Asian stocks finished higher to the highest level in nine months, as investors cheer upbeat beginning of the US earnings season. In Japan, the Nikkei225 main index added 0,32 percent to 22,238 the highest since December 4th, 2018, the Hang Seng benchmark in Hong Kong finished 0.68 percent higher at 30,007. Chinese stocks are rallying, with Shanghai Composite finishing 1.55 percent higher at 3,226, and in Singapore, the FTSE Straits Times index finished 0.16 percent higher at 3,329. Australian equities have overcome early losses to end the day higher. The ASX 200 continues to trade on lighter volumes with school holidays and the Easter long weekend coming up. The ASX 200 index managed to lift by 26 points or 0.42% to 6277.4.

In commodities markets, Crude oil consolidates below five months high, at 63,27 area amid OPEC’s ongoing supply cuts, geopolitical uncertainty and the US additional sanctions on Iran. During the weekend, Russia’s Finance Minister Anton Siluanov said that Russia and OPEC might decide to boost production to fight for market share with the United States. On Friday, the weekly release of the Baker Hughes US rig counts showed a decline of 3 rigs giving a 1022 figure for the week ended on April 12. The near-term upside target for black gold is at the 65.00 figure, but I expect some profit taking to prevail as oil has reached overbought levels, the RSI trading above 70. Brent oil gives up some cents and trades today at $70.84/barrel near recent highs. Gold started the week lower and continues its trip south today at $1284, at the lowest levels since April 3rd. XAUUSD technical picture has turned negative, and now immediate support stands at 100-day moving average at $1284, which if broken can accelerate the downward move to 1260 and the 200-day moving average. Strong resistance now stands at the $1300 round figure and then at the 50-day moving average around $1307.

European session started slightly positive, tracking a strong session in Asia as strong Chinese macro figures supported sentiments. DAX30 is 0.13 percent higher to 12,034, CAC40 is 0.01 percent higher at 5,508 while FTSE100 in London is 0.07 percent higher at 7,442 and the FTSE MIB in Milan is trading 0.16 percent higher at 21,929.

In cryptocurrencies market, Bitcoin (BTCUSD) started the week on positive mood but lost over 80 dollars during US session at 5,064 and trades below the key 200-day moving average resistance at $5,147, making the daily low at 4,999. BTCUSD pair broke the $5,000 level the previous week but rebounded from $4,920 support area. Bitcoin will find support at the 50-day moving average at 4,089. Ethereum (ETHUSD) lost 5 dollars to 161, and it is placed nicely above the 100-day moving average, while Litecoin (LTCUSD) is also lower at 78.40. The cryptocurrencies market cap is currently above $160.0B.

On the Lookout: Bank of Japan Chief Kuroda, says that the central bank needs to bear in mind the possibility that prolonged low-rate policy may hurt financial intermediation. He further said that the BOJ would consider additional easing if momentum towards 2% inflation is lost adding that there is no need to change the 2% inflation target. The Reserve Bank of Australia (RBA) did discuss the impact of a rate cut while noting that inflation is likely to remain low for some time, but there is no strong case for a near-term move in interest rates.

Eric Rosengren, president of the Federal Reserve Bank of Boston, said that while the pace of economic expansion has slowed, overall, the US economy is doing quite well and the possibility of a recession is quite low.

Business conditions in the New York region improved more than expected in April, but growth remained “fairly subdued”, according to a survey released by the New York Fed. The Empire State manufacturing index rose to 10.1 from 3.7 in March, surpassing expectations for a reading of 6.0. Its new orders index rose to 7.5 this month from 3.0 the month before, while the shipments index increased to 8.6 from 7.7.

In the macro calendar from the Americas today, we have the Canadian manufacturing sales at 12:30GMT, followed by the US capacity utilization and industrial figures due at 13:15GMT. New Zealand’s GDT price index data that will be published around 14:00GMT. Oil traders will await the release of the US API weekly crude stocks data that will be released at 2030GMT.

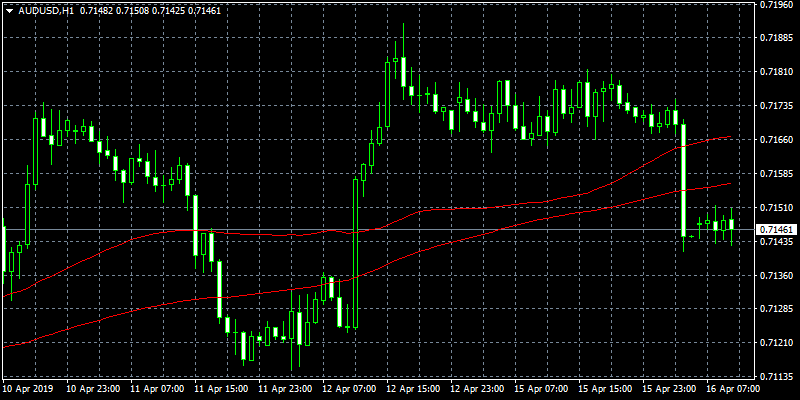

Trading Perspective: In Forex markets, US dollar consolidates around 96.50, while AUDUSD is trading 0.35 percent lower at 0.7145 as RBA April meeting’s minutes was widely read as dovish, and the likelihood of near term rate hike is low. Kiwi is trading 10 pips lower at 0.6756.

GBPUSD The pair failed to break above the 1.31 area and continues the consolidation around 1.3085. On the downside, major support will be found at 1.2975 at the 200-day moving average while solid protection can be found at the 100-day moving average around 1.2942. On the flipside, immediate resistance stands at 1.3195 the high from previous week session, and from there major resistance can be found at 1.3232 while 1.3382 the yearly high will be met with strong supply.

In GBP futures markets open interest increased 3.7K contracts to their open interest positions on Monday, reaching the third build in a row. Volume, instead, dropped by nearly 29.5K contracts following two consecutive advances.

EURUSD is trading in record low range, just 10 pips between 1.13 and 1. The pair made the daily high at 1.1320 and the low at 1.1297. Euro holds above the 50-day moving average and now is targeting the 100 DMA at 1.1348. Immediate support can be found at the 50-hour moving average around 1.1287, and further bids will emerge at 1.1278 and the 100-hour Moving average. As Michael Moran mentioned yesterday, speculative EUR shorts continue to grow. The latest COT report (week ended 9 April) saw speculative EUR short bets increase to -EUR 102,200 bets from the previous week’s -EUR 99,200.

EURO remains in negative mood following recent poor figures in Eurozone. In fact, recent disappointing readings in the region somehow confirm that the slowdown in the bloc and the ‘patient-for-longer’ stance from the ECB could be among us for longer than expected.

In Euro futures markets, open interest shrunk by nearly 1.9K contracts on Monday from Friday’s final 500,343 contracts, according to advanced figures from CME Group. Volume followed suit and dropped by around 83.7K contracts.

USDJPY: Same story here as the pair is trading in just 14 pips trading range, having hit the low at 111.85 and the high at 112.02. Major support for the pair stands at 111.51 the 200-day moving average and then at the 111 round figure if the pair manages to break below the 100-day simple moving average at 111.10. Immediate resistance for the pair stands at 112.10 the March 2019 high.

Open interest in JPY futures markets increased for the fourth straight session on Monday, this time by more than 3K contracts. Volume, instead, shrunk by almost 38.7K contracts after two consecutive daily builds.

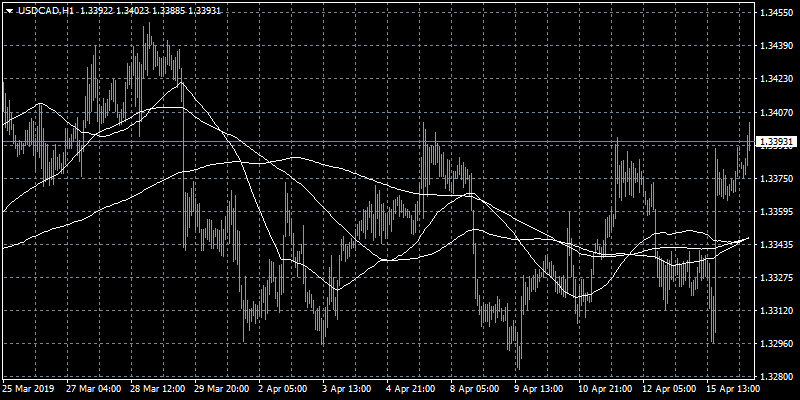

USDCAD is the winner of the day, as it rebounds from yesterdays low at 1.3331 to 1.3378 as oil prices retreat from recent highs. The pair will find immediate support at the 100-day moving average around 1.3322 while extra support stands at 1.3192 and the 200-day moving average which if breached will drive prices down to 1.31 key support. On the upside, immediate resistance stands at 1.34 a break of which can escalate the rebound towards 1.3430.