Summary: The Dollar ended little-changed against it’s Rivals in a quiet start to a likely slow Easter Week. Currency volatility, already at multi-year lows around 5%, remained depressed. There were few catalysts to move the currencies. Second-tier NY Empire State Manufacturing Index rebounded to 10.1 after a near 2 year low of 3.7 in March. The Dollar Index (USD/DXY), a measure of the Dollar’s value against a basket of foreign currencies (mainly the Euro) closed little-changed at 96.931 (96.85). USD/CAD rose 0.4% to 1.3370 (1.3330) after the Bank of Canada released its Q1 downbeat quarterly business survey report. The Euro was unchanged at 1.1302. Sterling rallied to 1.3100 (1.3077) as immediate Brexit risks faded. Ahead of today’s release of the RBA’s March meeting minutes, the Australian Dollar was flat at 0.7172. The Dollar finished at 112.05 Yen (112.02 yesterday). Markets awaited progress on China-US trade talks. US Treasury Secretary Mnuchin said he hoped that the two sides were “close to the final round” of negotiations. Stocks and bond yields slipped. The S&P 500 was down 0.07% (2,905).

- EUR/USD – The Euro traded in a narrow 1.12975-1.13209 range without much to drive the Single currency. EUR/USD ended at 1.1303, little-changed from 1.1300 yesterday. Today sees the release of German ZEW Economic Sentiment Index. Eurozone inflation (tomorrow) and Euro area PMI’s (Thursday) will hopefully stir this market up.

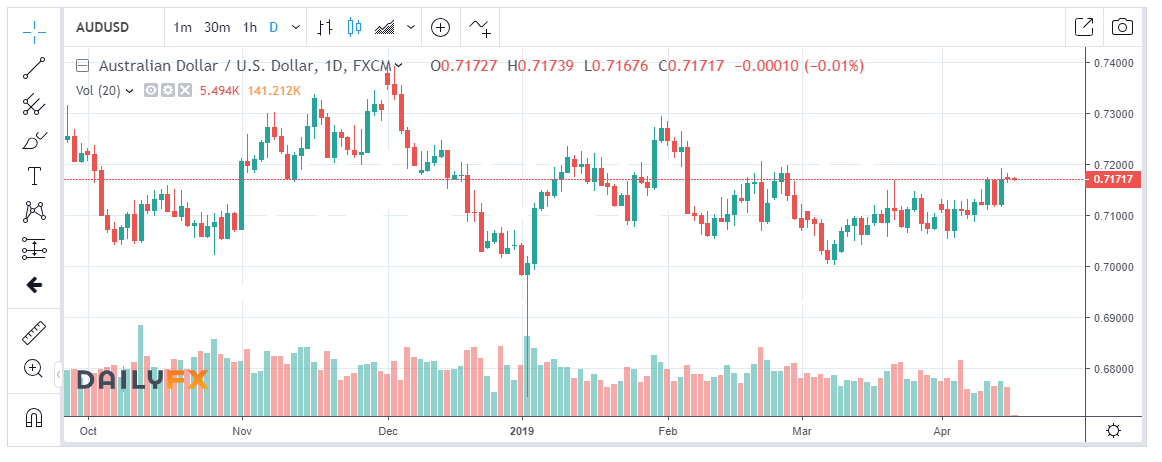

- AUD/USD – Australian Dollar volatility fared no better. AUD/USD closed at 0.7172, exactly where it was yesterday. Gimme a break! AUD/USD traded to a high of 0.71822. Emerging Market currencies were mostly weaker which kept the Battler from advancing. The RBA minutes are expected to show an increase in uncertainty and data-dependence.

- USD/JPY – the Dollar managed to close above 112.00, little-changed from yesterday. The overnight trading range for USD/JPY was a narrow 21 points (111.89-112.10).

- GBP/USD – Sterling edged higher as any immediate Brexit risk was removed by the delay and quiet trading conditions. The British Pound closed at 1.3100 from 1.3075 yesterday.

On the Lookout: “Watching and waiting”.. for something to happen. On the trade talks between China and the US. Any deal between the two is expected to remove headwinds to global growth. How close are they really to a deal? Despite what Mnuchin and other officials say markets are uncertain. I am. EM currencies were mostly lower yesterday while stocks slipped.

Events and data releases pick up today and hopefully see some volatility injected back into the currencies. The day starts off the release of the minutes of the RBA’s March meeting. Traders expect a cautious outlook from the Australian central bank. Australia’s NAB bank expects that the Reserve will show that uncertainty and data-dependence has increased. Australian Employment data are due on Thursday. The UK releases its Average Earnings Index (Wages), Claimant Count Change (Jobless Claims) and Unemployment rate. The UK’s Unemployment rate is expected to remain at 3.9% while Wages are forecast to gain to 3.5% from 3.4%. Claims for Unemployment benefits are forecast to drop. Germany’s ZEW Economic Sentiment Index follows next. The US round off the day’s data with March Industrial Production and Capacity Utilisation.

Trading Perspective: Markets can expect the relatively tight ranges to hold today, with little fresh catalysts to move them. The RBA meeting minutes should stir the Aussie which is poised to move either way. Overnight, US bond yields eased, the 10-year finished at 2.55%, down two basis points. Rival global yields were either higher or unchanged. Only Canada’s bond yields dropped (3 BP) due to the BOC’s downbeat quarterly business report. The Bank of Canada’s survey report had a gloomy outlook for the first quarter of this year.

We reported yesterday that net total USD long bets were trimmed. Short Euro, Yen and Australian Dollar shorts remained at multi-year highs. Sterling shorts were cut further to total -GBP 6,500 from -GBP 9,900. With little else to move the markets, traders may look to adjust their positions into the long Easter weekend

- EUR/USD – the Single Currency closed virtually flat at 1.1302. Overnight high traded was 1.13209. The overnight low reached was 1.12975. Given that the close was just above 1.1300, we may drift lower to immediate support at 1.1280. The next support level is at 1.1250 and that should hold for now. The near-term trading range has moved up a notch to 1.1250-1.1350. A sustained break of either side would dictate the next big move. For today, a trading range of 1.1285-1.1325 is likely. Prefer to buy dips to 1.1285. Market positioning remains short Euro at multi-year highs.

- USD/JPY – The Dollar should have topped out at 112.098, overnight highs against the Yen. US 10-year yields slipped 2 basis points to 2.55%. Japan’s 10-year JGB yield rose 2 basis points to -0.04%. This should keep the Dollar Yen from moving much higher. USD/JPY has immediate resistance at 112.10 followed by 112.40. Immediate support can be found at 111.90 and 111.50. Risk appetite should support the USD/JPY but the market’s position in short JPY.

- AUD/USD – The Aussie traded in a tight 0.7164-0.7182 range overnight, a mere 18 pips! Today sees the release of the RBA meeting minutes, the outcome of which is expected to be cautious. This would keep a lid on the Aussie near the overnight highs. Thursday’s Employment data follow which the RBA will look at closely. The Australian Dollar has immediate resistance at 0.7190-0.7200. The next resistance level is found at 0.7230. Immediate support can be found at 0.7160 and 0.7130. Look to buy dips in a likely 0.7150-0.7200 range today.

- GBP/USD – Sterling rallied as Brexit’s uncertainty faded in the background for now. No news is good news (on Brexit) for the British currency. Data has been on the improving side for the most part of it. Today’s UK Employment data will be the focus and a good report should see Sterling approach the strong resistance at 1.3200. GBP/USD closed at 1.3100. Immediate resistance can be found at 1.3130 followed by 1.3150. Immediate support lies at 1.3050 and 1.3020. Look to buy dips with a likely range of 1.3085-1.3135 today.

Happy trading all.