Summary: President Donald Trump took aim at the Euro, accusing Europe of devaluing the single currency to the disadvantage of the US Dollar. In several tweets, Trump also criticised the US Federal Reserve’s monetary policy, with “The Fed Interest rate way too high”. The Euro rallied 0.10% to 1.1327 (1.1310) while the Dollar Index (USD/DXY), a mirror of the Euro, edged down to 96.72 (96.79). Sterling climbed back to 1.2724 from 1.2687, up 0.3% after British wages rose in April, beating forecasts. Wage growth is exceeding inflation which could force the Bank of England to raise interest rates. The Australian Dollar steadied to 0.6962 (0.6959) while the Dollar eased against the Yen to 108.50 from 108.60. Emerging Market currencies rallied against the Greenback.

Wall Street stocks ended their winning streak, settling lower. The DOW lost 0.11% to 26,058.00.

Bond yields steadied with the US 10-year at 2.14% (2.15%). Ten-year UK Gilts rose 2 basis points.

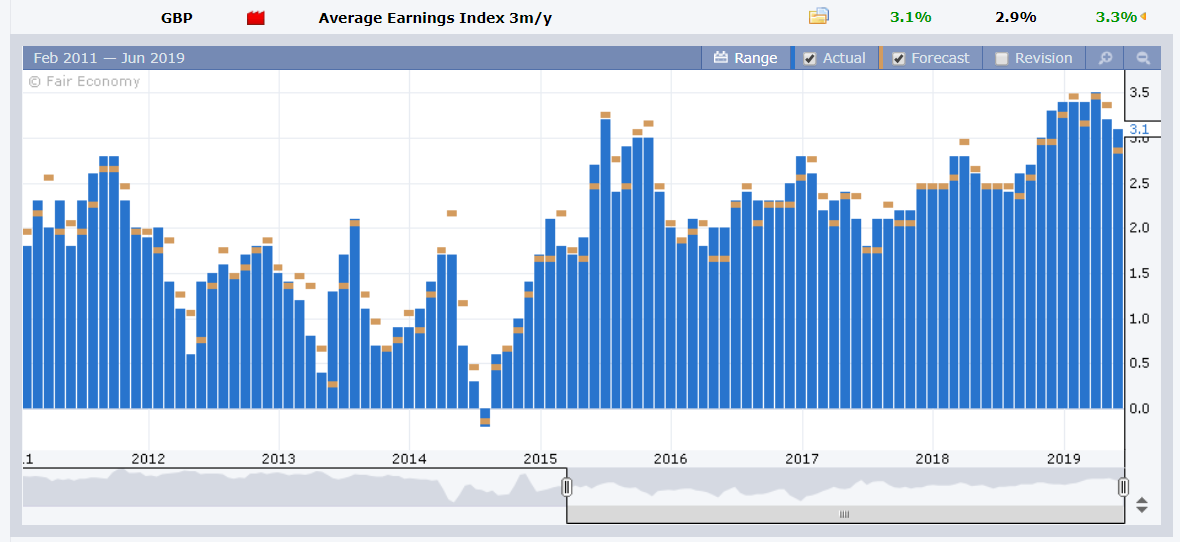

The Eurozone’s Sentix Investor Confidence Index dropped to -3.3 against a forecast of 2.3. UK Average Earnings (Wages) rose to 3.1%, beating forecasts of 2.9%. US Producer Prices matched forecasts. The US TIPP Economic Optimism Index slumped to 53.2 from 58.6 and a forecast of 59.2.

- EUR/USD – The Single currency rallied off 1.1300 to end 0.1% higher at 1.1327. Ahead of this month’s G20 Conference in Osaka (18-29), US President Trump took aim at the Euro, tweeting that “the Euro and other currencies are devalued against the Dollar”.

- USD/JPY – The Dollar slipped back against the Yen after rallying yesterday to 108.800 (overnight high), settling at 108.50 in New York. The US 10-year yield eased to 2.14% from 2.15%.

- AUD/USD – The Australian Battler steadied at 0.6962 (0.6958) on the back of the broad-based US Dollar weakness. The Aussie faces a test tomorrow with the release of Australia’s Employment report.

- GBP/USD – Sterling rallied to 1.2824 (1.2687) after a strong rise in British wages which beat forecasts and exceeds inflation could see the Bank of England raise interest rates. Boris Johnson launched his leadership bid, promising Conservatives “no more delays”.

On the Lookout: Market focus on the US-China trade war continues. Risk sentiment improved after Mexico and the US reached a deal and President Trump avoided tariffs yesterday. Ongoing tension with China continues to weigh on risk sentiment. Trump’s recent tweets taking aim at the Euro weakness and criticizing the Fed for its monetary policy may start to impact the Dollar more soon. US economic fundamentals, unlike in the past, have begun to weaken which means his pronouncements on the value of the currency will carry more weight in the markets.

Today’s data highlight is the US Inflation report (Headline and Core CPI), which is closely monitored by the Fed. Prior to that, Asia starts off with Australia’s Westpac Consumer Sentiment Index followed by Japanese Core Machinery Orders and Producer Prices. China reports its annualised CPI and PPI. Australia’s RBA Vice-Governor Christopher Kent (Finance) delivers a speech at the Australian Renmembi forum in Melbourne. ECB President Mario Draghi will deliver the opening remarks at the ECB Conference on central, eastern and south eastern Europe in Frankfurt.

Trading Perspective: The Dollar is poised to head lower if US inflation and retail sales reports show that the US economy is weakening. After Friday’s US job growth was significantly lower than expect, interest rate markets are now pricing in a September Fed rate cut chance at 94%. While US 10-year bond yields have stabilised, weaker inflation and retail sales reports will see the benchmark race toward 2.0% and lower.

Lastly current net long US Dollar market positioning, although trimmed, is still excessive. A significant correction has yet to be seen.

- EUR/USD – The Euro steadied to finish above 1.1300 to 1.1327 currently. Overnight high for the Single currency was 1.13375. Immediate resistance lies at 1.1340/50. A sustained break higher will see 1.1400 and beyond. Immediate support can be found at 1.1300 and 1.1280. Despite the big drop in Eurozone Sentix Investor Confidence Index, the tweet from President Trump on the Euro as he mulls tariffs on Europe, will weigh on the Single currency. Market positioning is currently short Euro bets near multi-year highs. Look to buy Euro dips with a likely range today of 1.1310-1.1360.

- USD/JPY – the Dollar steadied against the Yen yesterday to 108.50 after its post-US Payrolls slump to 107.88. Risk sentiment improved and the US 10-year yield jumped back to 2.15%. Overnight, the Dollar slipped back to 108.50 from a high of 108.80. USD/JPY has immediate resistance at 108.80 and 109.00. Immediate support can be found at 108.30 (overnight low 108.35) and 108.00. Look for a likely range today of 108.20-108.70. Prefer to sell rallies.

- AUD/USD – The Australian Dollar settled at 0.6962 after falling to 0.6947 overnight. Markets will eye Chinese Inflation data as well as the RBA’s Christopher Kent’s speech in Melbourne. The Aussie has immediate support at 0.6940 followed by 0.6920. Immediate resistance can be found at 0.7000 and 0.7030. With market positioning short of Aussie Dollar bets prefer to buy dips with a likely range today of 0.6955-0.7005.

- GBP/USD – Sterling steadied back above 1.2700 to close at 1.2725, buoyed by the rise in UK Wages and the possibility of a BOE rate hike. The latest Commitment of Traders/CFTC report (week ended 04 June) saw speculative GBP shorts increase to -GBP 44,400 contracts from the previous week’s -GBP 32,000. Speculators are getting bolder carrying shorts in a currency that could turn either way given the uncertainty of Brexit, US-China trade war, and a weakening US economy. GBP/USD has immediate resistance at 1.2740 (overnight high 1.27325). The next resistance level is at 1.2780. Immediate support lies at 1.2685 followed by 1.2650. Look to buy dips with a likely range of 1.2690-1.2790.

Happy trading all.