Equities and forex assets opened on positive note today as investors risk appetite boomed on Sino-U.S. trade deal optimism but Brexit woes continued to pressure investor sentiment in European markets.

Equities and forex assets opened on positive note today as investors risk appetite boomed on Sino-U.S. trade deal optimism but Brexit woes continued to pressure investor sentiment in European markets.

Summary: Major equities, forex pairs and equity benchmark indices across Asia and European markets are trading positive today. The first quarter of the financial year 2019-20 is seeing positive price action underpinned by headlines from weekend and optimism on Sino-U.S. trade talks. The weekend saw headlines from China which stated that the state council has decided not to impose any additional tariffs on US productions during April as a token of good will in response to US decision to delay tariff on Chinese import products. Further, hopes for positive outcome that could lead to trade deal between two parties are high in the market following last week’s face to face discussion between representatives of both nations in China. Optimism surrounding Sino-U.S. trade talks and positive Chinese macro data helped sustain risk on trading activity in Asian and early European market hours. European equity market saw positive opening on cues from US Wall Street and Asian markets. However, gains were capped following worse than expected EU area manufacturing PMI and CPI updates. Risk on trading activity also underpinned positive action in Forex markets but EURO lost early gains on disappointing macro data albeit trading in green across European market hours on a flat note with positive bias.

Precious Metals: As risk appetite boomed in the global market today, both gold and silver suffered sharp declines. Positive Chinese macro data, headlines from China on delaying tariffs and optimism surrounding trade deal between two nations serve as key factors pressuring safe haven demand sustaining positive action in risk assets. But US Dollar also weakened on positive action in forex market while Brexit woes provided some level of support to precious metal bulls preventing sharp declines.

Crude Oil: Crude oil price saw sharp gains in global market today as optimism surrounding Sino-U.S. trade deal boosted prospects of more demand for Crude oil from China. This helped Crude oil stay well above $60 per barrel while support stemming from OPEC’s production and supply cut enforcement also continues to provide positive support to Crude oil bulls ensuring positive price action across Asian and European market hours.

DAX: DAX index is trading on positive note in European market today. Despite bearish influence from Brexit woes and disappointing macro data pressuring investor sentiment in European markets, positive cues from international market helped DAX open on positive note. Further, gains in auto sector shares and energy sector shares helped the index see over 1% increase in value.

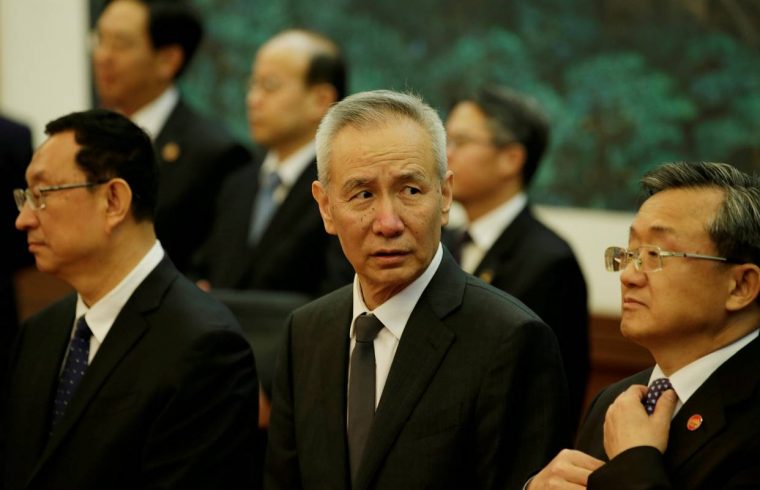

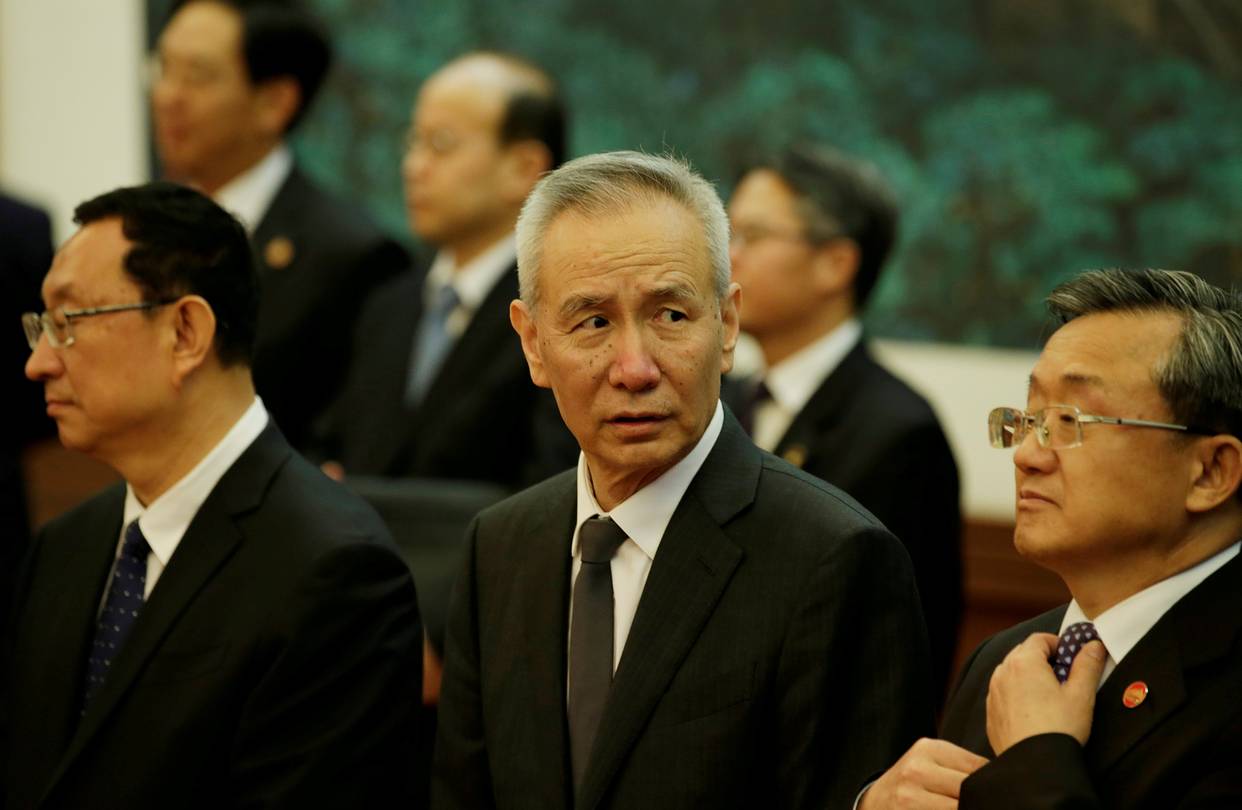

On The Lookout: Geo-Political issues remain the main focus of investors across the globe as headlines pertaining to Brexit and Sino-U.S. trade talks continue to greatly affect price action of risk assets on all major markets. Given the fact that the third vote on PM May’s deal was rejected yet again in UK parliament, UK has less than two weeks for Brexit and scenario points to hard Brexit unless lawmakers agree to participate in EU parliament elections requesting for longer Brexit or accept PM May’s Brexit deal. UK parliament will see lawmakers meet to decide on indicative votes to move forward with Brexit while Chinese vice Premier Liu He is expected to travel to Washington this week for further high level trade talks between China and U.S.A which could pave way for trade deal between two nations. While investors eagerly await updates pertaining to these events, they are also on lookout for macroeconomic releases for short term directional cues and profit opportunities. US calendar is set to see the release of ISM manufacturing PMI, retail sales data and business inventories data updates which are expected to provide directional cues for forex assets and set tone for opening activity in US Wall Street.

On The Lookout: Geo-Political issues remain the main focus of investors across the globe as headlines pertaining to Brexit and Sino-U.S. trade talks continue to greatly affect price action of risk assets on all major markets. Given the fact that the third vote on PM May’s deal was rejected yet again in UK parliament, UK has less than two weeks for Brexit and scenario points to hard Brexit unless lawmakers agree to participate in EU parliament elections requesting for longer Brexit or accept PM May’s Brexit deal. UK parliament will see lawmakers meet to decide on indicative votes to move forward with Brexit while Chinese vice Premier Liu He is expected to travel to Washington this week for further high level trade talks between China and U.S.A which could pave way for trade deal between two nations. While investors eagerly await updates pertaining to these events, they are also on lookout for macroeconomic releases for short term directional cues and profit opportunities. US calendar is set to see the release of ISM manufacturing PMI, retail sales data and business inventories data updates which are expected to provide directional cues for forex assets and set tone for opening activity in US Wall Street.

Trading Perspective: Given prevalent risk on trading activity in the global market, US Wall Street is likely to see positive opening today. Risk assets across forex and equity markets will be highly active during today’s American market hours.

US Index Futures: US Index futures trading in international market ahead of American market hours saw positive price action on upbeat Chinese macro data and Sino-U.S. trade talk related optimism. Prevalent risk on investor sentiment also provides strong support to market bulls suggesting that major Wall Street indices such as S&P 500, DOW 30 & NASDAQ will see positive price action as trading session starts for first quarter of FY @2019-20.

EUR/USD: While the pair opened positive for the week and traded with bullish bias during Asian and European market hours, upside is capped near mid-1.12 handle as disappointing EU area macro data and Brexit woes continue to pressure the common currency. Investors now await US macro data updates for short term directional cues and profit opportunities.

USD/CAD: The pair saw range bound price action near Friday’s lows since trading session started for the week. Better than expected Canadian GDP data and positive crude oil price gave Loonie an upper hand on Friday resulting in sharp declines near which the pair continues to trade range bound today as USD remains weak on renewed risk appetite while CAD received support from positive crude oil price ahead of US macro data update release.