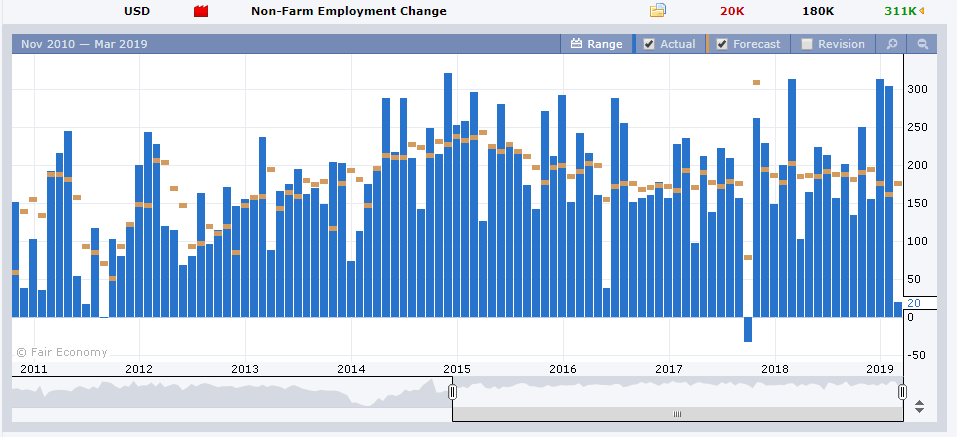

Summary: Despite a disappointing US February Payrolls increase, just 20,000 jobs in February (versus f/c of 180,000), the Dollar ended with modest losses against its peers. Gains in Wages, an upwardly revised January Payrolls number, and a fall in the US Unemployment rate cushioned the effect of the weak Jobs gains report. The Euro rebounded from a 20-month low following a dovish tilt from the ECB a day before. At the close in New York, the Dollar Index (USD/DXY) settled at 97.359 (97.674). The Australian Dollar rallied to 0.7046 from 0.7010 while USD/JPY slipped 0.45% to 111.17 (111.60).

Elsewhere the British Pound slumped 0.63% to 1.3020 (1.3075) on continued uncertainty over Brexit ahead of Tuesday’s Parliamentary vote.

Wall Street Stocks ended marginally lower after recovering from sharp losses earlier in the day. China reported a steep plunge in its February exports which saw risk appetite dive in Asian time.

The US 10-year bond yield fell to 2.63%, its lowest since January 3.

- EUR/USD – rebounded to finish at 1.1235, up 0.29% after plunging to 1.1185 earlier on Friday. The dovish tilt from the ECB following their policy meeting (Thursday) pushed the Single Currency to 20-month lows. Most of the Dollar’s gains came via the Euro’s plunge on Thursday.

- GBP/USD – Sterling suffered further from as uncertainty on Brexit prevailed. If the UK Parliament rejects Brexit on Tuesday, PM May has promised to let them vote the next day on whether to leave without a deal. A rejection here would see another election on Thursday to vote on a “limited deal”. GBP/USD slumped 0.63% to settle at 1.3020 in New York (1.3075 Friday morning). PM May’s future hangs in the balance with all her delays.

- USD/JPY – the Dollar slipped against the Yen to 111.17 from 111.60 as the US 10-year bond yield dropped to 2.63%, its lowest since January 3. The Bank of Japan meets on policy on Friday in a busy week ahead.

On the Lookout: Markets shrugged off a dismal US Payrolls gains, preferring to focus on the strong Wages and drop in the Jobless rate. Other analysts pointed to weather distortions. January’s Jobs Gains were revised upwards to 312,000 from 304,000. Lastly there are those who point out that the Dollar is “still the best game in town”. All of this may be true, but the market’s positioning is also long Dollars and still reluctant to let go of them. This opens the way for more downside in the Dollar.

There will be much scrutiny on March’s Payrolls numbers. Meantime the week ahead leaves us with plenty of data to chew on.

Today starts off with Fed Chair Jerome Powell speaking on interest rates, the economic outlook, and financial stability in an interview on the US network CBS’s 60 Minutes. Data releases sees Japan’s Preliminary Machine Tool Orders for February. Germany releases its Industrial Production report and Trade Balance. The Euro Zone also holds its Eurogroup Meetings in Brussels. Lastly, the US reports on February Headline and Core Retail Sales.

Tuesday sees the UK Parliamentary Brexit vote, UK GDP, Manufacturing Production, Industrial Production and Trade data. The US reports on its Headline and Core CPI (February).

The Chinese trifecta of Retail Sales, Industrial Production and Fixed Asset Investment are released on Thursday. Finally, the Bank of Japan has its rates and policy meeting on Friday.

Trading Perspective: The “mixed” US Jobs report saw a mild retreat for the US Dollar. In the old days, a miss as big as the Payrolls gains would see a plunge in the Greenback. However, the Japanese Yen outperformed its peers, transitioning from the weakest to the strongest over the past week. Weaker risk appetite, and pressure on the Cross Yen pairs (EUR/JPY, GBP/JPY, AUD/JPY) also led to Yen strength. With the BOJ policy meeting at the end of this week, the USD/JPY could take the market’s focus if the Dollar falters further. Speculative market positioning is long Dollars which will weigh on the Greenback.

- USD/JPY – slip-sliding away. The Yen was the best performing currency on Friday, gaining 0.45% against the Dollar. USD/JPY traded to a low of 110.757 before rallying at the close to 111.17. Immediate resistance can be found at 111.20 followed by 111.50. Immediate support lies at 110.75 and 110.40. The US 10-year yield dropped to a 3-month low to 2.63% on Friday. Look for a likely trading range today of 110.75-111.25. Prefer to sell rallies.

- EUR/USD – The Euro finished up 0.29% at 1.1235 after falling to 20-month lows at 1.11765 on the ECB’s dovish stance. Overnight high traded was 1.12461. Immediate resistance lies at 1.1250 followed by 1.1280 and 1.1300. The big level is a pivot at 1.1340. Immediate support can be found at 1.1210 and 1.1180. Look for a likely trading range today of 1.1210-1.1280. Prefer to buy dips to 1.1210.

- AUD/USD – had a good bounce off 0.7010 after testing an overnight and January 3 low of 0.70032. The fall in China’s trade surplus due a plunge in February exports weighed on the Australian Dollar. Australia sees National Australia Bank’s Business Confidence Index report tomorrow. Immediate support can be found at 0.7010 and 0.6970. Immediate resistance lies at 0.7050 and 0.7080. Look to trade a likely range today of 0.7020-0.7070. Prefer to buy dips

Have a good week ahead all. Happy trading.