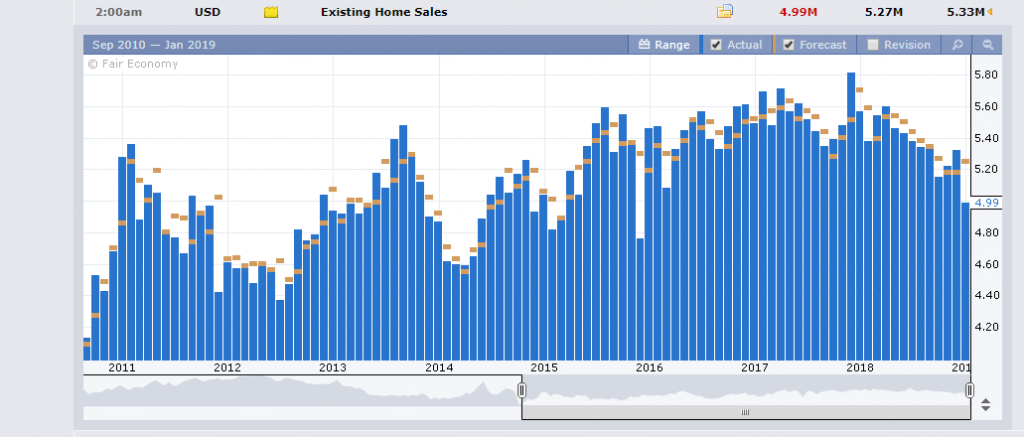

Summary: Trade optimism faded, and the prospects of a slowing global economy weighed on markets. The Trump administration reportedly cancelled extended trade talks with China which were scheduled for January 31. It was risk-off which sent stocks, yields, resources and the Aussie tumbling. Risk appetite soured further after the IMF cut its global growth forecast to 3.5% from 3.7% in 2019 and 3.6% from 3.8% in 2020 due to the US-China trade war. The IMF and the world’s top executives are meeting at the World Economic Forum in Davos, Switzerland. The Dollar dropped against the haven Yen to 109.25 (109.65). The Aussie slumped 0.57% to 0.7122 (0.7160). Prospects for a delay in Brexit lifted the British Pound. Wall Street stocks tumbled with the S&P 500 down 1.2 % to 2632 (2664 yesterday). Bond yields fell with the benchmark US 10-year note down 5 basis points to 2.73%. US December Existing Home Sales missed forecasts, falling to 4.99 million, the lowest since November 2015

- USD/JPY – the Dollar slid against the safe-haven Yen to 109.145 overnight low (109.65) before settling at 109.22. The drop in the US 10-year yield to 2.73% from 2.78% also weighed on USD/JPY. The Bank of Japan is expected to maintain its policy and keep interest rates unchanged at the conclusion of its 2-day meeting today. Traders will be focusing on the BOJ’s Quarterly Economic Outlook for Japan’s assessment of the economy.

- AUD/USD – The risk-off profile came back to haunt the Aussie Battler which underperformed, slumping 0.57% to an overnight low of 0.71200 (0.7160). The Australian Dollar, often the proxy for China and Asia, fell after China reported its slowest GDP growth in nearly 3 decades.

- GBP/USD – Sterling outperformed, climbing against the US Dollar and other Rivals. Market expectations are growing for a delay in Britain’s departure from the EU over continued bickering amongst Parliament on Brexit terms. The British Pound rallied to 1.2965, up 0.53% against the Dollar. EUR/GBP slipped 0.57% to 0.8770 from 0.8820 yesterday.

On the Lookout: Amidst all the news that led to last night’s risk-off stance, the partial US government shut-down dragged into its 32nd day and is in danger of becoming a full-blown crisis. Over 800,000 US government employees are entering their second week without pay. Markets have shrugged this aside as it has not affected the US currency in the past. However, we are now in uncharted waters. The Chicago Commodities and Futures Trading Commission is one of those government offices affected by the shutdown. The last complete Commitment of Traders CFTC report was on December 18. Many traders are in the dark over the market’s positioning.

The benchmark US 10-year bond yield slumped 5 basis points to 2.73% from 2.78%. Existing US Home Sales slumped to the lowest figure since November 2015. Other global yields were either flat or had smaller falls. Which is a further constraint for the Dollar to advance.

Today’s data and events include: New Zealand’s Q4 CPI, just released rose 0.1% beating forecasts of 0.0%. Japan’s Trade Deficit is forecast to narrow with a fall in imports and exports expected. The Bank of Japan’s interest rate decision, Monetary Policy Statement and Quarterly Economic Outlook are released at 1 pm Sydney. The BOJ’s press conference follows later in our afternoon. Canadian Headline and Core Retail Sales and US Richmond Manufacturing Index round off today’s numbers.

Trading Perspective: Markers will continue to monitor both trade and global growth developments after both took a hit on recent developments. In all this mix, the Dollar Index (USD/DXY) was little-changed at 96.28 (96.36 yesterday). EUR/USD finished flat at 1.1365 as traders await the ECB’s meeting tomorrow. US economic growth has also slowed with US housing lagging behind employment and wages. As the government shutdown enters its 32nd day in unprecedented waters the risk is for a lower Greenback. Watch the US yields.

- USD/JPY – the Dollar rallied back to 109.35 current levels as traders await the BOJ announcement. While the BOJ is not expected to deliver any surprises, markets will focus on their economic outlook given recent developments. A weaker appetite for risk as well as lower US bond yields will keep the USD/JPY topside limited. Immediate resistance can be found at 109.60 and 109.90. Immediate support lies at 109.20 (overnight low 109.145) followed by 108.90. Look to sell USD rallies. Likely range 109.00-70.

- AUD/USD – The Australian Dollar is once again hampered by the markets risk-off stance and slowing Chinese economy. This has prevented the Aussie from breaking through the strong resistance between 0.7210-0.7260. However, lower the Australian Dollar is also quoted against the US Dollar, something which is fundamental to the Aussie trade. Both factors should continue to exert influence on the Battler. Look to trade either extremes. Yesterday Australian 10-year bond yields were unchanged at 2.30%, while its US counterpart fell 5 basis points. This should be AUD/USD supportive. Immediate support at 0.7110/20 should hold. The next support can be found at 0.7080. Immediate resistance lies at 0.7150 and 0.7170. Look to buy dips with a likely 0.7110-0.7170 range.

- GBP/USD – The British Pound outperformed all currencies, climbing 0.53% against the US Dollar and the Euro. We can assume that the market positioning has been short in the Pound and this is a correction. The chances of a soft or delayed Brexit have increased with a second referendum a possibility. GBP/USD consolidated its gains, trading to an overnight high of 1.29758 which remains immediate resistance. The next level is the psychological 1.3000. Sterling traded to a high of 1.29988 a week ago on the back of a generally weaker US Dollar. Immediate support is found at 1.2920 and 1.2880. Look to trade both sides today with a likely range of 1.2920-1.2990. Prefer to sell rallies.

Happy trading all.