadied. The US 10-year treasury yield closed at 2.09% (2.08% yesterday).

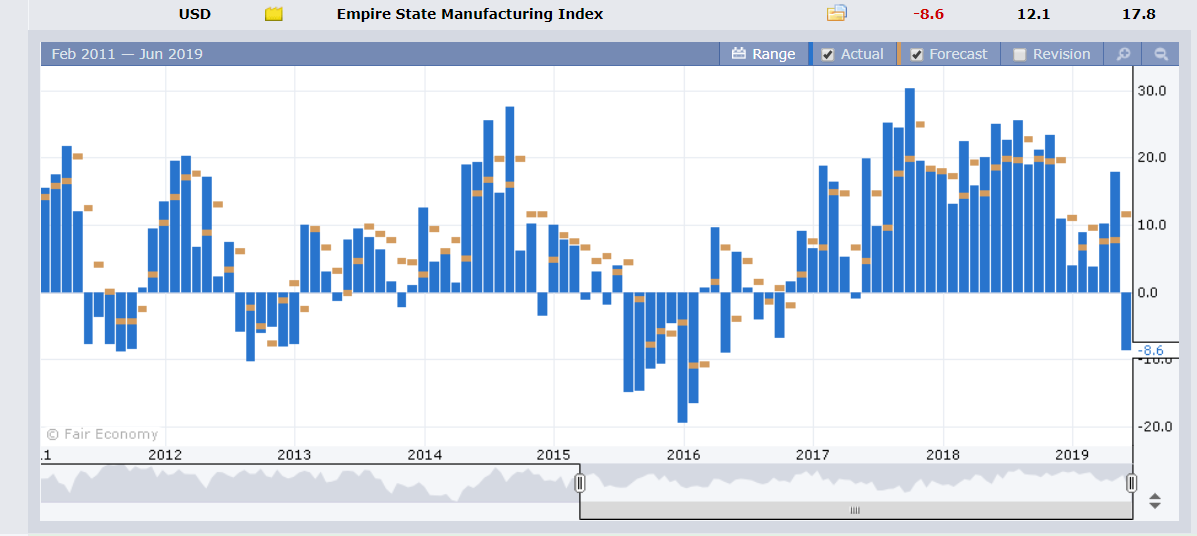

The Fed’s New York Manufacturing Index nosedived to -8.6 against a forecast of +12.1 and a previous +17.8, its lowest since July 2017. US Homebuilders Sentiment unexpectedly posted its first drop in 2019 to 64 against a forecast of 67 and a previous read of 66. Bloomberg reported that the US Treasury’s Long-Term Securities Transactions (TICS) revealed China had cut its US Treasury holdings to the lowest in almost 2 years.

- EUR/USD – rallied off its recent base near 1.1200 to a high at 1.12470 before erasing most of its gains to close at 1.1220, up 0.13%. Markets will focus on the ECB’s forum on central banking in Sintra, Portugal which starts today.

- GBP/USD – slip-sliding away. The combination of broad-based US Dollar strength and the likelihood of Boris Johnson as replacement to PM May weighed on the Pound which traded to January 2019 lows. Johnson is widely expected to push Britain to a no-deal Brexit. GBP/USD closed at 1.2535 (1.2588 yesterday).

- AUD/USD – The Aussie extended its slide for the 6th day running to finish 0.19% lower at 0.6855. Markets will look to today’s release of the RBA’s latest meeting minutes for any additional insights after last month’s mixed Jobs report failed to impress.

On the Lookout: Expectations for a Fed rate cut at the conclusion of their two-day meeting this week have fallen. US bond yields have steadied at their lows. Rate cut expectations for July are still around 70%. The Dollar has rallied against all its Rivals. However, the broad economy is still showing weakness. New York state’s factory activity slumped to a 2-year low as manufacturing continues to be a weak link in the US economy. This is due to uncertainty caused by tough US trade policies. US Building Permits and Housing Starts data are reported today.

Today’s data releases begin with Australia’s House Price Index for Q1. Germany reports on its ZEW Economic Sentiment Index. The Eurozone releases it Final Headline and Core CPI report, Trade Balance, and Eurozone ZEW Economic Sentiment. Canadian Manufacturing Sales round up the day’s reports. ECB President Mario Draghi and BOE Governor Mark Carney are due to speak at the ECB forum on central banking in Sintra.

Trading Perspective: Markets have priced in a no change in rates from the Fed at the conclusion of its meeting this week. The Fed is also expected to acknowledge the deterioration in the global environment and the downside risks for growth.

We highlighted yesterday that short market positioning in the 4 major IMM currencies against the US Dollar were little changed. Meantime US economic data continue to underwhelm.

- EUR/USD – The Euro held the 1.1200 level trading to a low of 1.12078 after a topside attempt above 1.1250 failed. EUR/USD has immediate support at 1.1200 followed by 1.1170. Immediate resistance can be found at 1.1250 followed by 1.1300. Markets will look to the ECB’s forum on central banking in Sintra where Mario Draghi and Mark Carney are due to deliver speeches. Net short Euro bets are still near multi-year highs. Look for a likely range today of 1.1210-1.1280. Prefer to buy dips.

- AUD/USD – The Australian Dollar remained under pressure due to the broad-based US Dollar strength. The ongoing China-US trade conflict has been a weight on the Aussie which is experiencing overwhelming bearish sentiment. AUD/USD trade to an overnight low of 0.68487, which are lows since the flash-crash in January. RBA meeting minutes will be monitored by traders although they may have been diminished following Governor Lowe’s speech on the eve of his 1st rate cut. Market positioning is currently short Aussie bets. AUD/USD has immediate resistance at 0.6885 (overnight high) followed by 0.6910. Immediate support can be found at 0.6840 and 0.6810. Look to buy dips with a likely range today of 0.6840-0.6910.

- GBP/USD – Sterling slipped further as political and Brexit uncertainty once again weighed. Markets will focus on BOE Governor Mark Carney’s speech at the ECB Sintra forum tonight into this week’s BOE policy meeting. Speculators have become bolder in adding to short GBP bets as the British currency began to wilt under the weight of broad-based USD strength. Net speculative GBP shorts were trimmed to -GBP 44,800 bets from -GBP 47,800. GBP/USD has immediate support at 1.2520 followed by 1.2480. Immediate resistance can be found at 1.2560 and 1.2610. Prefer to buy dips with a likely range today of 1.2520-1.2620.

Happy trading all.