Asian stocks finished strong as investors digest better China PMI figures and progress in trade negotiations between the US and China. In Japan, the Nikkei225 main index added 1,43 percent to 21,509, the Hang Seng benchmark in Hong Kong finished 1.69 percent higher at 29,541. The Shanghai Composite outperformed for one more day, finishing 2.58 percent higher at 3,170, and in Singapore, the FTSE Straits Times index gained 1.02 percent higher at 3,245. Australian equities also in positive performance. The ASX 200 closed up 36 points or 0.6% to 6217, marking the fifth consecutive day of gains.

In commodities markets, Light Crude Oil bulls are in full control today sending the price at daily high and trades at 60.70, while Brent oil also breaks higher at $68.45/barrel. The Energy Information Administration data released last week showed that domestic crude stocks rose by 2.8 million barrels per day during the week ended March 22, bringing the figure to 442.3 million barrels, which reportedly amounts to a 3% increase year-on-year. Gold started the week lower as traders dumped safe-haven assets and trades near three-week lows at $1288. XAUUSD technical picture has deteriorated, and now immediate support stands at 100-day moving average at $1277, which can accelerate the downward move down to new YTD lows at the 200-day moving average at $1247. Strong resistance now stands at the $1300 round figure.

UK lawmakers will once again vote on Brexit indicative proposals following last week’s rejection, as markets now price-in a softer Brexit heading into the April 12th Brexit deadline. A positive start for equities in early European session mirroring the improved sentiment in Asian markets as investors watching the developments surrounding Brexit. DAX30 gains 0.32 percent to 11,465, CAC40 is 0.58 percent higher at 5,327 while FTSE100 in London is 0.44 higher at 7,266 and the FTSE MIB in Milan is trading 0.31 percent higher at 21,110.

On the Lookout: In the Asian session macro news, the Australia RBA Commodity Index SDR (YoY) registered at 11% above expectations (10.8%) in March, the Japan Nikkei Manufacturing PMI above forecasts (48.9) in March: Actual (49.2).

In our calendar today, US retail sales, business inventories and construction spending data will be released, along with the ISM manufacturing survey.

In central bank announcements tomorrow, we expect the Reserve Bank of Australia (RBA) to keep the Official Cash Rate unchanged at a record low of 1.50% on Tuesday, April 2nd.

Key Upcoming Events

10/04/2019 ECB Interest Rate Decision

12/04/2019 UK leaves the European Union

18/04/2019 Dissolvement of current EU Parliament

Trading Perspective: In forex markets, AUDUSD is trading higher as risk on mood prevails and trades at 0.7131 Kiwi, also rebound from previous week heavy losses at 0.6822, after the Reserve Bank of New Zealand abandoned its long-standing neutral stance and turned dovish, saying that the next move in interest rates would likely be down. US dollar index is losing some pips and now is trading at 96.63 after being capped in the 96.80 region in the wake of the dovish FOMC event last week.

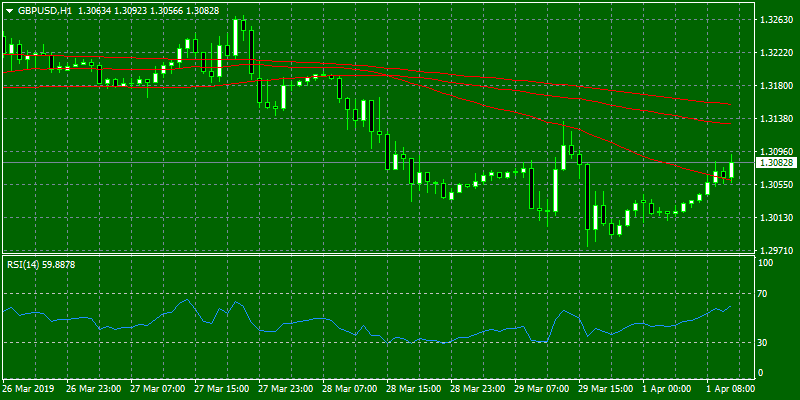

GBPUSD investors turn bearish for the first time in March as the pair broke below the 50-day moving average awaiting new votes related to Brexit from the Parliament. The pair today managed to rebound from the lows during the Asian session at 1.30 to 1.3068 giving bulls a breath above the 50-hour moving average. On the downside, major support will be found at 1.30 round figure while more protection can be found at a 200-day moving average around 1.2980. On the flip side, immediate resistance stands at 1.3088 the high from Asian session, and from there major resistance can be found at 1.3202 where the 50-hourly moving average stands and then at 1.3232 the cross point of 100 and 200-hourly moving averages while 1.3382 the yearly high will be met with strong supply.

In GBP futures markets, open interest rose for the third consecutive day on Friday, this time by just 167 contracts. Volume, in the same line, rose by around 51.3K contracts, reversing the previous drop.

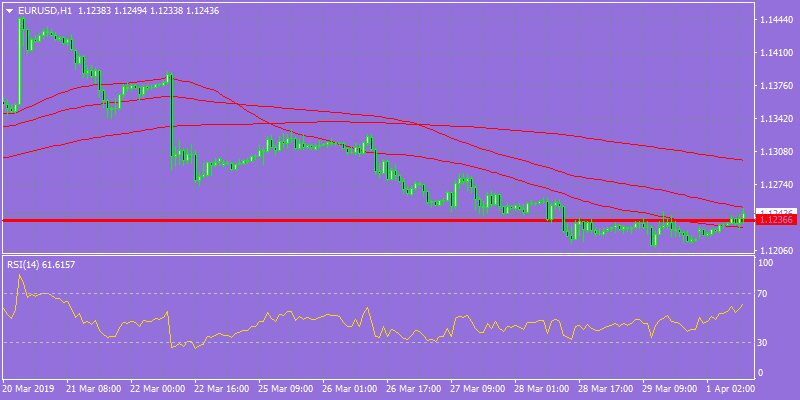

EURUSD started the trading week with bids above the horizontal lower band of the short term trading range at 1.1236 and now looks to break above the 100-hour moving average at 1.1251 to establish short-term bullish momentum. Immediate support can be found at 1.1218 the low from early Asian session, while more buying interest will emerge at the 1.12 zone.

On the Euro political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist and right-wing option among voters.

In Euro futures markets, traders added around 3.3K contracts on Friday from the previous day, while volume shrunk for the second session in a row, this time by more than 5K contracts.

USDJPY gains momentum and trades at the daily high to the 111.13 zone having hit the low at 110.84. Major support for the pair stands at 110 round figure. Immediate resistance for the pair stands at the 111.19 zone where the 100-day moving average crosses, followed by 111.49 the 200-day moving average stands.

Open interest in JPY futures markets dropped by just 467 contracts on Friday from Thursday’s final 155,316 contracts. On the other hand, volume rose for yet another session, this time by 872 contracts.