Summary: The Dollar steadied against most of it’s Rivals as FX trade slowed ahead of the US Thanksgiving holiday weekend. The Dollar Index (USD/DXY), a popular gauge of the Greenback’s value against a basket of foreign currencies, finished little changed at 98.274 (98.3 yesterday), a drop of 0.05%. Dollar Yen (USD/JPY) edged higher to 109.07 (108.97) on elevated risk sentiment due to trade optimism. The Euro rebounded off its lows near 1.10 (1.1007) to 1.1020, up 0.10%. Sterling eased 0.2% to 1.2860, confined to a relatively tight range, as trade abated. The Australian Dollar remained confined within familiar ranges, closing at 0.6787 (0.6777 yesterday). New Zealand’s Kiwi gained 0.16% to 0.6727 (0.6407) on an upbeat Q3 Retail Sales report. NZ Core Retail Sales in Q3 rose to 1.6% against a forecast of 0.6%, beating Q2’s 0.3%. Emerging Market currencies were mostly easier against the Greenback. The USD/CNH (US Dollar- Offshore Chinese Yuan) dipped further to close at 7.0125 (7.0315 yesterday).

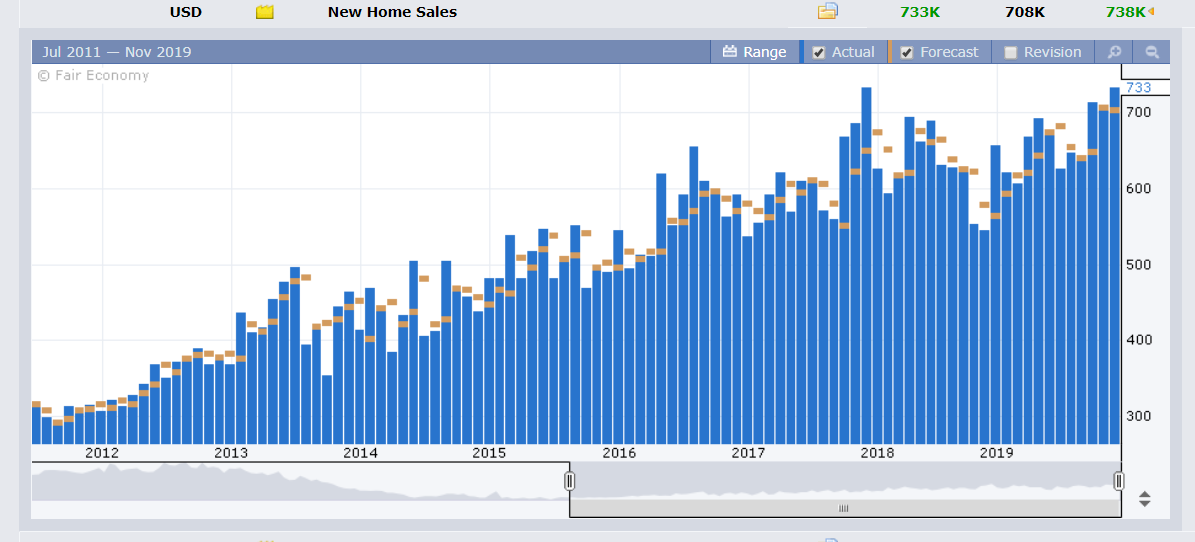

Americans had much to be thankful for as data showed the US Housing market firmed due to easier monetary policy from the Federal Reserve. While US Consumer Confidence fell in November for the fourth straight month, the Conference Board’s Index remained sufficiently at levels consistent with a modestly growing economy. US Goods Trade Balance narrowed in October to its smallest deficit since June 2018 on lower imports and exports on diminishing global trade flows. US November New Home Sales beat forecasts rising to 733,000 units against an expected 708,000.

- USD/JPY – The Dollar rallied to 109.208, overnight and fresh two week high on upbeat risk sentiment buoyed by trade hopes. USD/JPY eased to settle at 109.07 at the New York close.

- EUR/USD – The shared currency kept within a tight 18-point range as trading slowed. The Euro closed at 1.1020 after trading to an overnight low at 1.10071. Sentiment remains bearish on the Euro but with the speculative market short, the 1.1000 level attracts buyers.

- GBP/USD – The British Pound stayed confined to familiar ranges, easing to 1.2860 from 1.2904 yesterday. Ten-Year UK bond yields ease 4 basis points to -0.65% (against 2 basis point ease in US 10-year rates).

- AUD/USD – the Australian Dollar closed a touch firmer at 0.6787 (0.6777). Like most other Majors, the Battler remained confined within a 27-point range (0.6768-0.6795).

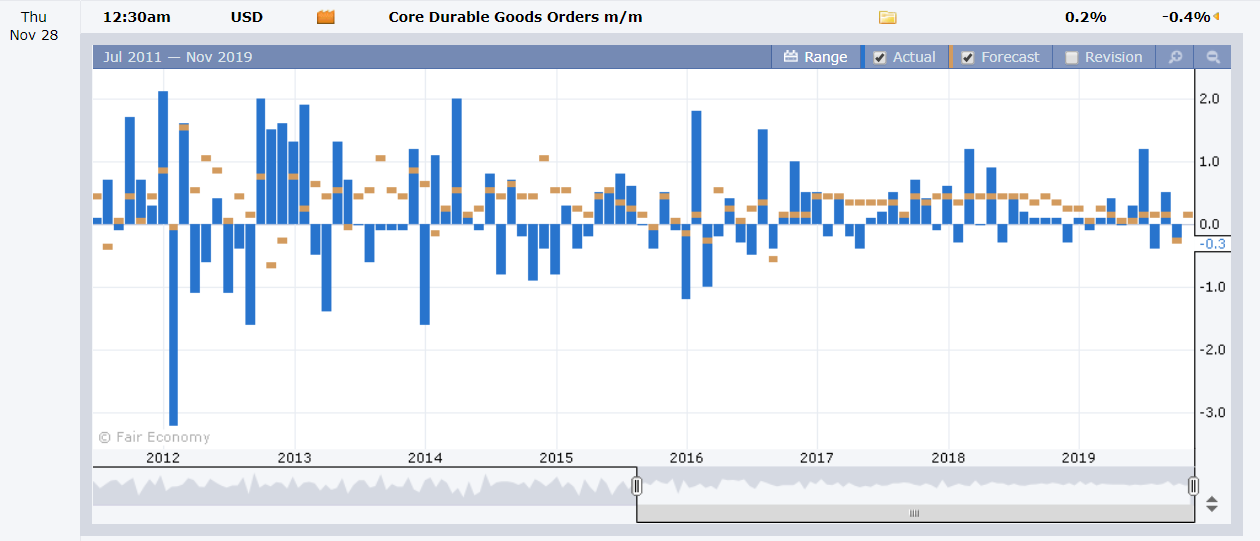

On the Lookout: Today sees the last set of US reports ahead of the Thanksgiving holiday (Thursday). Highlight is the US Headline and Core Durable Goods Orders (November) reports, which are leading indicators of production.

New Zealand starts off our day with the RBNZ Financial Stability Report (an insight into the RBNZ’s views on inflation and the economy). The report is followed by a press conference speech from RBNZ Governor Graeme Orr. New Zealand also reports it’s November Trade Balance.

Australia’s Q3 Construction Work Done follows. Euro area reports start with Germany’s Import Prices and Credit Suisse’s Swiss Economic Expectations.

Apart from the Durable Goods Orders report, US data to be released are: Preliminary Q3 GDP and GDP Price Index, US Weekly Unemployment Claims, Chicago PMI, Personal Spending (November), Core PCE Index, Pending Home Sales and Personal Income.

Trading Perspective: Trade hopes and relatively upbeat US economic data have kept the Dollar steady against its rivals. The Dollar Index (USD/DXY) managed to keep above the 98.00 level this week, last night closing little changed at 98.274. While trade hopes remain high, Hongkong remains a sticky point. President Trump is expected to announce a decision on the Hongkong bill, which is a law that supports the city’s democratic freedoms. This would upset China and ramp up trade headlines. US economic reports have been relatively upbeat. Today’s US Durable Goods Orders and Preliminary GDP reports will either confirm or deny the trend. With thinner volumes, we could see FX volatility, which is traditional come US Thanksgiving. US stocks and bond markets will be closed tomorrow and open half-day Friday. FX will be open for the rest of the week.

We reported yesterday that market positioning had seen a build-up in speculative US Dollar long bets to 4-week highs. While Trump has said that the US and China are nearing a trade deal, the US want things to go well in Hongkong. Watch the headlines, any breakdown on the trade talks between the two largest economies in the world due to Hongkong will lead to a Dollar dump.

- EUR/USD – the Euro managed to hold above 1.1000 trading to an overnight low at 1.1007. Yesterday the Euro dipped to a two-week low at 1.1003. The immediate support at 1.1000 continues to attract buyers and the speculative market is short of Euros. EUR/USD rallied to an overnight high at 1.10248, easing to a close at 1.1020 in New York. Immediate resistance lies at 1.1030 followed by 1.1060. There is immediate support today at 1.1010 and 1.1000. Look to trade a likely range today of 1.1010-1.1060. Prefer to buy dips, a short market risks a squeeze.

- USD/JPY – The Dollar continued to edge higher against the Yen buoyed by the increase in risk appetite on trade hopes. Bond markets have been quiet, and the inverted US bond yield feels like ages ago. Meantime, speculators have switched from long to short JPY bets. Yesterday we reported that speculative JPY short bets increased to -JPY 35,031 in the latest COT report (week ended Nov 19). Just two months ago, JPY positioning was long by a similar amount. USD/JPY closed at 109.07 with the overnight traded at 109.208, a 2-week high. Immediate resistance lies at 109.30 followed by 109.50. Immediate support can be found at 108.90 (overnight low 108.875) followed by 108.60. Look to trade a likely range of 108.70-109.20. With the speculative market now short of JPY bets, prefer to buy Yen and sell USD’s.

- AUD/USD – The Aussie traded within familiar ranges between 0.6768 and 0.6796 yesterday. The Aussie Battler closed at 0.6787. The currency failed to climb much above 0.68 cents despite the positive risk environment boosted by trade hopes. Traders are bearish which is the result of negative domestic sentiment on the economy and the currency. The latest COT report saw speculators add to their short Aussie bets to total -AUD 47,240, a 16% rise from the previous week and the biggest total since mid-October. Based on personal FX experience, the locals can often get it wrong, and we may see a fierce short squeeze in the making. Look to buy dips with a likely range today of 0.6775-0.6835.

We can be thankful that volatility might come back to FX on Thanksgiving Day.

Happy trading all.