Summary: The Dollar ended flat in cautious, typically quiet Monday trade with markets partially closed for the US holiday. China’s Q4 GDP growth slipped to 6.4% (6.5% for Q3) as expected. Hopes for more stimulus from Beijing saw a modest rise in Asian shares. In other data, China reported a fall in Fixed Asset Investment which was offset by a stronger rise in Industrial Production. The Dollar Index (USD/DXY) was 0.02% lower to 96.338. USD/JPY slipped to 109.64 (109.77) while the Euro was virtually flat at 1.1367 (1.1364 yesterday). Sterling ended at 1.2885, up 0.11% (1.2875)

British Prime Minister Theresa May revealed no changes in her presentation of Brexit Plan B to the House of Commons. May resolved to be more open with Parliament in negotiating Brexit.

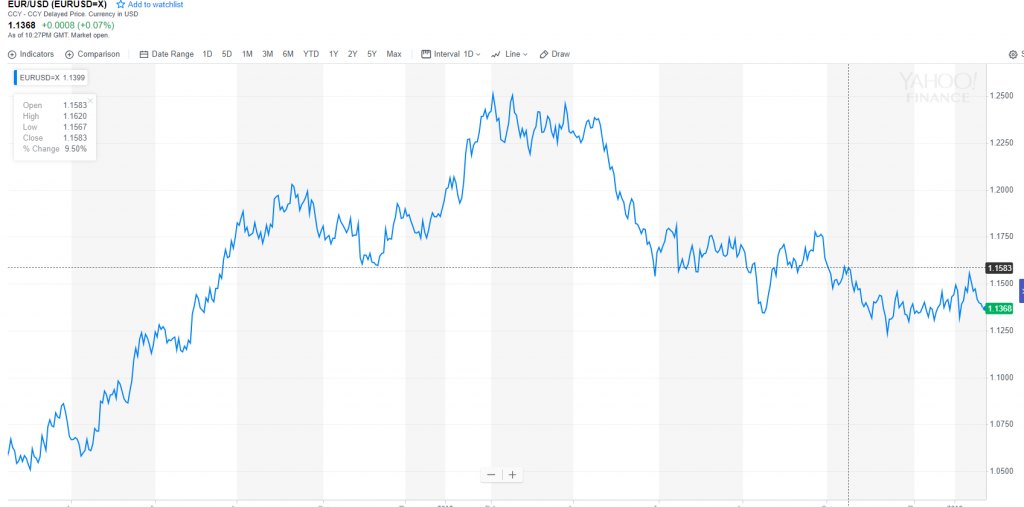

- EUR/USD – The Euro finished little-changed at 1.1368, the low end of its recent range. The ECB is expected to acknowledge that risks are now to the downside given recent disappointing Euro area data, moderation of inflation expectations and global growth slowdown fears.

- USD/JPY – The Dollar eased to 109.65 Yen after the strong bounce from 108.25 a week ago. The Bank of Japan holds their 1st rate policy meeting for the year tomorrow. Like the ECB and other global central banks, Governor Haruhiko Kuroda and his fellow policymakers will discuss how to respond to the weakening outlook.

- GBP/USD – The British Pound maintained its levels amidst continuing Brexit uncertainty, closing at 1.2885 (1.2875 yesterday). Whilst Theresa May’s Plan B revealed no changes, markets still hope cautiously for a soft Brexit.

On the Lookout: Expect a slow start in Asia today with cautious, directionless trade to dictate. Today’s data start with a raft of data out of the UK: UK Average Earnings Index (a leading indicator of Consumer Inflation) Public Sector Net Borrowing (Britain’s Budget balance), Unemployment Rate, and Claimant Count Change (number of people claiming unemployment benefits).

Europe sees German ZEW Economic Sentiment Index for January, expected to slip to -18.8 from November’s -17.5. The Euro-Zone ZEW Economic Sentiment Index is forecast to improve from -21.0 to -20.1. Finally, US Existing Home Sales round up the day’s data with expectations of a fall to 5.27 million from 5.32 million.

Trading Perspective: Directionless trade will see the currencies stay within recent ranges. The Dollar though looks to have topped out against the Yen. The downside though should be limited given the BOJ meeting starts tomorrow. US Treasury markets were closed for the Martin Luther King holiday. US bond yields ended with a weekly gain with the benchmark 10-year up 7 basis points to 2.78% from 2.70%. Existing Homes Sales data will have some impact on bond yields, something to look out for. Watch the 10-year bond yield, 2.80 is strong resistance.

- EUR/USD – The Euro seems to have found a base near it’s lows although the Single Currency will remain range-bound until the ECB meeting. Traders are now looking a dovish-leaning ECB in the current environment. We have seen the Euro slide from 1.1500 a little over a week ago weighed by disappointing Euro area data. Since the December meeting fears of a more prolonged slowdown in the Euro zone have grown. The ECB is expected to keep rates unchanged with a cautious wait and see attitude. EUR/USD has immediate support at 1.1350 and then 1.1320 (strong). Immediate resistance can be found at 1.1400 followed by 1.1430. Would prefer to buy dips down at current levels.

- USD/JPY – The Dollar topped out just under 110.00 following a decent bounce since its’ flash-crash on January 4. USD/JPY closed in New York at 109.65. The focus now falls on the Bank of Japan as it meets for the first time this year. The Bank of Japan meets today and tomorrow, announcing its outcome tomorrow. The BOJ is expected to maintain its policy rate at its current -0.10%. The Bank also releases its latest Quarterly Outlook Report where policymakers could lower their economic forecast. USD/JPY has also risen with the market’s risk-on profile. Any negative changes to the optimism on China-US trade will keep USD/JPY from climbing too high should the BOJ hint at further stimulus if they lower their economic forecast. The US 10-year bond yield also impacts the Dollar Yen. USD/JPY has immediate resistance at 110.00 and 110.40. Immediate support can be found at 109.40 and then 109.00.

- USD 10-Year bond yield – The benchmark 10-year bond yield has climbed all the way from 2.54 (January 4 flash-crash) to 2.798 highs before settling at 2.788% over the weekend. US Treasury markets were shut for the Martin Luther King holiday yesterday. Immediate resistance can be found at 2.80 and 2.82% which are the highs touched on December 27, 2018. Immediate support lies at 2.75% and 2.70%. If US Existing Home Sales fall more than forecast, this could pull US yields down/ Which would affect the US Dollar’s performance. 2.82 looks to be toppish with a likely pullback to 2.70%.

Happy trading all.