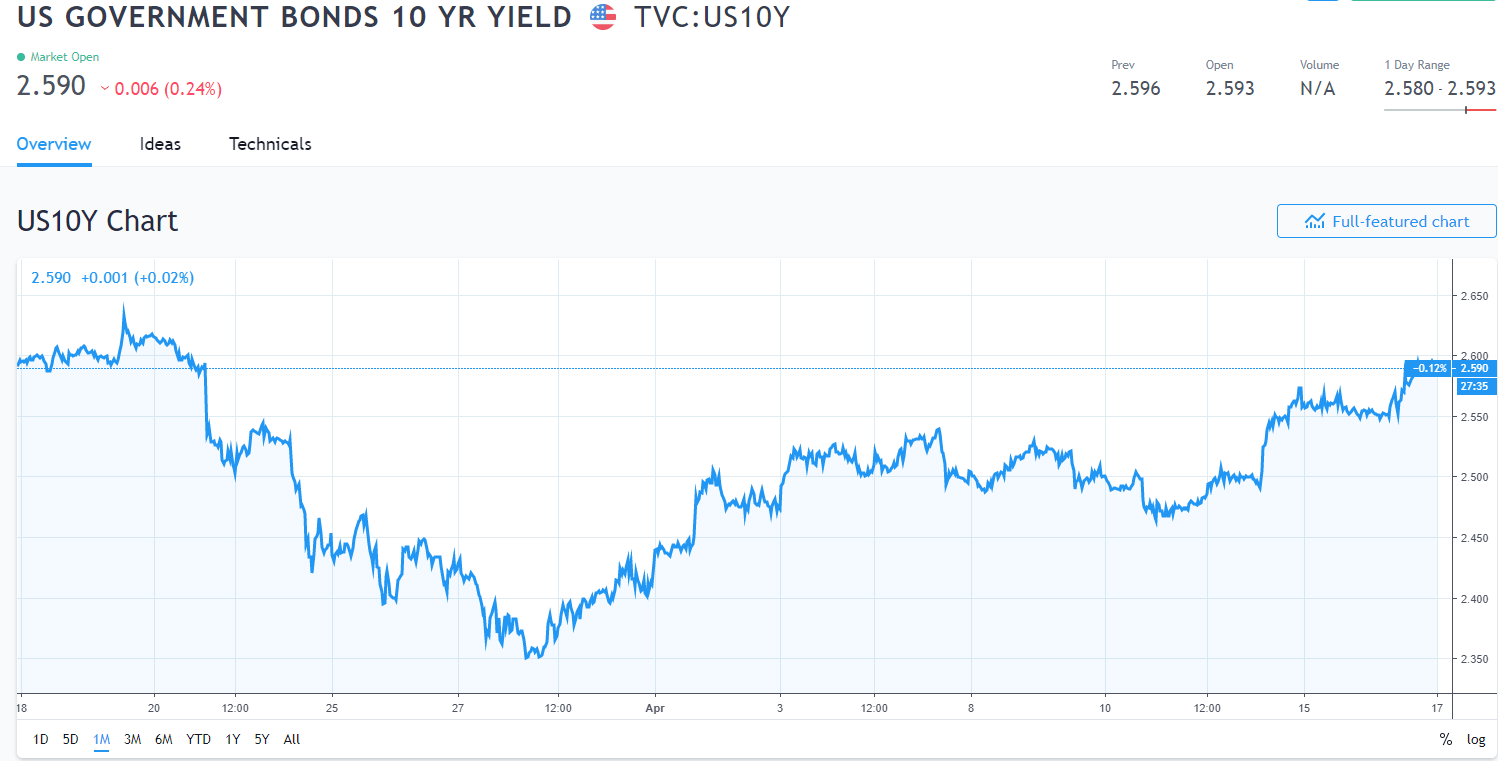

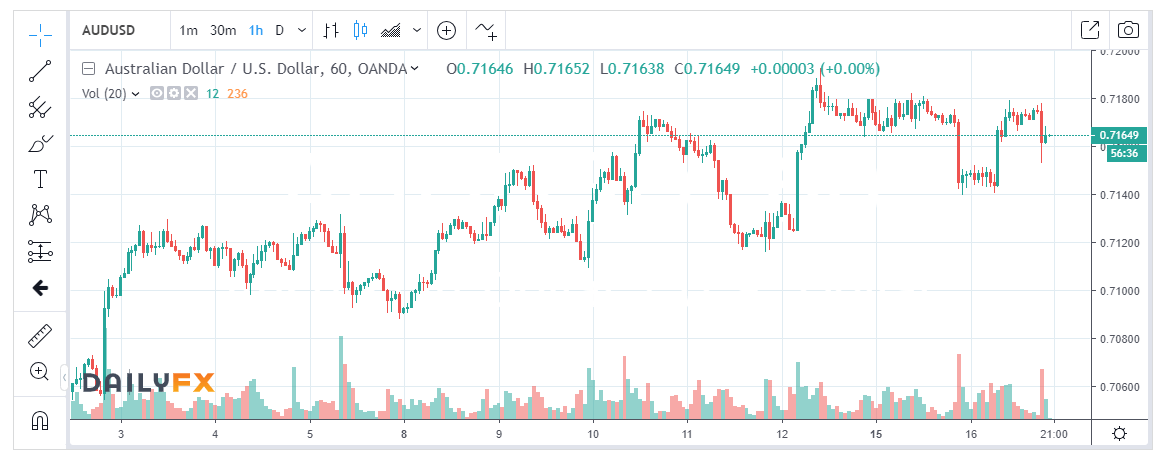

Summary: Higher US bond yields boosted the Dollar despite a decline in Industrial Production. The benchmark US 10-year yield climbed 3 basis points to 2.59%, back to March 20 pre-FOMC levels. The Euro retreated to finish at 1.1280 (1.1302) while Sterling fell back 0.39% to 1.3051 (1.3100). Germany’s ZEW Economic Sentiment Index in March soundly beat forecasts. A solid UK Employment report failed to lift the British currency against the overall stronger Greenback. The Dollar Index (USD/DXY) rose to 97.085, up 0.15%, its highest in 4 days. Elsewhere, the Australian Dollar slumped to 0.71396 immediately following the release of the RBA minutes which traders interpreted as dovish. The Aussie Battler bounced back to close little-changed at 0.7172. A data-dump from China, the trifecta of Industrial Production, Retail Sales, Fixed Asset Investment, including Q1 GDP, will determine the fate of risk and the Aussie today. Emerging Market currencies eased. Stocks slipped at the close. The Dow was down 0.06% while the S&P 500 lost 0.03%.

- AUD/USD – the Aussie closed flat at 0.7172 after testing an overnight low at 0.71396. Markets initially interpreted the RBA minutes as dovish. Policymakers were less confident in the labour and housing markets. However, the RBA did not weigh an interest rate cut.

- EUR/USD – the Euro failed to break up through the strong resistance level of 1.1320-30 and closed at its immediate support level of 1.1280. Germany’s ZEW survey showed concerns on the region’s outlook are fading. Tomorrow’s Eurozone Trade and inflation followed by Thursday’s Euro area and Eurozone PMI’s will be closely watched.

- GBP/USD – Sterling fell against the overall stronger Greenback to 1.3050 from 1.3100. Reports that talks between PM May and the Labour party had stalled also weighed on the Pound.

- USD/JPY – the Dollar finished little-changed against the Yen. Higher US yields will continue to support this currency pair. Market talk of an options play with a 112.00 strike abound.

On the Lookout: It’s all about China today. Analysts are expecting the worst for the world’s second largest economy to be over with. Recent export and credit data beat expectations. China’s Q1 GDP is expected to grow at an annual 6.3% from the previous 6.4%. Improvements are forecast in China’s trifecta of Industrial Production, Retail Sales and Fixed Asset Investment. We could be in for a few surprises. Tin helmets on.

Apart from China, the Eurozone reports on its Current Account and Final Headline and Core CPI data for March. The UK follows with its Headline, Core CPI, PPI input and House Price Index. Canadian Inflation (CPI, Core CPI and Trimmed-Mean CPI) are next. US March Trade Balance rounds up today’s busy data.

Trading Perspective: Easter markets are always characterised by less liquidity which lead to break-out attempts and wider trading ranges. Often, the break-outs are temporary. Traders need to keep aware of the respective levels. Market positioning will have a greater impact in thin conditions. There may be some large options strategies lying around with expiries in the next few days. The currencies have been stuck in relatively tight ranges content to consolidate, searching for catalysts to move. There is a lot of economic data released this week, the bulk of which come today and tomorrow. Keep watch on the data.

- EUR/USD – The Euro slipped to its immediate support level, settling just above 1.1280. The next support level lies at 1.1250. This is a strong support level and should hold if the Euro is to continue its march higher. Immediate resistance today can be found at 1.1310 and 1.1330. Bear in mind the speculative short Euro bets are at multi-year highs. Some of those shorts will be looking to cover on any dips. Sentiment on the Single currency is still bearish which should keep the Euro between 1.1250-1.1330 for now. Prefer to buy on dips.

- AUD/USD – The Aussie had a good bounce off it’s RBA induced lows. At the end of the day, the RBA did not signal any rate cuts even if policymakers expressed less confidence on the recent labour and housing data. It’s all about China today. AUD/USD has immediate resistance at 0.7180 and 0.7210. Immediate support lies at 0.7140 and 0.7110. Speculative Aussie short bets were pared to -AUD 54,400 from the previous -AUD 55,700. Look for a likely range today of 0.7160-0.7210. Prefer to buy dips.

- USD/JPY – The Dollar failed to gain ground against the Yen despite the climb in the US 10-year yield. Stocks reversed to ease at the close. USD/JPY closed at 112.01 (112.04 yesterday). Overnight high traded was 112.045. Immediate resistance lies at 112.10 followed by 112.30. Immediate support can be found at 111.85 followed by 111.55. The close around 112.00 is not surprising considering reports of an Options play with the strike price at 112.00. JPY short bets are the second biggest next to the Euro. The latest COT/CFTC report (week ended April 9) saw a build-up of net JPY shorts to -JPY 71,500 bets from the previous week’s -JPY 62,700. Look to sell rallies with a likely range of 111.60-112.10 today.

- GBP/USD – Sterling traded to an overnight low of 1.30425 after failing to clear above 1.3100. Solid UK Employment data which saw UK Unemployment remain at 45-year low of 3.9%, and an Employment rise to 179,000 failed to lift the Pound. Sterling has immediate support at 1.3040 followed by 1.3010. Immediate resistance can be found at 1.3100 and 1.3140. Look to buy dips today with a likely range of 1.3040-1.3110.

Happy trading all.