Summary: Sterling slipped anew as British PM May failed for the third time to get her Brexit deal through lawmakers. Although the magnitude of the loss was less than the previous two votes, fears that the UK may crash out of the EU without a deal grew. GBP/USD slid to 1.29779, 3-week lows before settling at 1.3030. The Dollar was mixed, climbing modestly against the Euro and Yen. Antipodean cousins, the Aussie and Kiwi, hit hard on Thursday, ended with mild gains, rebounding on the back of higher bond yields.

Wall Street stocks rebounded as risk appetite improved on rising optimism over progress on China-US trade talks. Bond yields rose. The benchmark US 10-year bond yield ended 2 basis points up at 2.41%. Australia’s 10-year bond yield climbed to 1.77% from 1.72% while Germany’s 10-year Bund yield was flat (-0.07%).

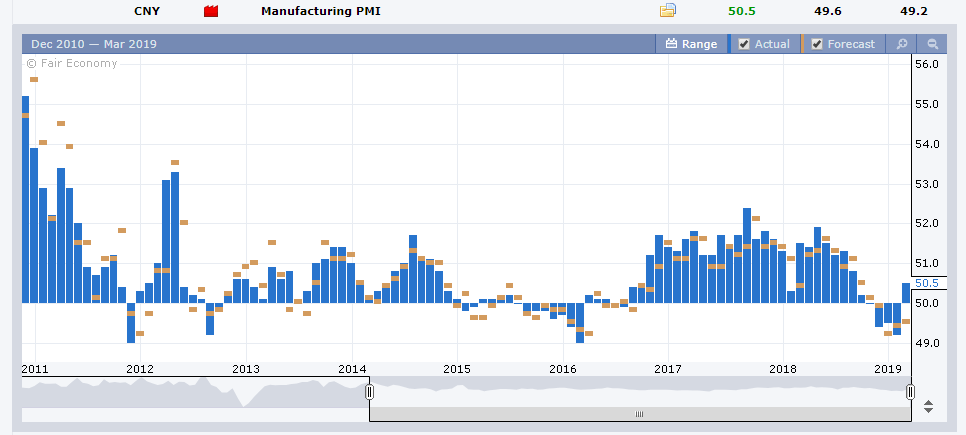

Yesterday, China reported that its Manufacturing PMI data in March rose to 50.5, beating forecasts of 49.6. This is the first rise in factory activity in 4 months and above the 50.00 mark. Factories in the world’s second largest economy ramped up production ahead of the Lunar New Year (as they traditionally do). Export Orders shrank for the 10th straight month.

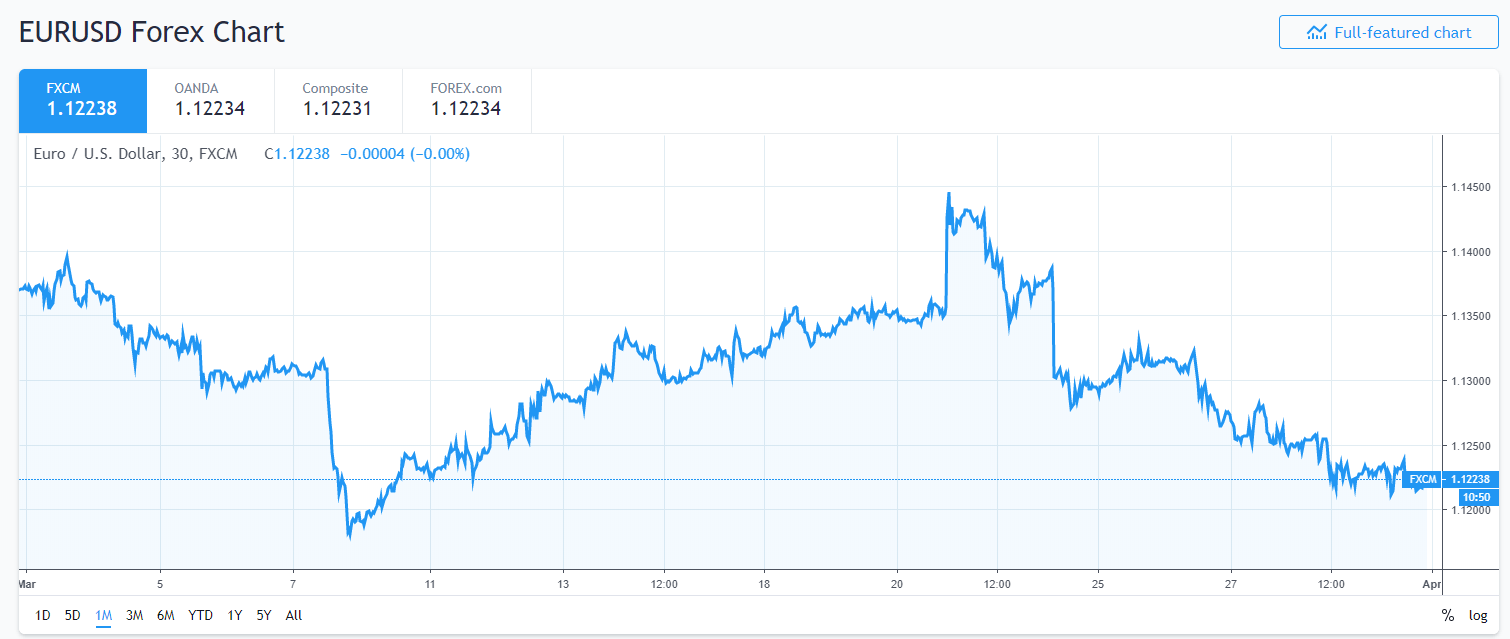

- EUR/USD – The Euro’s recovery was unable to extend following its attempt after the ECB’s dovish outlook. Data releases were mostly disappointing. The RBNZ became the latest central bank to join the dovish camp. Which sucker-punched the Kiwi. Finally, Sterling’s slump didn’t help either. EUR/USD closed at 1.1220, down 0.12% and just above the year’s low.

- GBP/USD – Sterling continues to slip-slide away. Although the Pound rebounded at the NY close to 1.3130 from 1.2978, Brexit’s future is uncertain as ever. PM May’s Brexit plan lost for the 3rd time in the British Parliament. Although many speculative positions have been unwound in Sterling, it remains heavy due to the uncertainty alone.

- USD/JPY – rallied on the back of higher US bond yields. With the 10-year yield up 2 basis points, the Dollar should be supported. USD/JPY closed at 110.85, its high for the week. Further recovery in risk appetite will also support this currency pair.

- AUD/USD – The Aussie finished with modest gains at 0.7097 from 0.7080 Friday. AUD/USD traded to 0.7070 lows. An overall stronger US Dollar will keep the topside limited while stronger risk appetite supports the base.

On the Lookout: A busy data day ahead to start off in Asia and the rest of the globe to start off Q2 2019. Australia starts off today with its NAB Business Confidence Index for March. Australian Commodity Prices and New Home Sales will also be released. Japanese Tankan Manufacturing, Non-manufacturing and Final Manufacturing Index reports are forecast to further highlight the slowdown in global PMI data. China rounds off today’s Asian data with their Caixin PMI for March, with analysts expecting a recovery to 50.1 from 49.9. Markets will be keenly watching for this.

European data begins with Swiss Retail Sales (March). This will be followed by Euro area Manufacturing PMI’s (Spain, France, Italy, Germany and the Eurozone). Eurozone Headline and Core CPI, as well as EZ Unemployment data follow shortly after.

The UK reports on its Manufacturing PMI for March. The US finishes off today with it’s Headline and Core Retail Sales (March) as well as Final and ISM Manufacturing PMI’s.

Markets will continue to track progress on the China-US trade talks.

Trading Perspective: Global central banks have all sprouted dovish wings which has kept the US Dollar in relatively tight trading ranges against its Rivals for most of Q1. Economic data releases have disappointed which has raised concerns on global growth moving forward. What’s keeping the markets and the Dollar buoyed is growing optimism on the progress of China-US trade talks. Risk and the Dollar rise when there is “good” news, while they both fall when there is “bad” news.

While the talks are to continue this week in Beijing, Nikkei reports that both countries remain at odds on the timing of ending tariffs. The Dollar Index (USD/DXY) closed flat at 97.21, near 3-weeek highs. USD/DXY starts off Q2 2019 near an important resistance area at 97.40/50. A risk-on stance looks likely for the start of this week.

Tomorrow we look at speculative market positioning for the latest week. Let’s hope for more volatility for this quarter.

- EUR/USD – The Single Currency opens in Asia just above support levels at 1.1210. The next immediate support level lies at 1.1190 which may get tested. Immediate resistance lies at 1.1250 followed by 1.1280. The overall range for most of Q1 was between 1.1250 to 1.1450. A close above 1.1250 would be needed to keep in within that trading range. Look for a likely range today between 1.1200-50.

- GBP/USD – The Pound has slid from 1.3350 to 1.3000 in 2 weeks. PM May goes back to the drawing board. The UK will now have to convince 27 of the EU capitals (whose patience is running out) to extend the April 12 deadline it has an alternative way out. A lot of the trading volume in the Pound has dropped. Speculators find it too hot to handle. That said, Sterling faces a slow death as the Brexit can gets kicked further down the road. Immediate support lies at 1.3000 followed by 1.2970. Immediate resistance can be found at 1.3050 and 1.3100. Look for the Pound to consolidate between 1.2980-1.3080 today

- USD/JPY – The Dollar’s rally against the Yen was steady as the market’s risk profile on Friday. The Japanese financial year-end finished with a whimper, with the Dollar’s trading range a paltry 110.53-110.95 range. In the old days, we could often get a 200 point either way on the Japanese fiscal year-end supply and demand factors. Times and markets have changed! Look for consolidation today between 110.70-111.20.

Have a good week ahead, Happy Trading.