The Government Accountability Office (GAO) recommends more involvement from the Consumer Financial Protection Bureau (CFPB) in guiding fintech companies involved in banking activities.

In a new blog post from the GAO, the watch dog looked at the burgeoning fintech alternative banking industry.

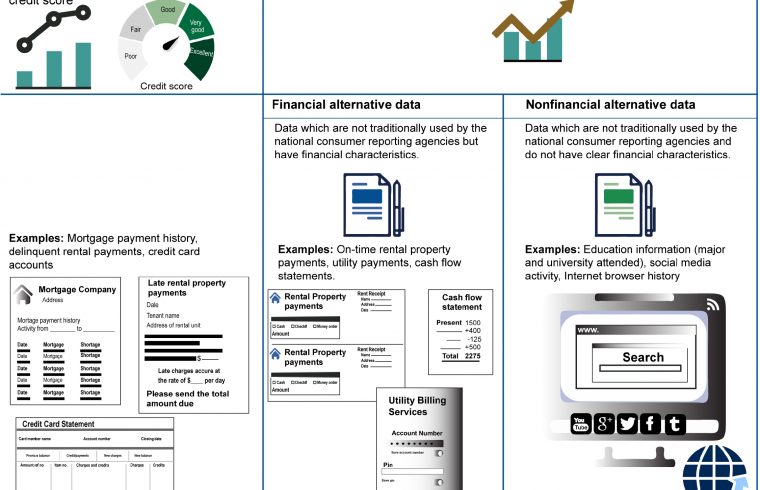

“Financial technology—or “fintech”—can help connect lenders and borrowers online. Some fintech lenders told us that they use alternative data to help determine borrowers’ creditworthiness. For example, lenders may supplement traditional data (such as credit scores) with information about a borrower’s college degree.” The GAO stated in the blog post.

The GAO further noted, “We recommended that CFPB, in coordination with the federal banking regulators, communicate in writing to fintech lenders about how to use alternative data.” The GAO is the Congressional arm which provides auditing, evaluation, and investigative services for Congress.

According to a fact sheet from Reuters,The CFPB was created as part of Dodd/Frank, largely the brain child of Massachusetts Senator Elizabeth Warren, and the CFPB “write and enforce rules for banks and other firms, aiming to protect consumers from deceptive and abusive loans and other financial products and services.”

According to the GAO blog, Alternative data “is generally defined as information not traditionally used by the national consumer reporting agencies in calculating a credit score. Some alternative data (such as on-time rent payments) are financial and similar to traditional data, while others are non financial (such as a borrower’s educational institution and degree). Some fintech lenders use alternative data to supplement traditional data used to make credit decisions or to detect potential fraud.”

Alternative data allows borrowers with little or no traditional credit history to get credit and also helps make the credit decision process more streamlined and therefore faster.

While alternative data provides a great deal of potential, the GAO listed several potential pitfalls.

- Some types of alternative data, such as online social network information about living in disadvantaged areas, may be associated with characteristics protected by fair lending laws (e.g., laws that prohibit discrimination on the basis of race or national origin). Consequently, using alternative data in credit decisions raises concerns that borrowers who are part of these protected classes may be adversely affected.

- Concerns also exist that there may be a lack of transparency about what alternative data is being used and how it is employed in the credit decision. The borrower may also be unable to dispute the information used.

- Recent cyber security breaches show there is a potential for security risks. This may become a growing concern as lenders expand beyond using traditional borrower data.

The blog post followed a December 2018 report by the GAO on fintech. You can find that report here.