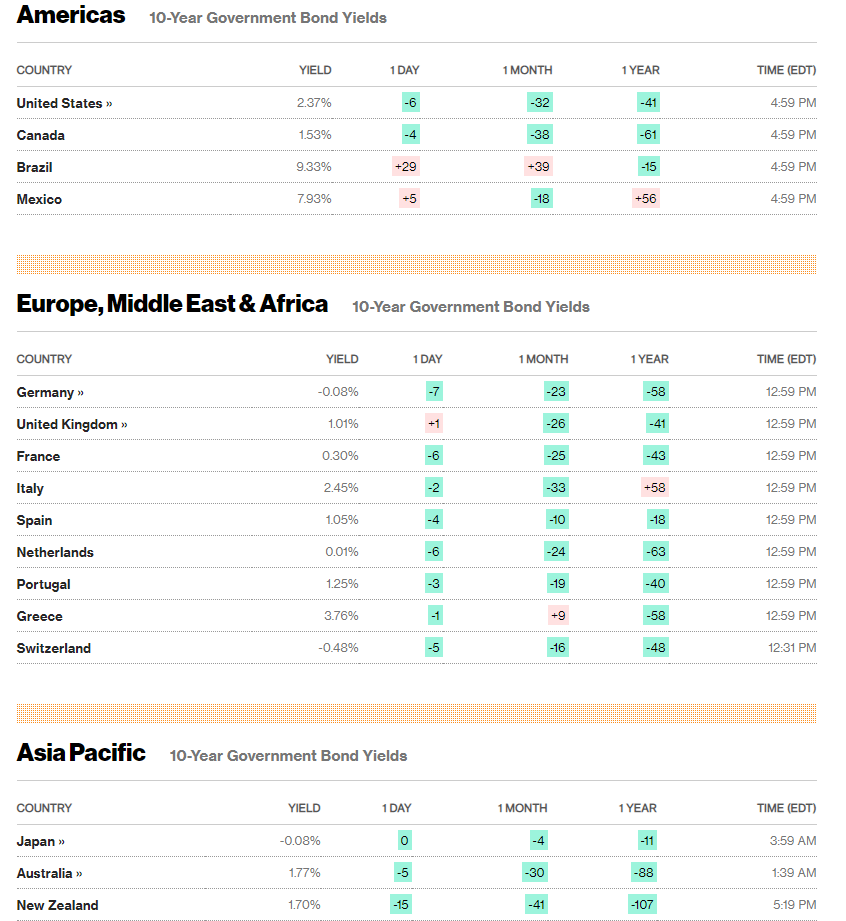

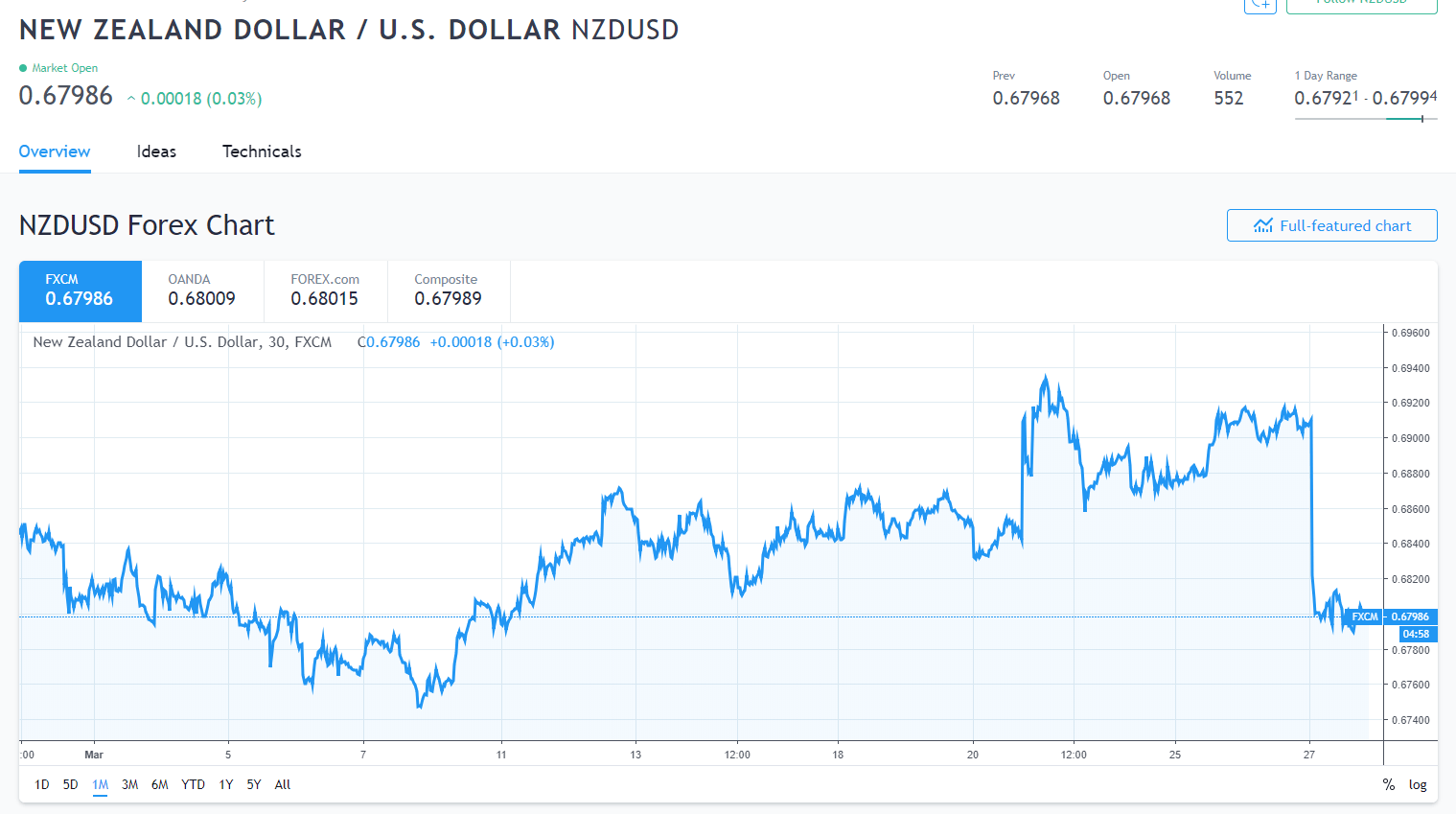

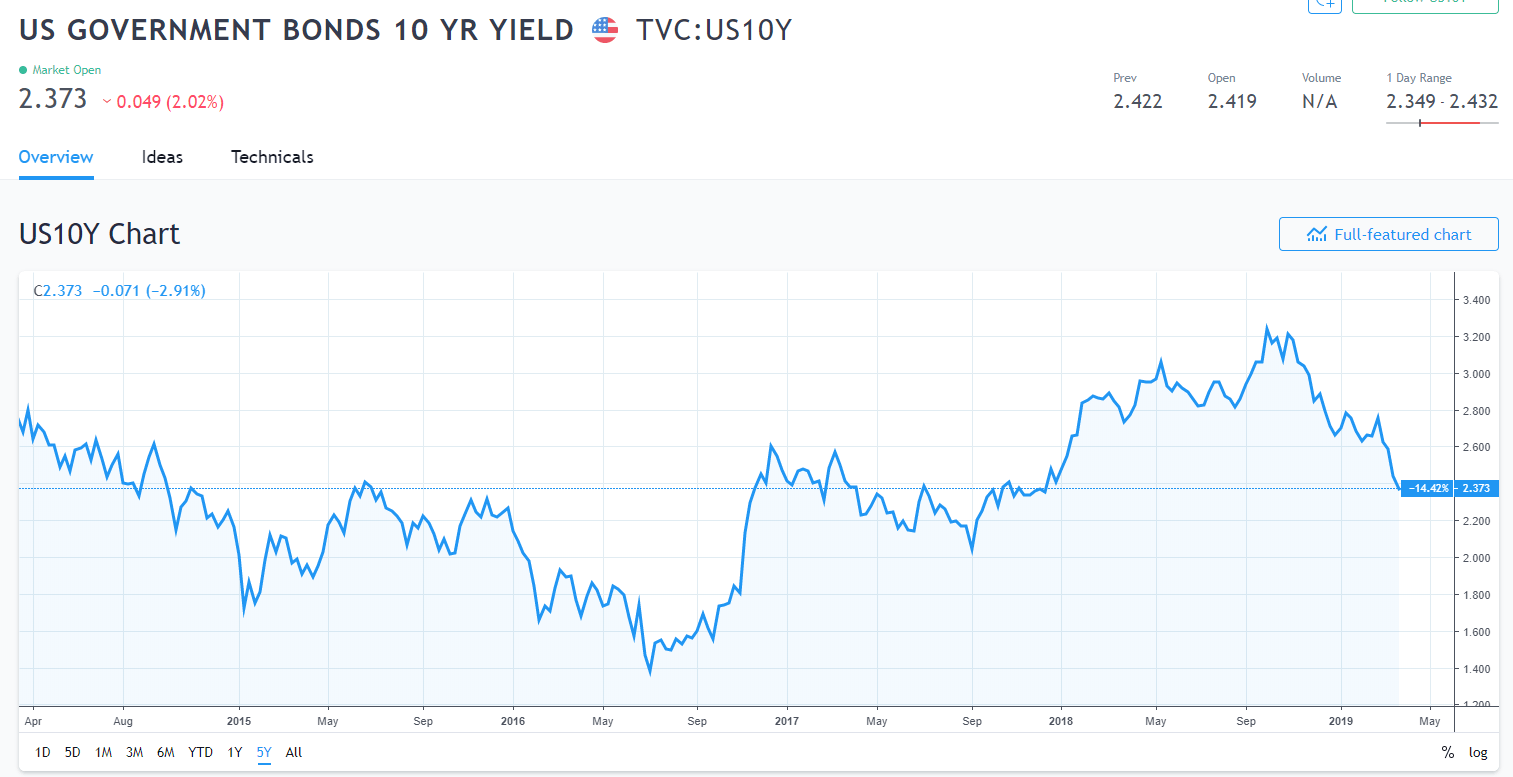

Summary: The RBNZ became the first of the G10 central banks to flag a rate cut, abandoning its neutral policy which caught traders by surprise. The Kiwi nosedived 100 pips (0.6905 to 0.6805) immediately after the announcement. The flightless “Bird” closed 1.69% lower at 0.6800. It’s antipodean cousin, the Aussie slumped 0.71% to 0.7090 from 0.7140 yesterday. New Zealand’s central bank said that its next move would likely be a rate cut, “given the weaker global economic outlook and reduced momentum in domestic spending.” Ten-year NZD bond yields plummeted by a whopping 15 basis points to 1.70%. Global treasury yields dropped in synch. The benchmark US 10-year yield fell 5 basis points to 2.37%, its lowest this year and not seen since December 2017.

Elsewhere, ECB President Mario Draghi said that the European Central Bank stands ready to delay a planned interest rate hike if necessary. Ten-year German Bund yields slumped to -0.08% (-0.02%). The Dollar finished mixed against its Rivals, USD/DXY ended a touch higher at 96.887, up 0.10%.

Wall Street stocks dropped on the fragile risk appetite. The S&P 500 was 0.54% lower (2,805).

- NZD/USD – The RBNZ’s dovish message caught traders by surprise and the Kiwi had its wings clipped, dropping like a stone to 0.6805 from 0.6905. NZD/USD closed at 0.6800, down 1.69%. Interest rate markets now predict not one, but two 0.25 basis point rate cuts to it’s Official Cash by the RBNZ this year. The Kiwi found good support at 0.6785.

- AUD/USD – As speculation mounted that the RBA would follow the RBNZ’s dovish shift from its current neutral stance, the Aussie slumped. AUD/USD traded to an overnight low of 0.70685, settling to close at 0.7090 (0.7140 yesterday).

- EUR/USD – The Single currency slipped to 1.1250 from 1.1270 after Mario Draghi said that the ECB stands ready to delay a planned interest rate hike. Draghi also pointed out that he and his colleagues are starting to worry about the side-effects of negative interest rates.

On the Lookout: The British Pound takes centre stage in early Sydney as reports of the UK Parliament vote on Brexit options trickle in. British lawmakers have so far voted to approve a Brexit delay. The result means that the UK will not crash out of the Euro tomorrow (March 29). Indicative votes have also shown that there is no majority for any Brexit option. Sterling fell from its NY close of 1.3246 to 1.3170 currently as the UK Parliament voted with still no majority for Brexit options. The drama continues.

Economic data released yesterday were mixed. The UK’s Realised Sales Index slumped to -18 from a forecast of 5. Canada’s Trade Balance underwhelmed. In the US, the Current Account fell further in the red to -USD 134 billion against a forecast of -USD 130 billion. The US Trade deficit narrowed in March to -USD 51.1 billion from February’s -USD 59.8 billion, much of the improvement coming from a reduction of the deficit with China.

Today sees New Zealand’s ANZ Business Confidence Index, German and Spanish CPI reports and the US Final Q4 GDP read. The US also reports its Pending Home Sales and Core PCE Q4 results.

Trading Perspective: The RBNZ was the first central bank to signal its next move is likely to be a rate cut. While other central banks, including the Fed, put a brake to any rate hikes and turned dovish, they have yet to signal any cuts. Given the slump in bond yields, its clear markets believe that they will follow. US interest rates still have a way to go, but they are catching up with their global peers. Given markets are still carrying large long Dollar bets (apart from Sterling), the Dollar will find further gains difficult. And we are starting to see some good old volatility back in the currency markets. Happy days!

- EUR/USD – The Single currency managed to hold above its immediate support at 1.1240, settling at 1.1250 in early Sydney. The next support level comes in at 1.1220 followed by 1.1180. Immediate resistance lies at 1.1280 and 1.1320. Look for the Euro to trade a likely range of 1.1230-80. Prefer to buy dips.

- GBP/USD – The choppy ride continues for the Pound. Sterling slumped in early Sydney by 80 pips after the reports of the UK Parliamentary Vote latest results. GBP/USD fell to 1.3165 from 1.3247. The British Pound hit a low of 1.3150 before settling at its current 1.3175. Sterling’s initial fall came after reports that the DUP (Democratic Unionist Party) was not supporting a Brexit deal. With no majority for any of the 8 Brexit options, markets await the next steps in the ongoing drama. Sterling to stay volatile. Immediate support can be found at 1.3150 followed by 1.3110, 1.3080. Immediate resistance lies at 1.3210 and 1.3260. Looking a choppy trade within a 1.3130-1.3230 range for now. Just trade the range shag.

- AUD/USD – The Australian Battler fell to 0.70685 overnight before settling at its current 0.7090. Immediate support lies at 0.7060 followed by 0.7040. Immediate resistance can be found at 0.7110 and 0.7150. Australian 10-year bond yields fell five basis points to 1.77%. Many expect the RBA to follow the RBNZ with up to two rate cuts this year. That remains to be seen. Likely range today 0.7060-0.7130. Look to buy dips.

- USD/JPY – The Dollar was little-changed against the Yen despite the market’s fragile risk sentiment. USD/JPY closed at 110.50 from 110.755 yesterday. Japan’s 10-year JGB yield was unchanged at -0.08%. The risk remains lower for this currency pair. USD/JPY has immediate support at 110.20 followed by 109.80. Immediate resistance can be found at 110.70 (overnight high 110.712) and 111.10. Look to sell any rallies to 110.70/80 today.

Happy trading all.