Summary: Equities rallied while the US Dollar climbed to end with its first weekly gain since December 14. The scheduled Washington trip of Chinese Vice Premier Liu He on January 30 fuelled optimism on talks with the US to resolve the trade standoff. The Greenback’s rally was broad-based with the Dollar Index (USD/DXY) finishing at 96.364, up 0.3%. Sterling slumped back down to earth to 1.2874 from 1.2994. USD/JPY climbed to 109.89, its high since the flash crash on January 4.

Wall Street stocks finished higher ahead of a long weekend with the US celebrating Martin Luther King holiday today. The DOW rallied 1.36% while the S&P 500 was up 1.28%. The yield on the US 10-year Treasury climbed to 2.78% from 2.75%.

US economic data was mixed. Industrial Production beat forecasts while Consumer Sentiment slumped. UK Retail Sales slowed in December to 3% from 3.4% November.

- USD/DXY – The Dollar Index climbed off the immediate support at 96.00 to end up 0.3% at 96.36. USD/DXY which measures the value of the US Dollar relative to a basket of 6 “major” currencies, rose to its highest since January 4. The Dollar Index hit its low on January 10 (95.15).

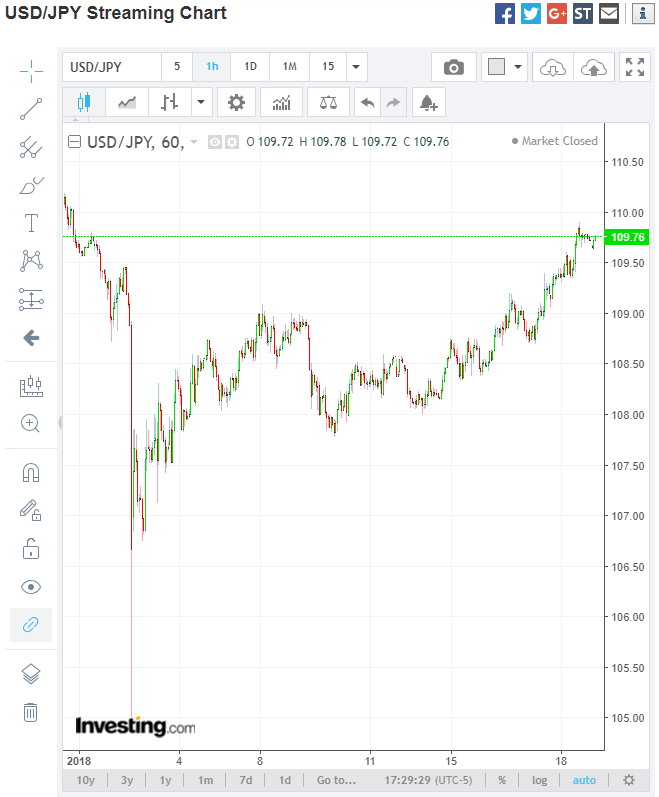

- USD/JPY – the Dollar rallied steadily to an overnight high of 109.89 before settling to close at 109.75 in New York. Continued optimism China-US trade outlook, higher bond yields boosted the Greenback against the Japanese currency. The BOJ’s policy rate meeting is on Wednesday (January 23).

- EUR/USD – The Single currency slipped to 1.1365 from 1.1395 on Friday. Overall US Dollar strength and recent softer Euro area economic data have sapped the Euro’s strength and halted its rally. The Euro closed at it’s lows since the January 4 flash-crash. The ECB has its policy rate meeting later this week

On the Lookout: The market’s focus today falls on China who release their annual Q4 GDP plus the trifecta of Industrial Production, Retail Sales, and Fixed Asset Investment. Economic growth in the world’s second largest economy is forecast to have slowed to 6.4% from 6.5% in Q4 2018. This would bring China’s Total 2018 GDP to 6.6%, the lowest since 1990. GDP Growth recorded in 2017 was 6.8%. A slowdown in the GDP to market expectations will put pressure on China to add further stimulus to promote growth. However, a mountain of stimulus would create more debt, something the country cannot afford.

The Bank of Japan and European Central Bank have their first rate-policy meets for the year. The Bank of Japan is not expected to deliver any surprises when they meet on Wednesday (23 Jan). The ECB is expected to carry a dovish tone following slower Euro area data when Mario Draghi gives his address. (Thursday, 24 Jan).

Following the Brexit drama, UK Employment numbers are out tomorrow as well as Germany’s ZEW Economic Sentiment (22 Jan). New Zealand’s CPI is released on Wednesday (23 Jan) and Australian December Jobs data are out on Thursday (24 Jan).

Trading Perspective: All eyes on China this morning. The market’s higher risk profile is based on a combination trade optimism and Chinese stimulus which has lifted equities and the US Dollar. Slower-than-forecast GDP would put pressure on the Dollar and risk. The world’s second largest economy cannot afford to our in more stimulus with the risk of further debt.

Markets have shrugged off the partial US government shutdown as it doesn’t have a precedent for weighing on the Greenback. We are now in the fourth week, with no clear end in sight.

The market’s positive risk profile may be in jeopardy as we look ahead to this week. Which may be a detriment to further US Dollar strength.

- USD/JPY – The Dollar’s rebound has taken us to virtually where we began on the morning of the flash-crash. Higher US bond yields have lifted USD/JPY with the 10-year US bond yield closing at 2.78%. Japan’s 10-year JGB was up 1 basis point to 0.00%. The BOJ is not expected to deliver any surprises when they meet on Wednesday. The market’s risk-on profile lifted the USD/JPY to current levels. Any change in that will see a reversal. Immediate resistance lies at 109.90-110.00. The next resistance level can be found at 110.10 and then 110.40. Immediate support lies at 109.40 followed by 109.10. The strong bounce in the Dollar Yen may be overextended and any move lower in risk appetite will see USD/JPY slip. Likely range today 109.00-109.90. Prefer to sell rallies from here.

- USD/DXY – the Dollar Index has rebounded well off the base at 95.15 seen in early January. As the market raced off to sell Greenback’s the optimism built from trade talks and the rally in bond yields lifted the US currency. The next resistance level on USD/DXY lies at 96.40 (overnight high 96.394), followed by 96.70 and 97.00. Immediate support can be found at 96.10 and 95.80. Look to sell rallies with the positive risk appetite overdone. US bond yields may have also hit their peak for now. Its’ difficult to see them much higher given the ongoing US government shutdown.

- EUR/USD – the Single currency found itself slip-sliding away given the overall USD strength. Euro area economic figures have continually disappointed, highlighting the slowdown in the continent. Traders who raced off buying Euro’s for the break higher were disappointed and turned when the 1.1570 level failed. EUR/USD traded to 1.13532, January 4 lows. Immediate support for the Euro can be found at 1.1350 followed by 1.1320. Immediate resistance lies at 1.1400 followed by 1.1440. EUR/USD has basically stayed in a 1.1300-1.1500 range with breaks unable to sustain themselves. Traders are expecting a slightly downbeat ECB this week. That said expect the base at 1.1300/s to hold with the range within 1.1300 and 1.1500.

- AUD/USD – The Aussie flipped 0.40% to 0.7165 after another failed attempt above 0.72 cents. An overall stronger US Dollar, buoyed by positive risk profile, has weighed on the Battler. Chinese GDP data is forecast to have slowed to 6.4% in Q4 2018. If the data comes out as expected, look for the Aussie to drift lower with good support at 0.7140/50. Anything stronger than 6.4% will see AUD/USD jump to 0.7200/10. Australian Employment growth due on Thursday is expected to slowdown in December to 18,100 jobs from 37,000 in November. Look to buy dips in the Aussie with a likely range of 0.7140-0.7220 range.

Have a good week ahead all, happy trading.