Amidst the persistent depreciation of the Japanese yen against the US dollar, pressure mounts on Japanese policymakers to translate their verbal assurances into tangible actions.

Despite repeated promises to closely monitor foreign exchange movements and take necessary steps, the yen continues its downward trend without abatement. Notably, the reluctance to directly intervene in the forex market raises doubts among investors about the government’s commitment to bolster the yen, especially in the face of rising US yields and a strengthening dollar. While Finance Minister Suzuki reiterates the readiness for intervention, the failure to halt the yen’s decline underscores growing scepticism among market participants, who increasingly clamour for concrete policy measures to halt the currency’s slide.

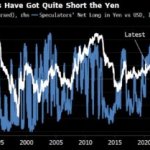

JPY is Getting Short Squeezed by the Institutions

Against the backdrop of a global economic landscape fraught with challenges for Japanese authorities, signs of robust growth momentum outside Japan pose significant hurdles. Business confidence surveys from Europe indicate a resurgence in economic activity, contributing to upward pressure on yields. The anticipation of strong US GDP growth in Q1 further solidifies this trend, prompting market players to adjust their expectations for rate cuts from major central banks. With minimal cuts being priced into the US and euro-zone markets, doubts persist about the effectiveness of intervention in shoring up the yen amidst prevailing market dynamics.

In contrast, the euro demonstrates resilience against the US dollar, maintaining its position within a defined trading range despite widening policy differentials between the European Central Bank (ECB) and the Federal Reserve. Although short-term yield spreads favour the US, the euro’s relative strength defies conventional expectations. ECB officials signal a gradual approach towards rate cuts in June, contingent upon economic developments and geopolitical risks. However, concerns linger regarding the potential impact of escalating energy prices on inflation dynamics and currency stability, potentially complicating the ECB’s policy stance.

Lower rates in the euro-zone are poised to alleviate growth headwinds, with early indicators pointing towards a budding recovery in economic sentiment. Stronger business confidence in key Eurozone economies underscores the potential for sustained growth momentum, providing tailwinds for the euro. Consequently, the euro’s descent towards previous lows encounters resistance, supported by the reversal of negative energy price shocks. This mitigating factor, coupled with improving economic prospects, underscores the euro’s resilience against external headwinds, challenging conventional narratives of currency depreciation.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.