Asian stocks finished on positive tones as investors digest better China PMI figures and progress in trade negotiations between the US and China. In Japan, the Nikkei225 main index added 0,13 percent to 21,537; the Hang Seng benchmark in Hong Kong finished 0.09 percent higher at 29,590. The Shanghai Composite outperformed for one more day, finishing 0.41 percent higher at 3,183 and in Singapore, the FTSE Straits Times index gained 0.52 percent higher at 3,267. Australian equities recorded a sixth straight session of gains, buoyed by improvements in the banking, energy, industrials, and healthcare stocks. The IT sector rallied 2%, mirroring gains by US counterparts overnight. The ASX 200 finished 25 points higher or 0.4% at 6,242.

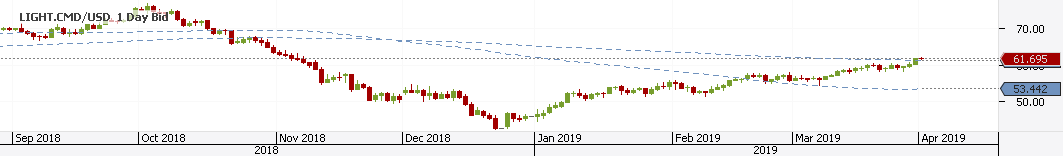

In commodities markets, Light Crude Oil rallies to five-month high at 61.75, breaking above the 200-day moving average as the United States is considering additional sanction on Iran, while Brent oil also breaks higher at $69.15/barrel. A Reuters survey shows oil supplies by the Organization of the Petroleum Exporting Countries (OPEC) dropped to a four-year low during March. Gold continues today in soft tones and trades near three-week lows at $1287. XAUUSD technical picture has deteriorated, and now immediate support stands at 100-day moving average at $1277, which can accelerate the downward move down to new YTD lows at the 200-day moving average at $1247. Strong resistance now stands at the $1300 round figure and then at the 50-day moving average. Expect the bears to defend $1307 with full force.

A positive start for equities in the early European session mirroring Wall Street as investors watch the developments surrounding Brexit and weak Eurozone macro data. DAX30 gains 0.05 percent to 11,688, CAC40 is 0.15 percent higher at 5,414 while FTSE100 in London is 0.46 higher at 7,351 and the FTSE MIB in Milan trading 0.37 percent higher at 21,536.

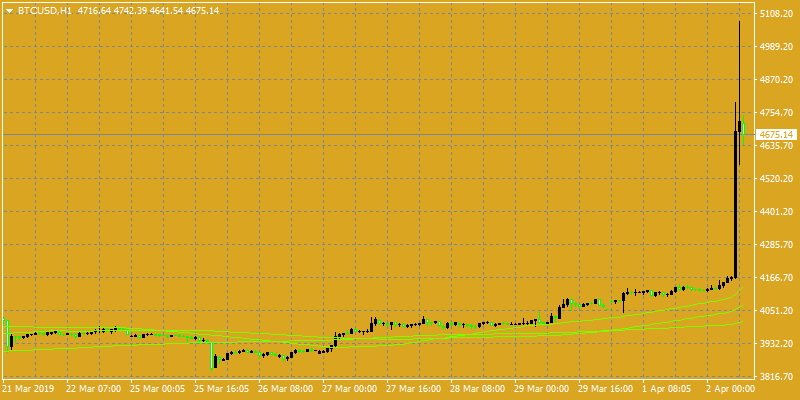

In cryptocurrencies, bitcoin (BTCUSD) after spending three days at 4,200 jumps more than ten percent to 5,000 without any specific reason and news, breaking above the 100-day average just to find resistance at the 200-day simple moving average. The rally in BTC triggered bids across the industry with Ethereum (ETHUSD) trading now at 150 and Litecoin (LTCUSD) jumping to 66.90.

On the Lookout: The Reserve Bank of Australia kept rates unchanged as expected and noted the continued improvement in the labor market “is expected” to lift wages over time, marking a slight downward revision from the March statement.

In Aussie macro news, council building approvals rose 19.1% in February according to the Australian Bureau of Statistics. Despite the second straight monthly improvement, total building approvals over the 12 months to February are still down 12.5%. The monthly increase in approvals was driven by increases in Victoria and NSW. The weekly ANZ-Roy Morgan consumer confidence rating rose by 2.6% – the biggest increase in 7½ months – to 114.7 points, while council approvals to build new homes rose by 19.1% (consensus: -1.8%) in February to be down by 12.5% over the year.

In our calendar today, US durable goods orders are released, along with vehicle sales and the ISM New York index.

Trading Perspective: In forex markets, AUDUSD is trading at daily lows at 0.7078 after RBA kept the interest rates unchanged. Kiwi is also losing some pips and trades lower at 0.6777. US dollar index gains momentum and now is trading at 96.90 looking for a break above 97 that will attract the bulls.

GBPUSD is trading at 1.3055 as investors digest UK’s parliament votes yesterday that rejected all the four Brexit proposals indicative votes, increasing the threat of no-deal Brexit. On the downside, major support will be found at 1.30 round figure while more protection can be found at the 200-day moving average around 1.2980. On the flipside, immediate resistance stands at 1.3112 the high from Asian session, and from there, major resistance can be found at 1.3202 where the 50-hourly moving average stands and then at 1.3232 the cross point of 100 and 200-hourly moving averages while 1.3382 the yearly high will be met with strong supply.

In GBP futures markets open interest shrunk by nearly 2K contracts on Monday, the first drop after three straight builds. In the same line, volume extended its choppy performance and decreased by almost 76K contracts.

EURUSD makes an attempt above 1.12, but the move can’t convince the bulls, a move to yearly lows is the most possible scenario. The pair needs to break above 1.1236 to give bulls a breath and then approach the 100-hour moving average at 1.1251 to establish short term bullish momentum. Immediate support can be found at 1.195 the low from Asian session, while more buying interest will emerge at 1.1177 the YTD low.

In Euro futures markets, open interest rose for the third session in a row on Monday, this time by around 3.7K contracts. On the other hand, volume dropped by around 13K contracts, recording the third consecutive decline.

USDJPY gains momentum and trades at the daily high to 111,38 zone having hit the low at 111.27. Major support for the pair stands at 111 round figure and then at the 50-day simple moving average at 110.57. Immediate resistance for the pair stands at the 111.46 where the 200-day moving average crosses, followed by the 112 zone.

Open interest in JPY futures markets increased by nearly 2.5K contracts to their open interest positions on Monday from Friday’s final 154,970 contracts. On the other direction, volume shrunk by around 18.3K contracts after three consecutive builds.