Summary: The Dollar steadied, rising modestly against most of its rivals, despite extended falls in US bond yields. Traders were reluctant to get too bearish on the Greenback ahead of today’s US Retail Sales report and upcoming Federal Reserve and G20 meetings. The Euro slipped 0.14% to 1.1275 (1.1290) after IMF Managing Director Christine Lagarde remarked that escalating trade tensions posed a risk to the Eurozone. The Australian Dollar edged lower to 0.6915 from 0.6927 after an Employment report, seen as mixed, heightened expectations of an RBA rate cut. Against the trend, USD/JPY slipped to 108.40 (108.50) and USD/CHF was at 0.9942 (0.9957) as global risk sentiment remained fragile. The Swiss National Bank kept its policy rate at -0.75% and said it could relax its ultra-loose monetary policy. SNB Chairman Thomas Jordan said that the appreciation in the Swiss Franc was due to the escalation of the China-US trade dispute in May.

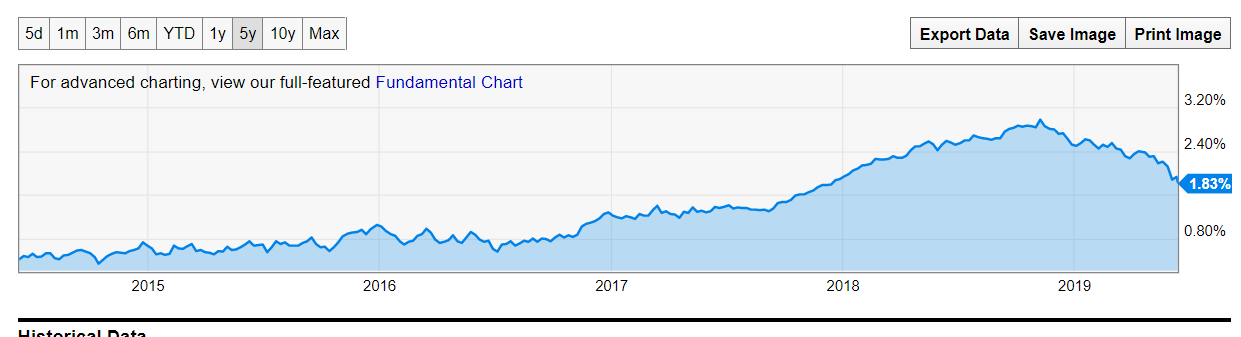

US bond yields extended their drop with the 2-year slumping 4 basis points to 1.84%, a 1.1/2 year low. The benchmark 10-year treasury yielded 2.09% (2.12% yesterday). Expectations for a Fed interest rate cut rose ahead of the Federal Reserve’s meeting next week.

Wall Street stocks rose together with treasuries. The DOW ended 0.46% up at 26,133.00. Brent Crude Oil prices rebounded 2.27% to US$ 61.00 (US$ 59.5) after an oil tanker attack off the coast of Iran.

- EUR/USD – The Single currency edged lower to close at 1.2475 from 1.2490 following a failed topside attempt above 1.1350 earlier in the week. The Euro spent the day trading under key level 1.1300 after Euro Zone Industrial Production slipped to -0.5%, against expectations of -0.4%.

- AUD/USD – slip-sliding away, the Aussie Battler slid to 0.6915 at the New York close. Australian Employment gained 42,300 jobs against expected gains of 17,500. Once again most of the gain was in Part-time employment. The Jobless rate increased to 5.2% from 5.1% which saw speculation increased for an RBA rate cut at its next meeting.

- USD/JPY – slipped to 108.39 from 108.50 against the general Dollar trend. The fall in US bond yields and heightened trade tensions kept a lid to any USD gains against this haven currency.

On the Lookout: Despite lower US bond yields, which are the result of growing expectations of a Fed rate cut in July, currency markets remain unimpressed. It seems bond market traders are more bearish than their currency counterparts. US economic data have underwhelmed with the latest US Employment report underwhelming all expectations. FX traders are reluctant to let go of their preference for the Greenback.

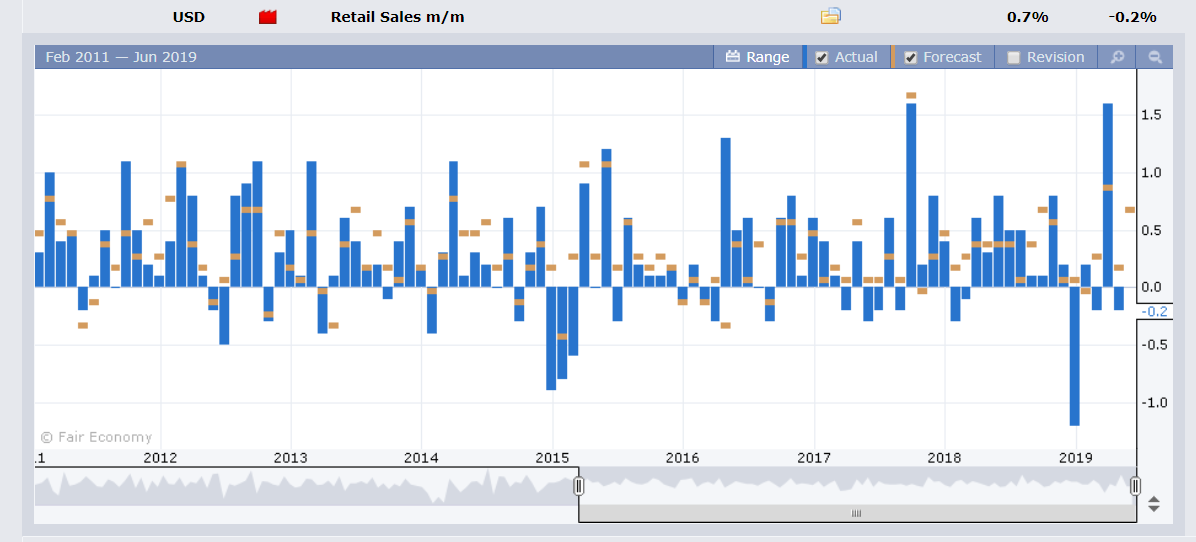

Tonight’s US Retail Sales report could be a game-changer. Median expectations from economists for Headline Sales are forecasting a gain to 0.7% for May from April’s 0.2%. An increase in Motor Vehicle Sales of 5.5% last month is the main contributor.

China releases its trifecta of key data today, Fixed Asset Investment, Retail Sales, and Industrial Production. Also set for release today is China’s Unemployment rate. Japan reports on its revised Industrial Production (May). Europe sees French Final CPI. US reports finish off the day with Core (ex-autos) and Headline Retail Sales for May, Capacity Utilisation Rate, Industrial Production and Preliminary University of Michigan Consumer Sentiment.

Trading Perspective: Without yield support, the Dollar will struggle to make substantial gains. Market positioning remains well long of US Dollars. A bearish read on tonight’s retail sales could shake FX markets and send the Greenback sharply lower.

- EUR/USD – The Euro traded to an overnight low of 1.12684. Immediate and strong support lies at 1.1260. The next support level can be found at 1.1210. Immediate resistance can be found at the key 1.1300 level (overnight high 1.13037). The next resistance level lies at 1.1340. The latest COT/CFTC report saw speculative Euro short bets trimmed to -EUR 89,900 from -EUR 92,400 bets. Net total shorts are still near at multi-year highs. Likely range today is 1.1270-1.1320. Prefer to buy dips.

- AUD/USD – The Aussie dropped to a low of 0.69013 before steadying to 0.6915 at the NY close. AUD/USD has immediate support at 0.6900 followed by 0.6870. Immediate resistance can be found at 0.6940 (overnight high 0.69385) and 0.6970. Market sentiment remains bearish on the Aussie and positioning is short. A sharply lower Greenback will turn the Aussie Battler around and send the shorts scrambling for the exits. Australia’s 10-year bond yield slipped 2 basis points to 1.40%. Which is mild compared to the fall in US yields. Likely trading range today 0.6900/50. Look to buy dips.

- USD/JPY – The Dollar slipped against the Yen to 108.39 after trading to an overnight high at 108.537. Immediate resistance today lies at 108.60 followed by 108.80. Immediate support can be found at 108.10 and 107.90. The fall in US bond yields and heightened risk tension will cap the Dollar at the 108 level. Japanese 10-year JGB yields were unchanged at -0.12%. Look for a likely range today of 108.10-60. Prefer to sell rallies.

Happy Friday and trading all.