Summary: A rebound in US bond yields, and a fall in those of its Rivals, lifted the Dollar higher. Benchmark 10-year US treasury yields rebounded to 2.39% from 2.37%. Rival bond rates fell. Germany’s ten-year Bund yield slipped to -0.07% from -0.06%. Japan’s 10-year JGB yield dropped 3 basis points to -0.11%. Speculation over further dovish moves from rival central banks following the RBNZ grew. New Zealand’s central bank said its next move in interest rates was likely to be a cut. The Euro slipped further to 1.1225 from 1.1250. USD/JPY rallied to 110.83 before settling at 110.60. The Australian Dollar closed at 0.7075, down 0.1% from 0.7090. The Dollar Index (USD/DXY) climbed 0.48% to 97.24 (96.89). Sterling was pounded to 1.3034 from 1.3247 as prospects over any Brexit agreement faded. Reports that a 3rd “meaningful vote” on PM May’s twice-defeated deal would not take place hurt Sterling. Instead a Parliamentary debate would take place. Latest reports that there will be a vote didn’t help the British Pound much.

Weaker-than-expected US data failed to pressurise the Dollar. US Q4 GDP missed forecasts at 2.2% (against 2.4%). March Pending Home Sales fell to -1.0% from +4.6% the previous month.

Wall Street stocks rose on reports of progress in the China-US trade talks in the crucial area of technology transfer. The DOW finished up 0.45% to 25,729. while the S&P 500 gained 0.5% to 2,818.

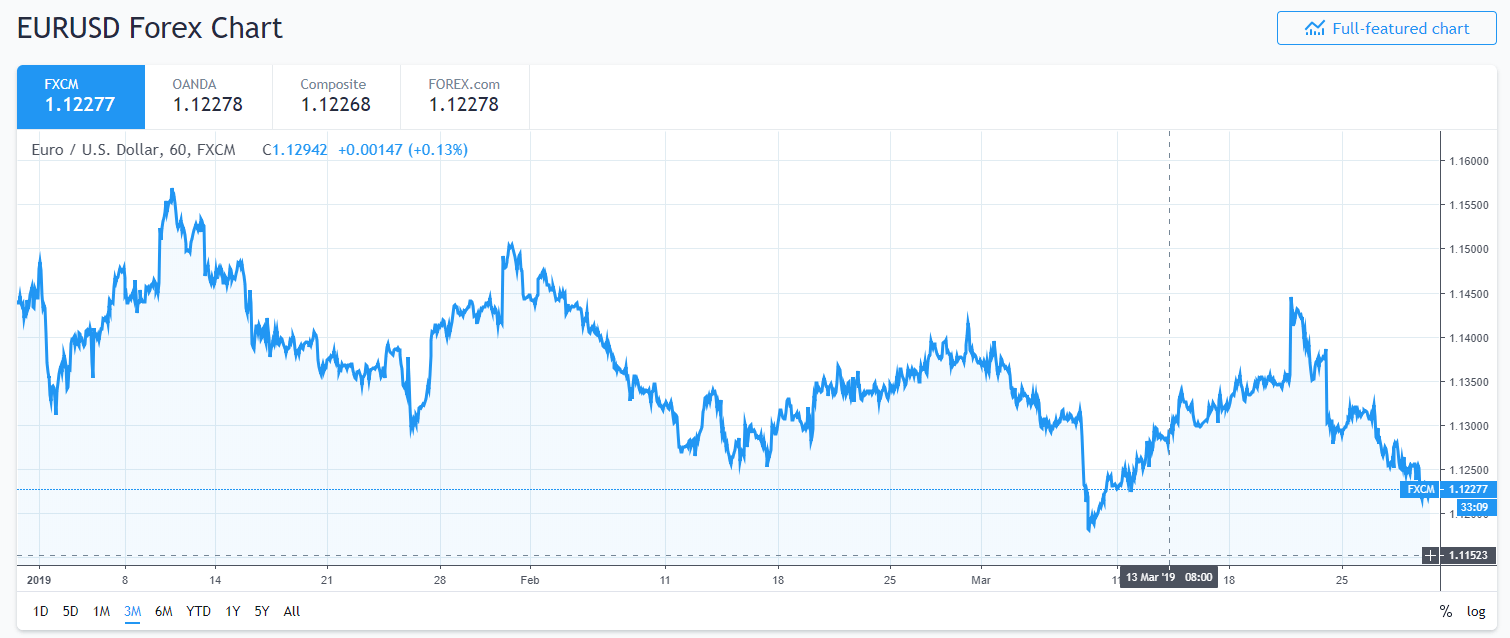

- EUR/USD – The Euro extended its losses against the Greenback as the differential between US and German yields widened in the former’s favour. Reports that the ECB would introduce a tiered deposit rate, which would keep rates low for longer weighed on the Single currency. EUR/USD traded to 1.12135 lows before settling at 1.1225.

- GBP/USD – The British Pound slumped to 1.30344 from 1.3165 following more Brexit uncertainty. PM May said she would be willing to step down if her Brexit deal was passed. That didn’t do the trick. Time is running out for May and her Brexit deal despite trying to kick the can further down the road a few times over.

- USD/JPY – The Dollar rallied against the Yen as the US 10-year yield rebound off its lows. Japan’s 10-year JGB yield fell 3 basis points to -0.11%. USD/JPY traded to a high at 110.83 before settling at 110.60.

On the Lookout: Traders ignored the weaker US data reports and instead focussed on yield differentials. Which have widened back in the Greenback’s favour. The RBNZ ‘s statement lifted the wings of all the doves. Risk appetite also improved with reports of progress in the China-US trade negotiations. US officials are in Beijing to try and nail a trade deal. The Dollar also rallied against the Emerging Market currencies.

Today’s data releases see a host of Japanese data to begin Asian trading. Japanese Preliminary Industrial Production, Retail Sales, Unemployment Rate and Tokyo Core CPI are released soon. Euro area data sees German Retail Sales, Unemployment and French Consumer Spending. The UK reports on its Current Account, Final Q4 GDP, Net Lending to Individuals (consumer credit) and Nationwide House Prices. Canada follows with its monthly March GDP report. The US reports on Core PCE Price Index, Personal Income and Spending, Chicago PMI and the University of Michigan Consumer Sentiment. The Brexit Parliament also has its Vote or Debate late Friday evening (early Saturday morning in Sydney)

Trading Perspective: With US bond yields rebounding off 15-month lows, the Dollar should be supported in Asia. However, traders cannot ignore the recent weakness in US economic data. The speculative market is positioned long of US Dollar bets. The only currency which saw a large reduction of long USD bets was the British Pound, which is now under pressure. Federal Reserve Vice-Chairman Clarida said that recent concerns about global economic and financial developments will keep the Fed “patient and data-dependent.” US FOMC member and New York Fed Head Williams said that the US economy is in a “very good place.” The Dollar’s recovery is temporary and should not result in a break higher.

- EUR/USD – The Single Currency has slid from a high of 1.1448 to 1.12135 in a little over a week. Broad-based US Dollar strength has weighed on the Single Currency which has retreated after the ECB’s dovish policy meeting. The weaker British Pound has also weighed on the Euro. Let’s keep in mind that Euro short bets are at multi-year highs. EUR/USD has immediate support at 1.1200 followed by 1.1170. Immediate resistance can be found at 1.1260 and 1.1300. I wouldn’t want to be short down here and prefer to buy any dips toward 1.1200.

- GBP/USD – Sterling was pounded as the Brexit drama extended. Markets are tired of seeing the Brexit can kicked down the road. PM May is running out of time for her deal and her future. Sterling traded to 1.3034 overnight low after it broke through 1.3200 in early Sydney yesterday. GBP/USD settled at 1.3050 this morning. Immediate support lies at 1.3020 followed by 1.2980. Immediate resistance can be found at 1.3080 and 1.3120. Expect more volatility in this currency with a likely range of 1.3010-1.3170. Am neutral, just trade the range shag.

- AUD/USD – The Australian Dollar slipped under the overall stronger US Dollar. While the Kiwi stabilised at 0.6780, Emerging Market currencies were lower against the Greenback. The Aussie Battler has immediate support at 0.7060 (overnight low 0.70644) followed by 0.7030. Immediate resistance lies at 0.7100 and 0.7140. We are near the bottom end of the Aussie’s trading range. Prefer to buy dips to 0.7060 with today’s likely range 0.7060-0.7130.

Happy Friday and trading all.