Gains were capped in the broad market despite increased risk appetite as investors are cautious ahead of next week’s major political events but bulls pushed for sharp upside move supported by weak USD owing to partial US government shutdown.

Gains were capped in the broad market despite increased risk appetite as investors are cautious ahead of next week’s major political events but bulls pushed for sharp upside move supported by weak USD owing to partial US government shutdown.

Summary: Global market is seeing positive price action today in both equity and forex marketscape supported by high-risk appetite in the broad market. All major high impact events of the week are over and price action in the broad market is purely influenced by investor sentiment and macro data-driven momentum. Key events that inspire caution for the week had come to pass and investors are now using the opportunity to book profits and place marginal bets ahead of next week which will see a flurry of high impact major geopolitical events that have potential to shape long term market outlook. Cues from Wall Street and Asian markets helped European equities trade positive. In the forex market, broad-based US Dollar’s weakness following US Senate meeting yesterday which saw both sides fail to get their plans approved and result in the continued partial shutdown of government combined with increased risk appetite in the broad market helped major global currencies and high risk assets trade positive.

Precious Metals: While both equity and forex market are seeing positive price action, precious metals are also trading in Green as investors are moving a portion of their funds to safe-haven metals while US greenback is weaker in broad market so as to safeguard their investment from high volatility that is expected to follow major political events that are to occur next week. Further owing to the possibility that dovish outcome could lower global economy, the medium-term outlook is positive for precious metals as investors view them as inflation-proof assets.

USD/JPY: The pair trades range bound as conflicting factors limit bulls from both sides of the pair. Improved risk appetite in broad market supports US Dollar to some extent, however partial shutdown in US government continues to extend following last night’s Senate meeting failing to succeed in reopening government which limits upside of USD. Meanwhile, positive macro data failed to support JPY bulls and positive investor sentiment in the broad market resulted in low fund flow in safe-haven currency market capping strength of JPY bulls.

AUD/USD: Australian dollar recovered from previous session lows on increased risk appetite in the broad market. However, the major positive factor was US dollar’s weakness following US Senate meeting failing to reopen US government during a meeting last night. However, the upside was limited in the lower half of 0.71 handle as investor sentiment was weighed down ahead of Sino-U.S. trade talks scheduled to occur later next week. Since key issues remain unresolved, investors are hesitant on placing major bets limiting upside move.

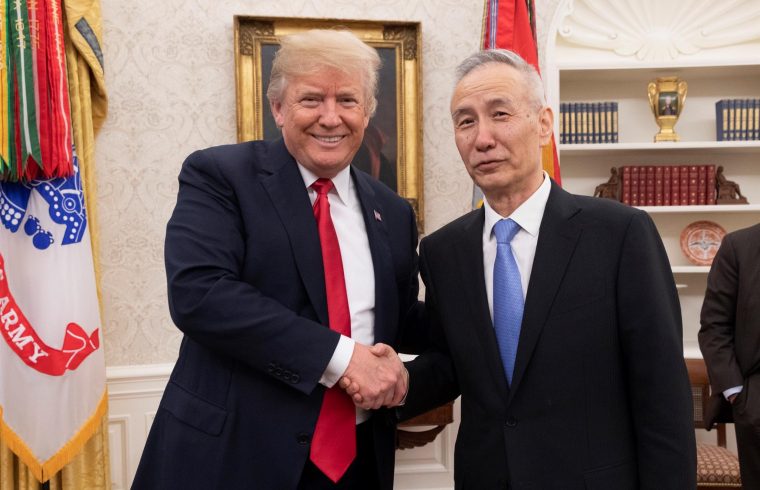

On The Lookout: Given increased risk appetite in the broad market, major equities and forex pairs are expected to continue positive price action. Investor focus is immediate future is on US core durable goods orders data and new home sales data for short term profit opportunities. However major focus in on next week’s UK Parliament vote on PM May’s Plan B for Brexit and Sino-U.S. trade talks with Chinese Vice Premier Lie He. Given that approval of PM May’s Plan B will lead to soft deal Brexit and she now has backing of DUP party members, Brexit headlines are expected to keep Sterling positive, however Key issues are expected to be addressed for the first time since US & Chinese Presidents agreed to 90-day truce and the outcome will have great influence on price action in major assets resulting in fund flow being limited for short period in major forex and equity markets. Next week’s action is likely to see thin trading volume and high volatility post today’s relatively steady risk appetite influenced price action.

On The Lookout: Given increased risk appetite in the broad market, major equities and forex pairs are expected to continue positive price action. Investor focus is immediate future is on US core durable goods orders data and new home sales data for short term profit opportunities. However major focus in on next week’s UK Parliament vote on PM May’s Plan B for Brexit and Sino-U.S. trade talks with Chinese Vice Premier Lie He. Given that approval of PM May’s Plan B will lead to soft deal Brexit and she now has backing of DUP party members, Brexit headlines are expected to keep Sterling positive, however Key issues are expected to be addressed for the first time since US & Chinese Presidents agreed to 90-day truce and the outcome will have great influence on price action in major assets resulting in fund flow being limited for short period in major forex and equity markets. Next week’s action is likely to see thin trading volume and high volatility post today’s relatively steady risk appetite influenced price action.

Trading Perspective: While investors are wary of key political events set to occur later next week and have held back from placing major bets, risk appetite remains steady in the market today which combined with two major macro data updates from US market are expected to keep price action highly liquid on last trading session of the week.

EUR/USD: This pair is one of the most active forex assets of the day and saw sharp gains as it has erased almost all losses incurred owing to dovish outcome in ECB MPC update and comments from ECB President Draghi yesterday. The pair is well near mid 1.13 handle and is expected to continue positive price action as US dollar is weighed down in the broad market by partial shutdown in US government and dovish Fed stance on rate hike plans for 2019. While US macro data could influence a short term rally in favor of US dollar, the pair is likely to close for the week well above 1.1300 handle as the trading session closes for the week.

GBP/USD: British Pound is the best-performing assets of the week as Brexit optimism continues to boost Pound bulls in the broad market. Further weak US dollar in the broad market also supports British Pound’s positive price rally. Investors are optimistic ahead of Tuesday Parliament vote in the UK as both possibilities of soft deal Brexit and possible extension of article 50 in case of PM May losing the vote are already priced in by the investors. This suggests the pair is likely to close on a positive note for the day with a price well above mid 1.30 handle even if profit booking activity drags the pair down from intra-day highs.

USD/CAD: Canadian Loonie gained upper hand earlier in the day as U.S. dollar fell in broad market as headlines hit the market that US Senate meeting failed to reopen the government. This combined with positive price action in broad market crude oil price, helped Loonie gain upper hand against USD and sustain a rally near intra-day lows. The pair is expected to continue trading in a relatively neutral note for rest of the day as both sides lack high impact update to provide a favorable breakout trigger. However, US macro data scheduled to release later in the day could provide short term opportunity in American market hours.