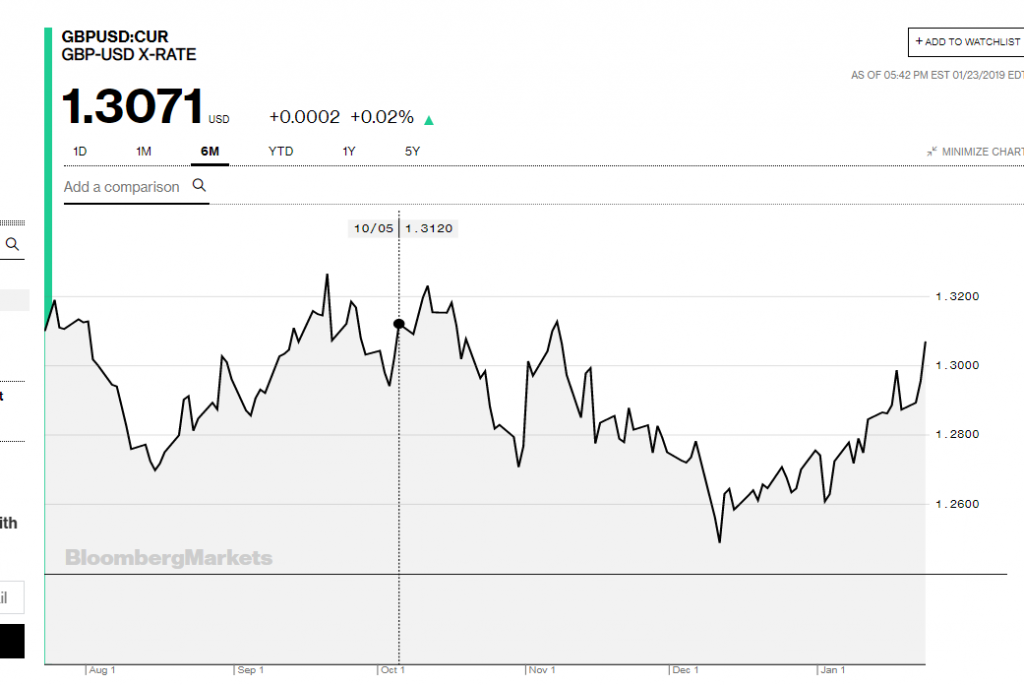

Summary: Sterling soared, breaking above 1.30 for the first time since November as big short positions ran for cover. Reports that the British Labour Party would back a proposal which would force the government to seek a delay to Brexit lifted the Pound. According to Reuters, who have been monitoring FX market positioning through the CFTC report, spec GBP/USD shorts reached 4.8 billion USD on Dec 21, 2018. This was the last from the CFTC before the US partial government showdown. GBP/USD closed at 1.3067, up 0.86%. The Dollar eased against most of the Majors, bar the Yen. The Yen weakened as risk appetite returned and the BOJ kept its monetary policy steady without any changes to its yield curve control. The BOJ also saw more downside to the economy like other central bank peers. The Kiwi outperformed on a surprise rise in inflation.

Stocks rallied after-hours on robust US earnings. The DOW rallied 0.63%, the S&P 500 gained 0.27%.

- GBP/USD – Sterling soared to 1.3067 as big shorts ran for the exits as less chances of a disorderly Brexit increase. The Reuters report on the last available CFTC data highlights the size of speculative short Sterling bets. Most of the big trading banks that participate actively in the FX markets have their own records of positioning via internal flows. While short GBP/USD positions have gradually unwound since their peak in September 2018, (6.5 billion USD), the overall bias remains short. With the government shutdown into its 33rd day, its difficult to gauge just where the markets positioning currently sits… on all currencies.

- USD/JPY – The Dollar bounced off its lows as the BOJ announced it was maintaining policy, keeping its yield curve control. The rise in risk appetite also buoyed the USD/JPY. US 10-year bond yields climbed 2 basis points to 2.75%.

- NZD/USD – the Kiwi outperformed, rising 0.6% against the Greenback to 0.6790 (0.6725 yesterday). New Zealand’s Q4 CPI rose 0.1% beating forecasts of 0.0% for an annual clip of 1.9% (vs f/c 1.8%). While much of the rise was due to seasonality, the underlying inflation trend remains underpinned. A softer US Dollar could see the Kiwi rally further. The Aussie rallied on the back of the Kiwi, ending with modest gains to 0.7137.

On the Lookout: Markets shrugged off the trade talk drama on reports that US delegates had cancelled a low-level meeting ahead of next week’s high-level talks with the visit of Chinese Vice Premier Liu He. The Jan 30-31 meeting is still on, and stocks in Asia saw mild gains. Meantime, the US government shutdown enters it’s 33rd day with no end in sight.

Events and economic data releases for today begin with Australia’s Employment Report for December. Prior to that, Australian Flash Manufacturing and Services PMI’s are released. Japan’s Flash Manufacturing and Services PMI follow shortly after. Europe sees Euro-area Manufacturing and Services PMI’s from France, Germany and the Euro-Zone. The big event is the ECB rates policy meeting. The ECB is expected to maintain its Main Refinancing Rate at 0.00%. Mario Draghi will follow with ECB Press Conference after. US Weekly Jobless Claims and Flash PMI’s round up today’s data. So, a busy day for PMI’s.

Trading Perspective: The Dollar Index (USD/DXY) has been consolidating around the 96.00 level. It closed at 96.115, down 0.19%. While the Dollar’s overall losses were mild, the Greenback fell more markedly against the Emerging Market currencies. The South African Rand rallied 0.94% while the Turkish Lira was up 1.07%. This may signal further Dollar weakness against the Major currencies.

As the government shutdown extends into unchartered territory, support for the Greenback will wane. While it may have no direct bearing on the US economy, where on this earth will any government shutdown be positive for its currency.

The last CFTC data on market positioning highlighted the GBP shorts against the US Dollar. Market positioning prior to that report saw extended USD shorts against most of the currencies that the CFTC records. Beware of further long US Dollar unwinds.

- GBP/USD – The Pound rallied above the 1.30 level without looking back, managing to trade to 1.30807 highs. Immediate resistance can be found at 1.3080 followed by 1.3110. Immediate support lies at 1.3020 and then 1.2990. While reports have highlighted that market positioning on the GBP/USD remains short, one should not get carried away up here. Brexit is still not yet resolved and while some of the negatives around it have been removed, its still a big deal. Look for more volatility ahead and be flexible with a likely range of 1.2980-1.3100 today.

- EUR/USD – the Euro had a muted day, rallying a modest 0.17% against the Greenback as the market prepares for a dovish-leaning ECB. Given the recent downturn in Euro area data and the IMF downgrade of global GDP (citing weakness in Germany’s auto market), the Euro is struggling to break much higher. One of the highlights of the Reuters report on Sterling market positioning was the fact that many speculators hedged their short GBP positions by selling EUR/GBP, according to one of the trading banks. This makes sense to me from my experience as an FX dealer from an active trading bank. Which suggests to me that there has been a build up on Euro shorts. Immediate resistance can be found at 1.1400 followed buy 1.1430. Immediate support lies at 1.1350 and 1.1320. Prefer to buy on dips to the mid to low 1.13’s.

- AUD/USD – the rally on the Kiwi lifted the Aussie to an overnight high of 0.7144 before easing to close at 0.7137 in New York. The Australian Dollar fell behind its antipodean cousin, the Kiwi. The AUD/NZD cross slipped to 1.0517 from 1.0595 yesterday. Australian Employment for December is forecast to have risen by 17,300 jobs from the previous +32,000 jobs in November. The unemployment rate is expected to remain at 5.1%. Unless we see an extremely bad set of numbers (i.e Employment growth less than 5,000 jobs or negative) expect the Aussie to remain in a 0.7110-0.7180 range today. An overall weaker US Dollar will keep the Aussie supported.

Happy trading all.