Asian stocks finished in positive tones to the highest level in nine months, as investors follow the gains from Wall Street indices on Friday helped by the upbeat beginning of the US earning season by JP Morgan and Wells Fargo. In Japan, the Nikkei225 main index added 1.37 percent to 22,169 the highest since December 4th, 2018. The Hang Seng benchmark in Hong Kong finished 0.02 percent higher at 29,914. The Shanghai Composite underperformed for one more day, finishing 0.34 percent lower at 3,177, and in Singapore, the FTSE Straits Times index finished flat at 3,329. Australian equities traded in a narrow range of 20 points on Monday, most of which was spent in negative territory. A late rebound helped the index to end with small gains at 6,347. Even though sellers had the edge over their counterparts, momentum was limited as the market commenced a holiday-shortened week and a month-long Federal Election campaign.

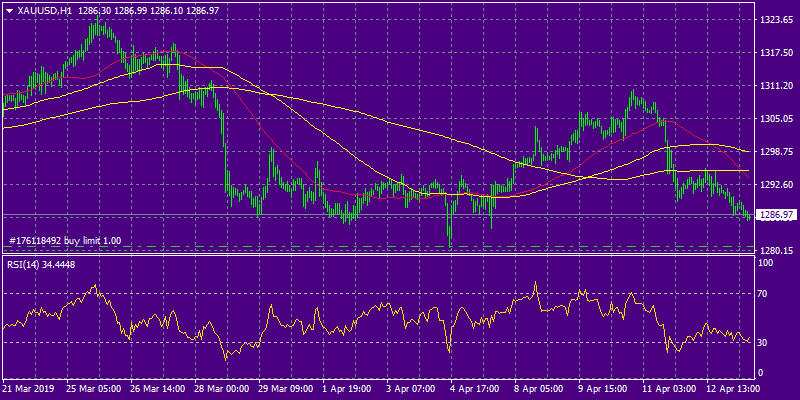

In commodities markets, Crude oil consolidates at a five-month high, around 63,50 area amid OPEC’s ongoing supply cuts, geopolitical uncertainty and the US additional sanctions on Iran. During the weekend, Russia’s Finance Minister Anton Siluanov said that Russia and OPEC might decide to boost production to fight for market share with the United States. On Friday, the weekly release of the Baker Hughes US rig counts showed a decline of 3 rigs giving 1022 figure for the week ended on April 12. The near-term upside target for black gold is at the 65.00 figure, but I expect some profit taking to prevail as oil has reached overbought levels, the RSI trading above 70. Brent oil started the week with bids and trades today at $71.34/barrel near recent highs. Gold started the week lower down to $1287, at the lowest levels since April 5th. XAUUSD‘s technical picture has turned negative, and now immediate support stands at 100-day moving average at $1285, which if broken can accelerate the downward move to 1260 and the 200-day moving average. Strong resistance now stands at the $1300 round figure and then at the 50-day moving average around $1307.

European session started slightly positive tracking a positive session in Asia due to sentiments supported by strong Chinese export figures. DAX30 is 0.02 percent higher to 12,000, CAC40 is 0.07 percent higher at 5,506 while FTSE100 in London is 0.03 percent lower at 7,429 and the FTSE MIB in Milan is trading 0.45 percent higher at 21,956.

In cryptocurrencies market, Bitcoin (BTCUSD) started the week on positive mood and trades at 5,147, fighting with the key 200-day moving average resistance at $5,189, making the daily low at 5,079. BTCUSD pair broke the $5,000 level the previous week and traded as low as $4,920. Bitcoin will find support at 50-hour moving average at 4,514. Ethereum (ETHUSD) also adds 3 dollars at 166, and it is placed nicely above the 100-day moving average, while Litecoin (LTCUSD) is also higher to 82.40.

On the Lookout: In China macro data, exports surged past expectations in March, rising 14.2% in US dollar terms from the previous year amid the ongoing trade dispute with the US, following a 20.8% drop in February. However, imports declined 7.6% compared to a 5.2% fall the month before. Analysts had been expecting exports to rise 6.5% and imports to edge up 0.2%.

IMF Director Christine Lagarde said on Thursday that the six-month delay of Britain’s exit from the European Union avoids the “terrible outcome” of a “no-deal” Brexit, but does nothing to lift uncertainty over the final outcome. RBA in its semi-annual check on Australia’s financial system said that overall household financial stress remains low, the health of the job market is key. It warned if unemployment were to rise there is a greater risk for mortgage defaults.

In Wall Street, first-quarter earnings season will continue, with results due from Goldman Sachs and Citigroup later in the day following impressive numbers from JPMorgan Chase and Wells Fargo on Friday.

In the macro calendar from Americas today we have the Bank of Canada (BOC) Business outlook survey which will be reported at 14:30GMT. Also, the speeches by the BOE MPC member Haskel and FOMC member Evans will grab some attention later today.

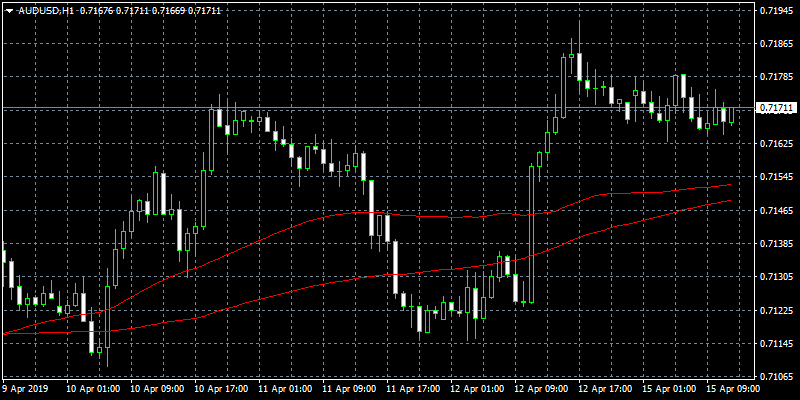

Trading Perspective: In Forex markets, US dollar is under pressure, AUDUSD is trading 0.04 percent higher at 0.7172 at a two-week high, after the cautious tone of the Reserve Bank of Australia during its bi-annual financial stability review last week. The central-bank downgraded growth forecasts and cited risks to trading partners and the global financial system. Kiwi is trading 15 pips higher at 0.6770 while the US dollar index is giving up 10 cents to 96.43.

GBPUSD: In Brexit front, the EU struck a final accord and offered a flexible Brexit deadline extension until Oct 31st to the UK, leaving doors open for an early exit if the PM May manages to clinch a Brexit deal.

The pair is in an attempt to break the 50-day moving average as it trades 0.21 percent higher at 1.3095 (low at 1.3068, high at 1.3105). On the downside, major support will be found at 1.2975 at the 200-day moving average while solid protection can be found at the 100-day moving average around 1.2942. On the flipside, immediate resistance stands at 1.3195 the high from previous week session, and from there major resistance can be found at 1.3232, while 1.3382, the yearly high, will be met with strong supply.

In GBP futures markets, open interest rose for the second session in a row on Friday, this time by more than 3.2K contracts. In the same line, volume rose once again by around 7.8K contracts.

EURUSD is adding 0.16 percent today at 1.1318. The pair made the daily high at 1.1320 and the low at 1.1297. Euro holds above the 50-day moving average and now is targeting the 100 DMA at 1.1348. Immediate support can be found at the 50-hour moving average around 1.1287, and further bids will emerge at 1.1278 and the 100-hour moving average. As Michael Moran mentioned earlier, speculative EUR shorts continue to grow. The latest COT report (week ended 9 April) saw speculative EUR short bets increase to -EUR 102,200 bets from the previous week’s -EUR 99,200.

EURO remains in negative mood following recent poor figures in Eurozone. In fact, recent disappointing readings in the region somehow confirm that the slowdown in the bloc and the ‘patient-for-longer’ stance from the ECB could be among us for longer than expected.

In Euro futures markets, traders added nearly 7.5k contracts to their open interest positions on Friday, while volume increased by around 83K contracts.

USDJPY: The pair is trading higher today at 111,98 having hit the low at 111.87 and the high at 112.08. Major support for the pair stands at 111.51, the 200-day moving average, and then at the 111 round figure if the pair manages to break below the 100-day simple moving average at 111.10. Immediate resistance for the pair stands at 112.10, the March 2019 high.

Open interest in JPY futures markets and volume are rising for yet another session on Friday by around 15.1K contracts and almost 26.3K contracts, respectively.

USDCAD retreats from recent high to 1.3331 as oil prices retreat from recent highs. The pair will find immediate support at the 100-day moving average around 1.3322 while extra support stands at 1.3192 and the 200-day moving average which if breached will drive prices down to the 1.31 key support. On the upside, immediate resistance stands at 1.34, a break of which can escalate the rebound towards 1.3430.