Summary: The Australian Dollar took a hit on the chin following a weaker-than-expected Q4 GDP report. Growth in the 4th quarter “Down Under” grew at a meek 0.2%, versus a forecast of 0.4%. The Aussie Battler plummeted 0.84% to 0.70212, 2-month lows, within striking distance of the psychological 0.70 cent mark. Predictions for a rate cut grew to 73% from 58% even as RBA Governor Philip Lowe maintained his firmly optimistic outlook. In North America, the Bank of Canada left its Overnight Rate unchanged (1.75%). The BOC said in its rate statement that the global slowdown was more pronounced and wider spread. The Greenback rallied 0.49% against the Canadian Loonie to 1.3425 (1.3345 yesterday). Price action in the Dollar remained muted. The Dollar Index (USD/DXY) finished little-changed at 96.869 (96.870 yesterday), down 0.02%. Ahead of what is expected to be a dovish ECB meeting, the Euro ended flat at 1.1307. Soft US data buoyed the Euro. USD/JPY slipped 0.06% to 111.80 (111.90).

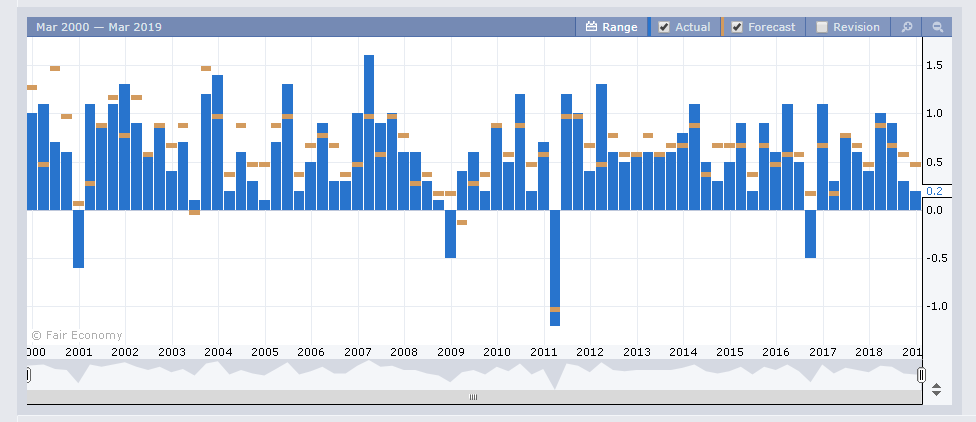

Date released yesterday saw US ADP Non-Farms Employment gains of 183,000 missing forecasts of 190,000 and a previous 213,000. US Trade balance, delayed by 29 days due to the government shutdown, saw the deficit in January climb to -USD 59.8 billion from -USD 49.3 billion in December.

Growth woes hit Wall Street. The DOW ended down 0.4% at 25,702 while the S&P 500 lost 0.50 to 2773. Yields fell. The benchmark US 10-year Treasury yield was down 3 basis points to 2.69%.

- AUD/USD – The Battler took a hit to the chin, which saw other growth and commodity currencies slump. AUD/USD finished at 0.7028 from 0.7087 yesterday. Australia’s annual growth rate for 2018 fell to 2.3% against an expected 2.8%. While the Aussie trades heavy at current level, a softer US Dollar should provide support for the Battler.

- EUR/USD – the Single currency bounced off its lows to close flat at 1.1307. The soft US data enabled the Euro to rally against its US counterpart. The ECB is expected to slash growth forecasts in its monetary policy statement following its meeting later today. This will enable Europe’s central bank to justify providing cheap loans to banks, a form of fresh stimulus. These expectations are fully priced into the Euro at current levels.

- USD/JPY – The Dollar slipped 0.06% against the Yen weighed by the lower US bond yields. Ten-year US treasury yields continued their drop which began this week, sliding to 2.69% from 2.75% on Monday. Japan’s 10-year JGB yield was down 2 basis points to -0.02% from 0.02% at the start of the week. USD/JPY closed at 111.80 with the 112.00 level strong resistance.

On the Lookout: Global central bank stances have turned dovish following their respective domestic slowdowns. The Fed released it’s Beige Book, an analysis of 12 Fed Districts around the country on local economic conditions. President Trump’s tariffs and the government shutdown were both drags on growth, the Beige Book concluded. Tomorrow’s US Payrolls data will have a significant influence on the economy moving forward.

Today sees the release of further economic data. Australia leads with its February Retail Sales data and Trade Balance. Japanese Leading Indicators follow next in Asia. Europe sees Swiss Unemployment rate, UK Halifax House Price Index, Euro-Zone Q4 Final Employment Change, as well as Revised Q4 GDP. US Challenger Job Cuts, Weekly Jobless Claims and Consumer Credit follow. “

The big event is the ECB’s Monetary Policy Statement and Press Conference following its meeting. The ECB is expected to keep its Main Refinancing Rate at 0.00%.

Trading Perspective: The US Dollar has stayed bid against it’s Rivals on its relative yield advantage. However, without fresh yield support the Dollar will struggle to add further gains.

Speculative market positioning is also long US Dollar bets. This will also serve as a damper to a full-blown US Dollar rally. We should see volatility start to climb after plumbing lows in February. Happy days!

- EUR/USD – The immediate support at 1.1280 is strong and should hold. Overnight and two- week low was 1.12857. Immediate resistance can be found at 1.1320/30 (overnight high was 1.1325). Look for a likely trading range of 1.1285-1.1325 into the ECB meeting. With the speculative market short of Euro bets at its largest in over two years, the downside should be limited. If anything, the risk is higher.

- AUD/USD – The Battler finds itself slip-sliding away with Australia officially joining the global downturn. The currency has already been under pressure due to its close alignment with the Chinese economy. The psychological 0.70 cent level looks likely to be tested but a sustained move lower with depend on the US Dollar. Market positioning is currently short of Aussie, but not at record levels. AUD/USD has immediate and strong support at 0.7015, followed by 0.7000 cents. Immediate resistance can be found at 0.7050 and 0.7080. Australian Retail Sales and Trade Balance reports are forecast to show improvement from previously. A good report on both could see short-covering triggered to 0.7070 first-up. Look for a likely trading range today of 0.7015-0.7055. Prefer to buy dips down here.

- USD/JPY – once again this currency pair had a tight trading range with muted action. The Dollar slipped against the Yen to 111.80 following a test of just above 112 twice this week. The move lower in the US 10-year yield will keep USD/JPY capped with 112.00 immediate and strong resistance. Risk appetite also waned overnight, which adds to downside pressure on the Greenback. Immediate support lies at 111.65 (overnight low) and 111.35. Look for a drift lower with a likely trading range of 111.30-111.90 today. Look to sell rallies.

Happy trading all.