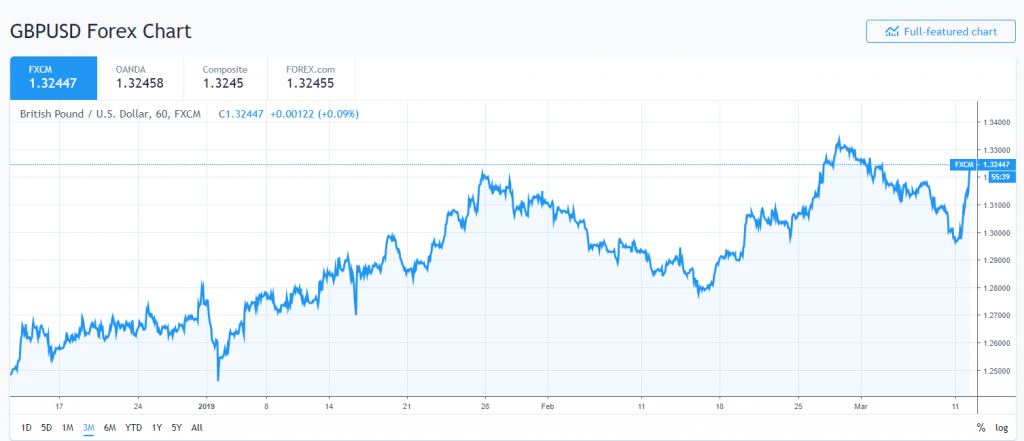

Summary: The British Pound outperformed, soaring almost 2% against a lacklustre US Dollar in early Sydney ahead of a key Brexit vote later today. A likely rejection of PM May’s withdrawal plan will see a further vote on Wednesday on whether Parliament want to leave the EU without a deal. Majority are expected to vote against a no-deal which would potentially damage the British economy. Sterling reversed a string of losses since late February as traders adjusted positions, anticipating further delays. Which reduces the risk of a hard-Brexit. GBP/USD rallied to 1.3145 where it closed in North America. In volatile trade, GBP/USD jumped to 1.3289 in early Sydney.

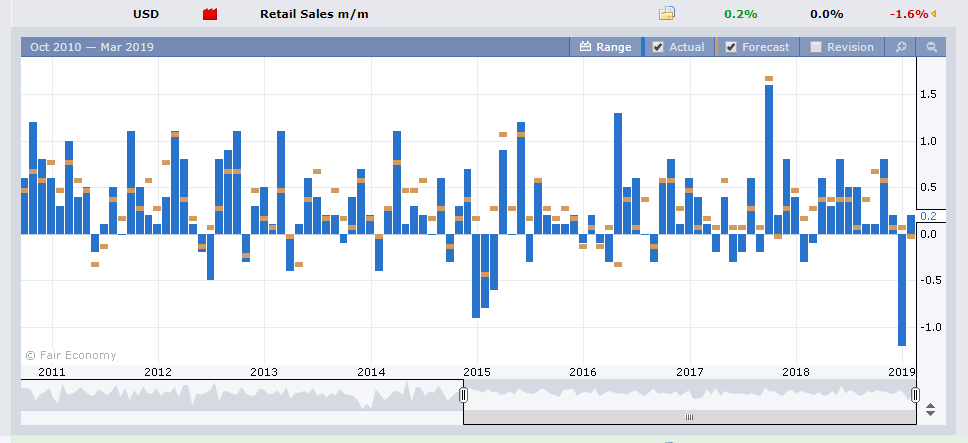

The Dollar slipped anew despite a better-than-expected Retail Sales report. While both Headline and Core Sales rose in January, December’s Sales data disappointed and were revised lower.

Meantime the latest Commitment of Traders/CFTC report (week ended March 5) saw speculators trim their net long US Dollar bets. The reduction of long Dollar bets against the Majors came mainly through a paring of Sterling shorts.

A strong rally in technology stocks (Facebook soared to 8-month highs) lifted Wall Street. The DOW finished up 0.57%. The S&P 500 rallied 1.31%. Global yields were mostly flat.

- GBP/USD – Sterling reversed losses, jumping to an overnight high of 1.3170. The Pound rose further in Sydney, o 1.32891 in a choppy start after it closed at 1.3145. GBP/USD settled at 1.3225 as this is written. PM May promised Parliament that should they reject her deal tonight, they will get a vote on whether to take the UK out of the EU. Which is an option previous votes have shown they will reject. Delays, which eliminate an immediate hard Brexit, lift the Pound. For now.

- EUR/USD – The Single currency extended its recovery, albeit slowly against the overall weaker Dollar. The latest COT report saw speculators increase their net Euro short bets. “

EUR/USD closed at 1.1250, up 0.15%. - AUD/USD – The Aussie climbed further above 0.70 cents to 0.7070, up 0.35%. The overall weaker Greenback lifted the Australian Dollar.

- USD/JPY – The Dollar was little-changed against the Yen, finishing in New York at 111.25 (111.20 yesterday). The increase in risk appetite supported the Dollar against the Yen.

On the Lookout: The revision of the US’s negative December Retail Sales downward cemented the view of a slowing economy. The sales data followed Friday’s disappointing Payrolls report. The Dollar Index (USD/DXY) slipped further to 96.946 on the Sterling’s amazing rally in early Sydney. This lifted the Euro to 1.1260, up 0.28%. Meantime market positioning saw speculators trim their net long Dollar bets to +USD 103,400 contracts from +USD 130,800.

Today starts off with Jerome Powell’s speech in the opening remarks of an Economic Conference in Washington DC. Australian Home Loans and the NAB’s Business Confidence Index follow. RBA Assistant-Governor Guy De Belle speaks at the Centre for Policy Development on Climate Change and the Economy in Sydney. The UK sees a plethora of data: GDP, Manufacturing Production, Goods Trade Balance, and Industrial Production. Finally, the US report on Headline and Core CPI (February) will be closely watched by the markets.

Trading Perspective: The positive in January’s US Retail Sales report was offset by the further negative surprises in December. Which is another indication that the Federal Reserve will extend its pause in raising rates. Market positioning is still long of US Dollar bets against the Majors. While net speculative Sterling shorts were trimmed, there were increases in short Euro, Yen and Australian Dollar short bets. Expect further Dollar depreciation whilst this is the case.

- GBP/USD – The British Pound had a volatile start to the day in early Sydney. Expect more of the same as we enter the voting period at the UK Parliament. GBP/USD soared to 1.3289, up almost 2%, matching highs from March 1, after opening at 1.3020 yesterday. Immediate resistance at 1.3290 remains strong. The next resistance level comes in at 1.3320. Immediate support can be found at 1.3260 followed by 1.3220. Market positioning is still short of Sterling. The latest COT report saw net speculative GBP shorts trimmed to -GBP 34,900 contracts from -GBP 47,500. Stand aside and look to trade the extremes, which are between 1.30 and 1.3300.

- EUR/USD – The Euro continues to grind higher, lifted by Sterling and an overall weaker Dollar. EUR/USD traded to a high of 1.1273 this morning after the strong up move in the Pound. The Euro has immediate resistance at 1.1270/80 followed by 1.1330. Immediate support can be found at 1.1240 and 1.1210. The latest COT report (week ended March 5) saw speculators increase their short Euro bets to -EUR 78,200 from -EUR 74,900. These are still multi-year highs. Beware of further short squeezes. Prefer to buy dips with a likely 1.1240-1.1290 range today.

- AUD/USD – The Australian Dollar jumped to 0.7080 on the Pound’s jump this morning. Net speculative Aussie Dollar shorts increased to -AUD 40,700 bets from the previous -AUD 37,100 in the latest COT report. Immediate resistance can be found at 0.7080 followed by 0.7120. Immediate support lies at 0.7040 followed by 0.7010. Look for a likely trading range today of 0.7050-0.7100. Prefer to buy dips.

Happy Trading all!