Summary: Trade fears took a breather overnight after the PBOC (Chinese central bank) set the midpoint rate (Fix) for the CNY at 7.0039, stronger than expected. A surprise rise in Chinese exports for July added calm and lifted risk sentiment. For now. Early breaking news in Asia from Bloomberg featured a news report that the US has delayed licenses to do business with Huawei after China halted buying of US crops. The Dollar Index (USD/DXY), a popular gauge of the US currency’s value against a basket of foreign currencies slipped to flat at 97.543 following a higher close at 97.63. The safe-haven Yen rallied against the Dollar to 105.87 from a much unchanged close in New York at 106.05. After outperforming overnight on the return in risk, the Aussie and Kiwi eased to 0.6794 (from 0.6804), and 0.6477 (from 0.6482) respectively. The Euro rose modestly to 1.1187 after falling from 1.1225 to 1.1182. Overnight, Italy’s Deputy Prime Minister Matteo Salvini said that there was no way to patch up differences with the ruling coalition and the only was forward was to hold fresh elections. Bond yields steadied for the second day running. The US 10-year rate closed at 1.72% (1.72% yesterday). The Philippine central bank eased interest rates, following the RBNZ, Bank of India and Bank of Thailand. Wall Street stocks erased about half of their overnight gains. The DOW slipped to 26,209 from 26,399 while the S&P 500 was down to 2,918 from 2,941.

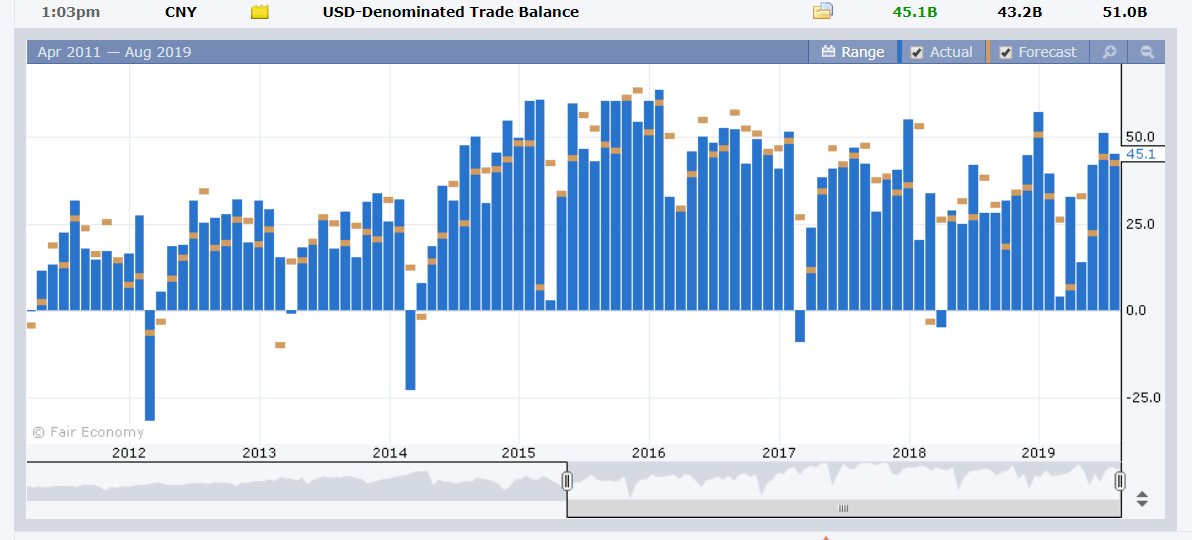

China’s Trade Surplus fell in US Dollar terms to USD 45.6 billion from June’s USD 51 billion. Exports climbed to 3.3% from -1.3%, beating forecasts. Imports also outperformed to -5.6% from -7.3%.

US Weekly Unemployment Claims improved to 209,000 from 217,000 the previous week.

– USD/JPY – The Dollar Yen had a less volatile session trading to an overnight high at 106.30 before slipping to close at 106.05. Early breaking news on the US delay on licenses from companies to do business with Huawei pressured the Dollar to 105.80, where it now sits.

- EUR/USD – The Euro slipped off its highs on the overall stronger Dollar and uncertain Italian politics, closing at 1.1182 from 1.1202 yesterday. The Single currency climbed in early Asia to its current level of 1.1187.

- AUD/USD – The Aussie outperformed on the back of the better than expected Chinese trade report as well as the stronger PBOC onshore Yuan fix. AUD/USD closed at 0.6805 (0.6760 yesterday). In early Asia, the Aussie Battler eased to 06797.

On the Lookout: Markets remain fragile with the trade dispute between China and the US far from being resolved. Another news agency (One American News Networks – OANN) reported that the White House is considering ending talks with China and imposing other sanctions like halting Chinese student visas and removing Chinese authorities from international agencies if Beijing uses its military to crack down on protests in Hongkong.

RBA Governor Philip Lowe speaks to the House of Representatives Standing Committee on the Economy in Canberra this morning (9.30. am Sydney time).

The RBA releases its Quarterly Monetary Policy Statement at 11.30 am Sydney time today.

Today’s data report sees Chinese CPI and PPI for July. Before that New Zealand’s Visitor Arrivals for July are released. Japan releases its Preliminary Q2 GDP report. European data sees German and Italian Trade Balances and French Industrial Production. The UK releases its GDP (July), Q2 Preliminary GDP, Manufacturing Production, Construction Output and Goods Trade Balance.

Canada’s Employment Report (Employment Change, Jobless Rate) and Housing Starts follow.

The US releases its Headline and Core PPI report (July).

Trading Perspective: Expect further choppy trading given the latest news reports. Traders will keep their eyes on any fresh developments/statements from trade officials (China and the US). Overnight President Trump tweeted that he “is not thrilled with our very strong dollar”.

We could see further short-term US Dollar selling against the Euro and the Yen mainly. The Australian Dollar will be sensitive to the RBA monetary policy statement and Chinese data.

- EUR/USD – The overnight range of 1.1180 to 1.1232 should stay intact, albeit in a choppy fashion. EUR/USD had a bid to it after Reuters reported that Germany is considering ditching its balanced budget goal by issuing new debt to finance a costly climate protection package. This u-turn in fiscal policy would arrest falling German interest rates, if implemented. EUR/USD has immediate resistance at 1.1230 followed by 1.1260. Immediate support can be found at 1.1180 and 1.1150. Look to trade a likely range today of 1.1180-1.1230. Prefer to buy dips.

- USD/JPY – The Dollar closed little changed versus the Yen in New York at 106.05 before easing this morning on the reports of another build in US-China trade tensions. USD/JPY fell to 105.72 lows in Asia before recovering to settle at 105.84 currently. Immediate support for the Dollar lies at 105.80 followed by 105.50. Immediate resistance lies at 106.00 and 106.30 (overnight high 106.304). Expect Japanese corporates and importers to be on the bid near this morning’s lows. Likely trading range today is 105.70 to 106.70. Prefer to buy dips.

- AUD/USD – The Aussie was best performing currency against the US Dollar overnight. The strong climb in Chinese exports and the lower USD/CNH lifted the Australian Dollar to an overnight high at 0.68219 before easing at the close to 0.6805. Asian trading saw the Aussie push down to 0.6778 before rallying to its current 0.6810. Immediate resistance can be found at 0.6820 and 0.6850. Immediate support lies at 0.6780 and 0.6750. Look to buy dips in a likely trading range of 0.6785-0.6815 today.

Happy Friday and trading all.