Asian stocks finished mostly lower amid concerns of slower global growth, Brexit complications and votes and US-China trade talks worries. In Japan, the Nikkei225 main index underperformed with losses 1.67 percent to 21,022. The Hang Seng benchmark in Hong Kong finished 0.14 percent lower at 28,691. The Shanghai Composite finished 0.85 percent higher at 3,022, and in Singapore, the FTSE Straits Times index gained 0.76 percent lower at 2,999. Australian equities in a similar performance to yesterday have again overcome a softer start only to charge higher in the latter part of the session. The ASX 200 overcame a soft lead from Wall St. to end the day 40 points or 0.65% higher to 6176, after being down around 20 points or 0.3% at its worst levels. The index has now improved for three straight sessions but is still down for the week after a steep fall on Monday.

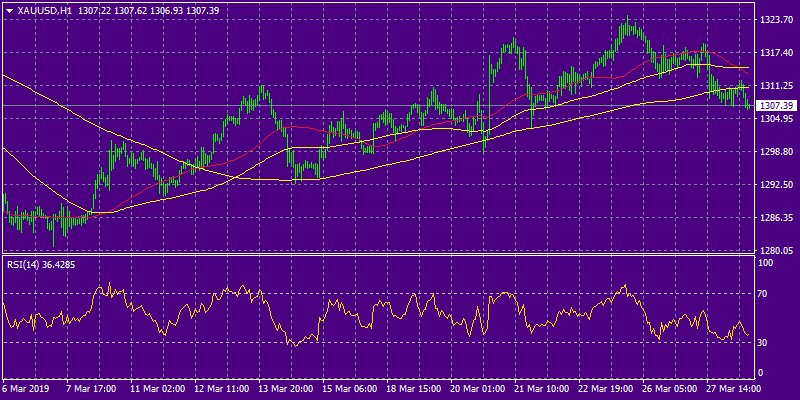

In commodities markets, Light Crude Oil consolidates at recent highs and trades at 59.20; Brent oil is trading 50 cents lower at $67.70/barrel. The Energy Information Administration data released yesterday showed the domestic crude stocks rose by 2.8 million barrels per day during the week ended March 22, bringing the figure to 442.3 million barrels, which reportedly amounts to a 3% increase year-on-year. Gold retraced back to $1308 yesterday after hitting the high at $1318 during the US session just to rebound today to $1311. XAUUSD’s immediate resistance stands at the previous high at $1323 while more offers will be found at the 1330 zone. The precious metal may find support at $1308 the low from yesterday, ahead of testing the $1300 round figure.

A positive start for equities in the early European session mirrors the improved sentiment seen in US equity futures, as investors watch the developments surrounding Brexit. DAX30 gains 0.51 percent to 11,477, CAC40 is 0.33 percent higher at 5,319 while FTSE100 in London is 0.76 higher at 7,249. Only the FTSE MIB in Milan trading 0.24 percent lower at 9,213.

On the Lookout: UK Lawmakers voted but still no majority for Brexit options. Fed’s George says the FED did not make a mistake to raise rates in Sept 2018 and noted that the US economy is operating above its potential. The New Zealand, ANZ business confidence for March came to -38.0 (prior -30.9) & Activity Outlook: 6.3 (prior 10.5).

In our calendar today the trade talks between the US and China will recommence with Trade Representative Lighthizer and Treasury Secretary Mnuchin visiting China. We will get preliminary March CPI for Germany and Spain, March confidence indicators for the Euro-area and final 4Q GDP print in the US along with latest weekly initial jobless and continuing claims, February pending home sales and March’s Kansas City Fed manufacturing activity index. In the evening, we will get Japan’s unemployment rate, February industrial production, and retail sales data.

In Central Bank Calendar, we have the speeches of ECB’s Guindos and Villeroy, and Fed’s Clarida, Quarles, Williams, and Bullard all due to speak. On Friday, ECB’s Coeure and Fed’s Quarles are also due to speak.

Trading Perspective: In forex markets, AUDUSD is trading higher on improved sentiment above 0.71 mirroring the Kiwi, (NZDUSD) which nose-dived yesterday after the Reserve Bank of New Zealand (RBNZ) abandoned its long-standing neutral stance and turned dovish, saying that the next move in interest rates would likely be down. The NZDUSD currently trades at 0.6825 having lost yesterday over 140 pips. The US dollar index is losing some pips and now is trading at 96.38 after capped in the 96.80 region in the wake of the dovish FOMC event last week.

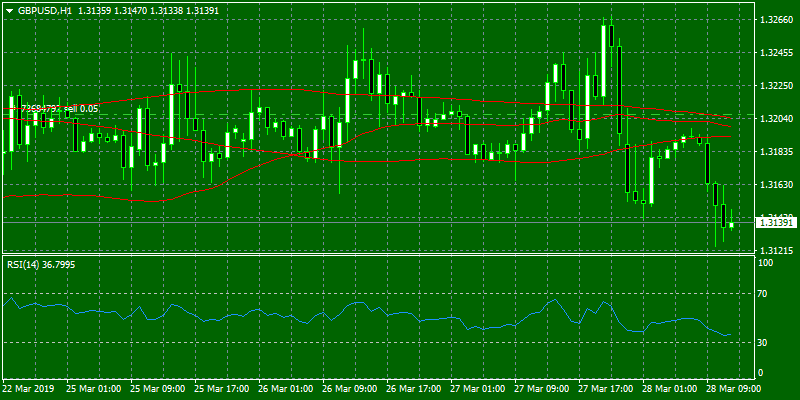

GBPUSD spends another day watching votes related to Brexit with an unclear outcome, and the pair keeps moving up and down following the news from the Parliament. The short term technical picture is still neutral for Sterling. On the downside, major support will be found at 1.3057 where cross the 50-day moving average while more protection can be found at 200-day moving average around 1.2982. On the flip side, major resistance can be found at 1.3202 where the 50 hourly moving average stands and then at 1.3232 the cross point of 100 and 200-hourly moving averages while 1.3382 the yearly high will be met with strong supply.

In GBP futures markets open interest rose by just 556 contracts on Wednesday from the previous session, while volume rose significantly by nearly 41.3K contracts for the first time after three consecutive drops.

EURUSD lost the 1.13 level after being rejected at the 1.1330 zone yesterday after ECB President Mario Draghi’s speech in Frankfurt where he repeated his cautious stance for the common economy. The pair looks vulnerable as fails to make any rebound on worse US economic news. Euro will find resistance at the 200-hour moving average at 1.1338 and is looking to break above in order to establish a new bullish trend targeting the yearly high at 1.1570. The low from Asian session at 1.1242 provides solid support, and further protection can be met at the horizontal support line at 1.1236 before a move to test YTD low at 1.1180.

On the Euro political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist and right-wing option among voters.

In Euro futures markets, traders cut their open interest positions by nearly 1.4K contracts on Wednesday from Tuesday’s final 486,804 contracts. On the other direction, volume rose for the second consecutive day, this time by around 52.8K contracts.

USDJPY lost momentum and trades just above the 110 zone having hit yesterday as high as 110.72. Major support for the pair stands at the 110 round figure. Immediate resistance for the pair stands at the 111 round mark and then at the 111.19 where the 100-day moving average crosses, followed by 111.49 where the 200-day moving average stands.

Open interest in JPY futures markets shrunk for the third straight session, now by more than 2K contracts on Wednesday from Tuesday’s final 157,145 contracts. Volume, instead, reversed two consecutive drops and rose by nearly 4.5K contracts.