GBP is the talk of the day in the markets as it broke yesterday above 1.30 and currently is trading at 1.3050 as the risk of a ‘no deal’ Brexit appears to be fading. Stocks in Asia ended mixed with Nikkei 225 in Tokyo down 0.10% at 20,574, the Shanghai Composite index gained 0.5%, and the ASX 200 finished the day higher by 22 points or 0.4% to 5,866 after December jobs data beat expectations. Crude oil is trading lower to $52.44 per barrel while Brent in London dropped 19 cents to $60.84 per barrel.

European markets started the day lower as investors focus turn to ECB meeting for a tip about the Eurozone economy. DAX gives up 0.26% to 11,043 CAC40 in Paris gives up 0.09% to 4,834 while FTSE100 is down 0.19% to 6829.

On the Lookout: Australia added 21,600 jobs in December, and the unemployment rate dropped to 5.0%. The Bank of Korea kept rates unchanged at 1.75%. The ECB monetary policy announcement at 12:45GMT followed by Mario Draghi’s press conference at 13:30 GMT is the main event today. Analysts expect no changes to its monetary policy settings. The German manufacturing activity grew at the slowest pace in 50-months in January, the latest manufacturing activity report from IHS/Markit research showed this morning. German manufacturing purchasing managers index (PMI) slipped into contraction territory and arrived at 49.9 versus 51.3 expected and 51.5 previous.

Meanwhile, the US government shutdown enters its 33rd day with no end in sight. In the US tonight, the ‘flash’ purchasing managers index is released with the leading index and weekly claims for unemployment insurance. The EIA crude stocks data is due at 15:30 GMT.

Trading Perspective: EURUSD is still trading in the neutral area awaiting Mario Draghi’s press conference later today. Currently, the pair is 0.08% lower at 1.1365. EURUSD failed to follow GBP’s rally yesterday as a wave of weak macro figures has hit the common currency. Meanwhile, investors concerns about political uncertainty in the continent grow. Macron is fighting with yellow vests in France, Italian government attacks ECB and IMF on their proposed measures about the Italian economy, while Greece will face election in an already troubled economy. A break above 1.14 will give bulls the upper hand targeting strong resistance at 1.1459 the 100-day moving average. On the downside, immediate support is at 1.1336 the low from January 22nd, while more solid demand will emerge at 1.13 the low from January 3rd. EUR futures markets from CME Group noted open interest rose by nearly 3.7K contracts on Wednesday from Tuesday’s final 527,176 contracts. On the other hand, volume dropped significantly by almost 48K contracts.

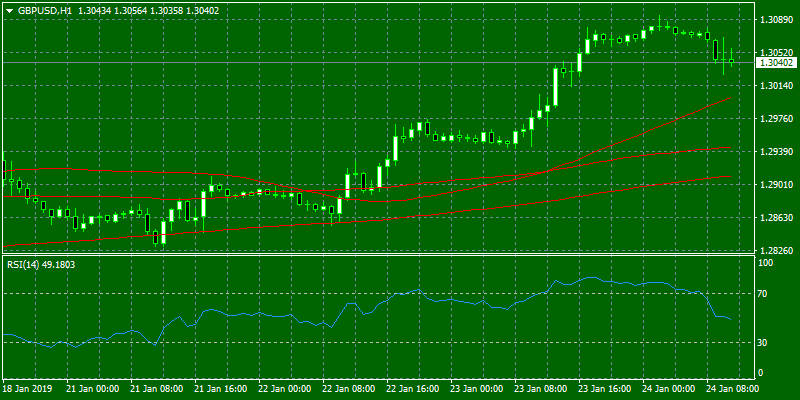

GBPUSD: The pair outperformed yesterday’s all major pairs as it broke above the 1.30 area, as traders are convinced that chances of a no-deal Brexit outcome are diminishing. Bulls are in full control, and an attempt to 1.31 area looks possible after taking a breath at mid 1.30. It is important for bulls to hold the 1.3050 November 2018 high. On the downside, the first support is at the 50-hour moving average at 1.2996, while further support is yesterday’s low at 1.2941. CME Group’s advanced figures for GBP futures markets noted investors trimmed their open interest positions for the fifth session in a row, this time by nearly 2.2K contracts. Volume followed suit, down by more than 34K contracts.