The boom in shale oil has seen an increase in most oil futures, but there is also a structural difference in brent and shale oil markets, CFTC Said.

CFTC Talks, the Commodities Futures Trading Commission (CFTC) podcast, is back and it is now a You Tube video.

In the most recent episode, CFTC staff examined the oil futures market.

Title oil, or as sometimes referred to as shale oil, saw a boom starting in 2008.

Shale oil “is a high-quality crude oil that lies between layers of shale rock, impermeable mudstone, or siltstone.” According to the website, The Balance.

According to Christopher Goodenow, CFTC’s Market Analyst in their Division of Market Oversight, shale oil accounted for 63% of all oil production in the US as of February 2019; it was only 9% in 2008, “which is when the shale boom is generally considered to have started,” Goodenow stated.

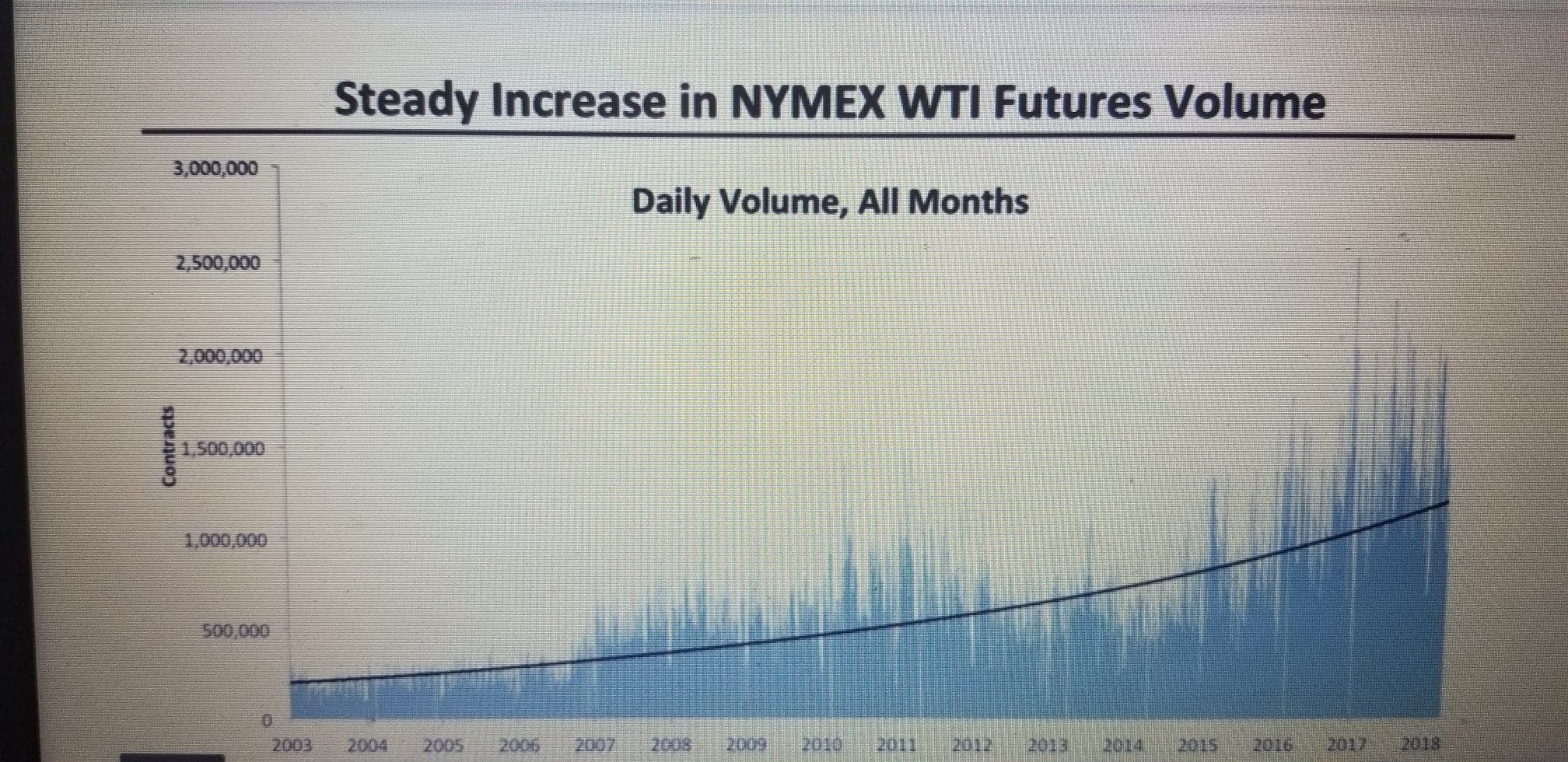

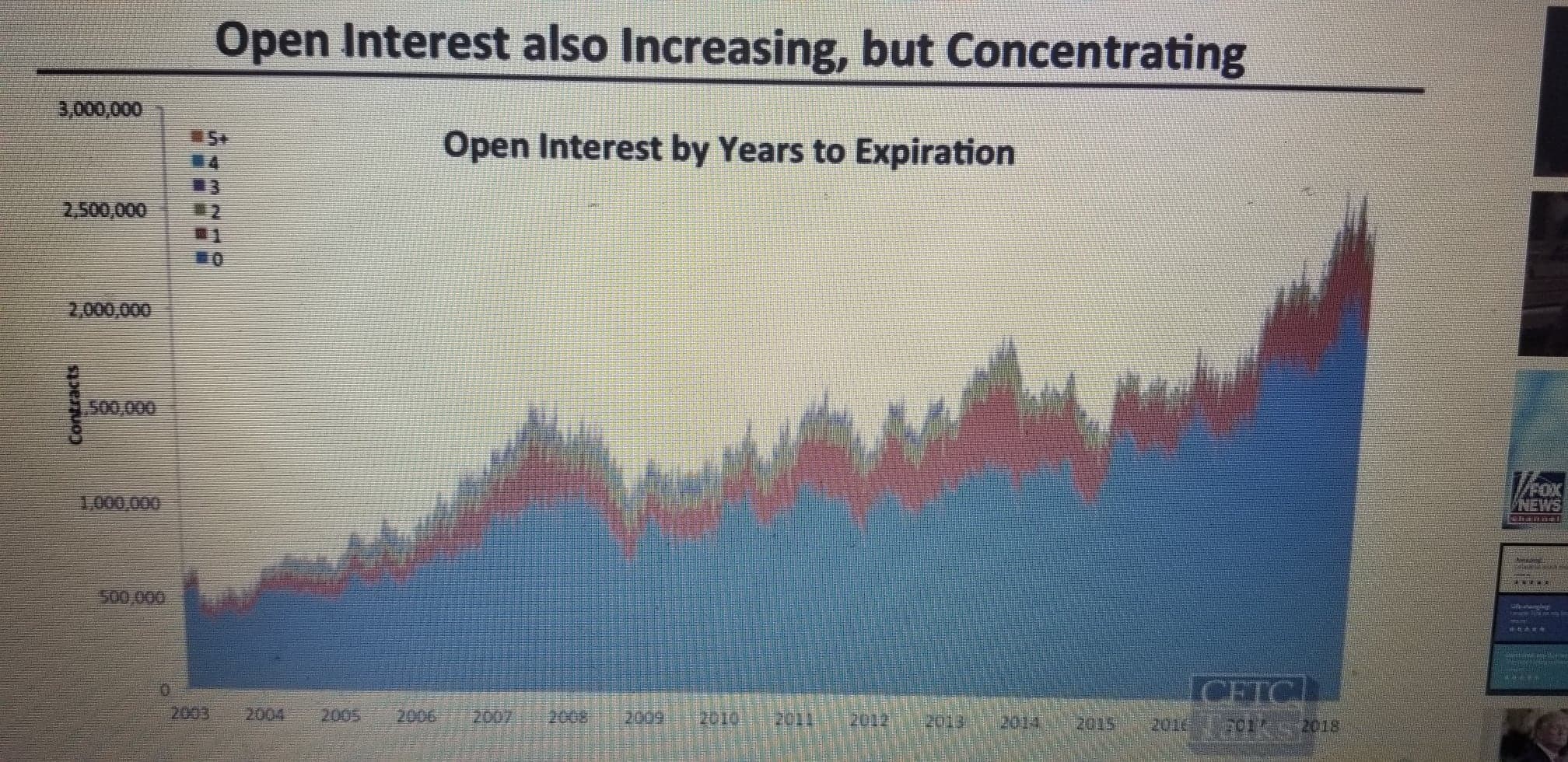

As he showed with several charts, as production ramped up, so too did trading in different shale oil futures on the NYMEX.

The two charts showed that both total trading volume and total open interest have increased just as shale oil production has increased.

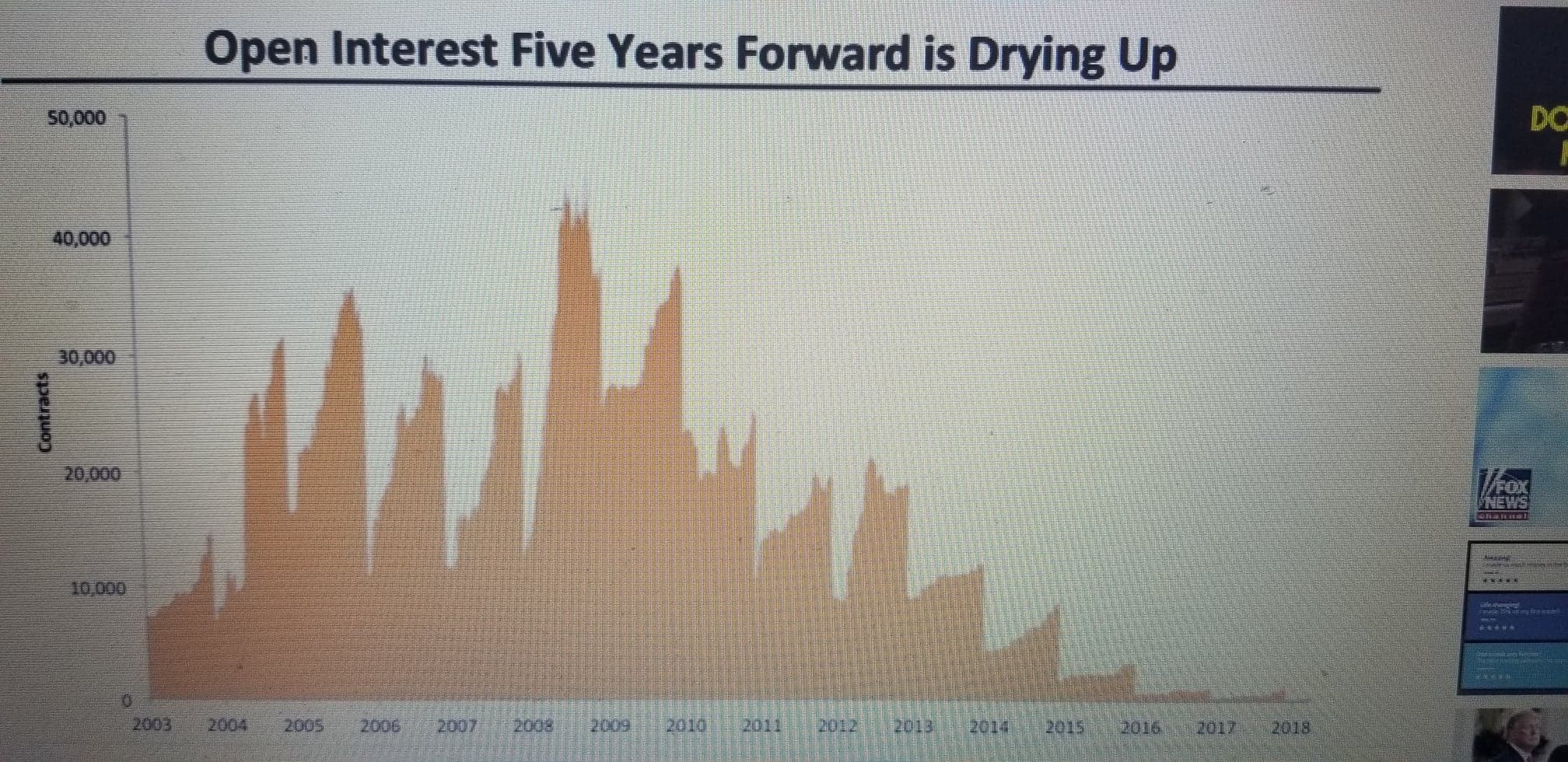

As Goodenow noted, open interest in contracts which go out five years have declined.

He noted that this is counterintuitive, “Unlike many traditional commodities such as corn, or wheat, or cattle, crude oil enjoys both a longer production life cycle and it doesn’t really spoil. You can store oil for years with no ill effects and once an oil reservoir is tapped, generally speaking, production will continue for years, barring some sort of mechanical or technical complication. As such, from the inception of the contract, the NYMEX WTI contract did a healthy amount of open interest farther out the curve than most commodities.” He said.

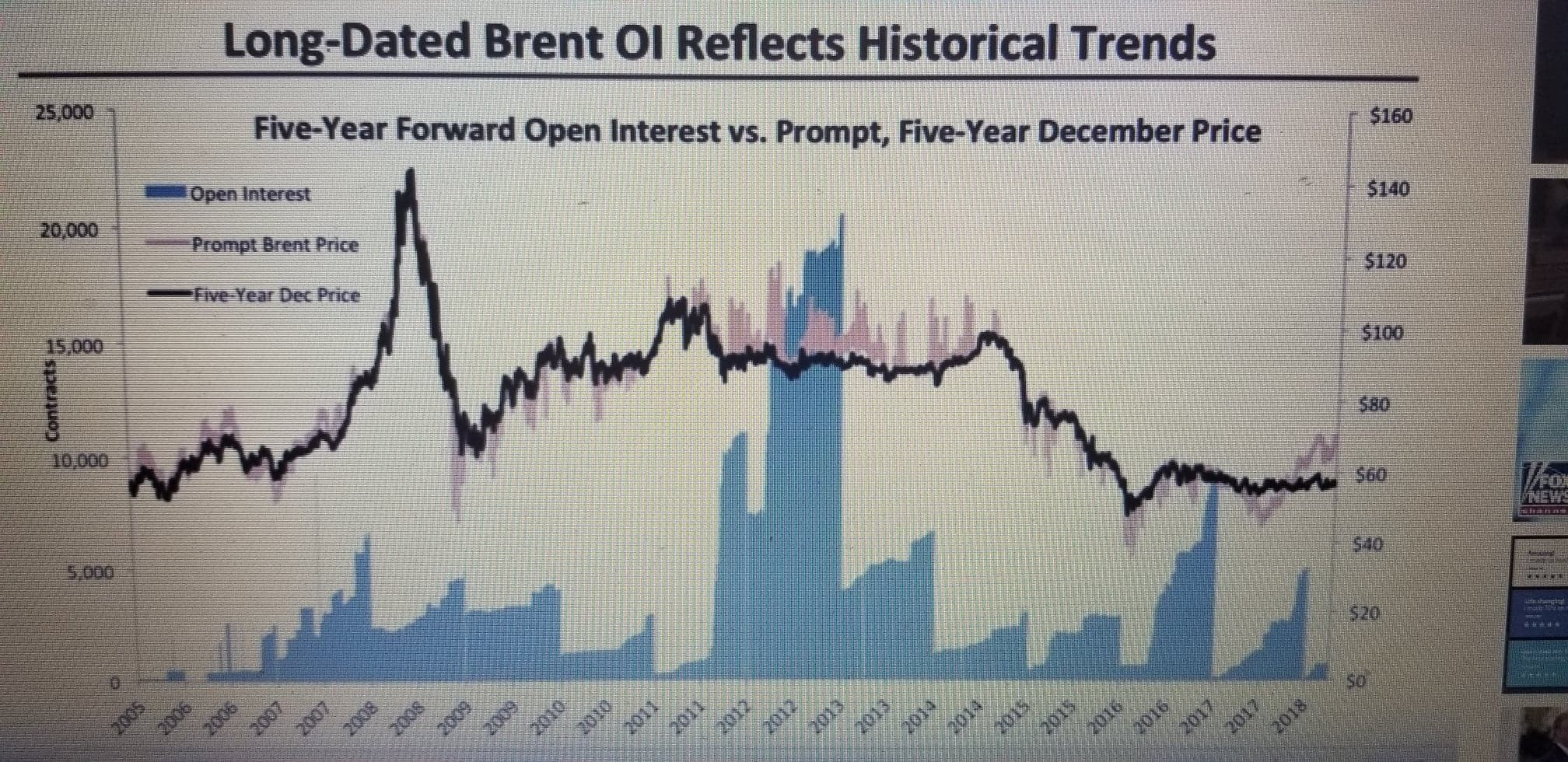

Unlike declines in open interest for shale contracts, five-year open interest for tradition Brent crude oil has not seen as much decline, Goodenow noted.

“While the magnitude of the peak level of open interest changes from year to year, the ICE Brent contract still has between 3,000 and 9,000 five year forward contracts outstanding, and this suggests there may be a structural difference in the two physical oil markets that accounts for the different behavior we see in the two futures contracts markets.” Goodenow said.

Goodenow said that Brent oil “is primarily driven by conventional oil field developments using more traditional oil rigs. As tight oil is a unique of the US market, we posit that the expansion of these types oil plays have altered the way US oil market participants use the WTI futures market.” Goodenow said.

Goodenow said staff analyzed participants in oil futures and found that oil producers, starting in 2011, largely stepped away from contracts five years out.

When speaking to these firms, Goodenow said the firms gave an explanation for why five year contracts became less attractive in shale oil.

“They noted that for each individual tight oil well drilled most of the oil is extracted in the first eighteen to twenty four months versus the longer time frame of the conventional well. Thus, the larger percentage of oil producing assets that comes from tight oil plays, the less oil these firms have to sell three plus years from today, thereby reducing their need to use futures that far down the curve.” Goodenow concluded.