Asian markets finished mixed today as China responded with a firm message that it does not want to sit down to negotiate so long as the US remains ‘insincere’ in trade talks. The Nikkei225 was the outperformer adding 0.89 percent to 21,250. The Hang Seng benchmark in Hong Kong finished 1.19 percent lower at 27,941. The Shanghai Composite crushed 2.59 percent to 2,878 while in Singapore, the FTSE Straits Times index finished 0.57 percent lower at 3,210. Australian stocks added to gains for the third day, supported by gains across all sectors, firmer commodity prices and market speculation of a potential RBA rate cut in June.

European session also started lower mirroring Asian indices. The DAX30 is 0.82 percent lower to 12,211 and CAC40 is 0.56 percent lower at 5,417 while the FTSE MIB in Milan is trading 0.45 percent lower at 21,056. The London Stock Exchange is giving up 0.48 percent to 7,318 as the no deal Brexit scenario is back on the table.

In commodities markets, crude oil trades higher for the third day at 63.14 after mounting tensions in the Middle East. Brent oil adds a half dollar at $72,76 per barrel. Gold got a hit on the chin yesterdays as it lost over 10 dollars down to 1285. The precious metal breached the 100-day moving average, and that gave the control back to bears. XAUUSD’s technical picture is bearish now after yesterday’s sell-off. Gold will find support at 1275, the April low, while more bids will emerge at the 200-day moving average at 1255. On the upside, resistance stands at 1296, the 100-day moving average.

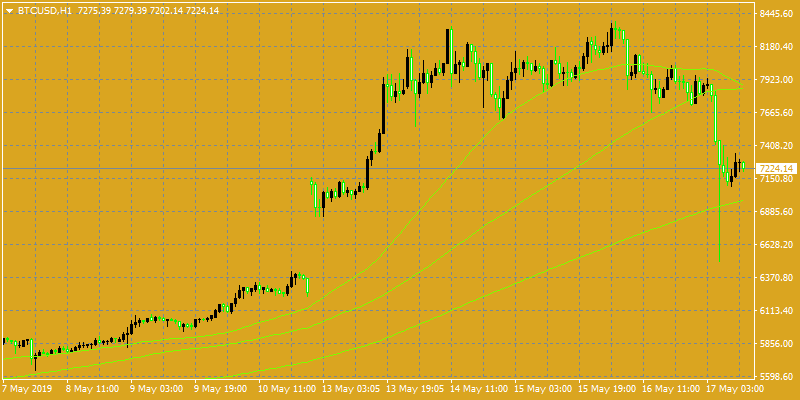

In cryptocurrencies market, bitcoin (BTCUSD) lost over 20% yesterday and gave up almost 800 dollars in an extreme volatility day without any specific news. The daily low for BTC was at 6,497 and the daily high at 7,957. BTCUSD’s immediate support stands at the $7,000 round figure and then at the 200-hour moving average at 6,949. On the upside, strong resistance stands at 7,959 the high from the Asian session. On Monday the CME Bitcoin futures reached an all-time record high of 33.7k contracts. Ethereum (ETHUSD) also retreated from recent highs down to 237. On the upside, the immediate resistance stands at 273, the high during the US session while the support stands at 200. Litecoin (LTCUSD) mirrors major cryptocurrencies losing almost 10 dollars down to 87.71. The crypto market cap holds above $173.0B.

On the Lookout: Reuters report that the PBOC will intervene and use monetary policy tools to ensure that the yuan does not weaken past 7.00 per dollar in the immediate term, citing three people familiar with the matter.

The Japanese Cabinet Office released a statement confirming that it will hold the next round of trade talks with the US on May, 21st in Washington.

An executive order by the Trump administration, aimed at banning Huawei equipment from U.S. networks, took effect on Thursday.

In Australia yesterday, the April employment data received the most attention. 28,400 jobs were added in April; 13,000 above consensus. Employment has improved for nine straight months.

In the America economic calendar, we await the US UoM preliminary consumer sentiment data, due at 1400 GMT, will remain the key focus. At 1700 GMT, oil traders will look forward to the US rigs count data due to be published by Baker and Hughes oilfield services company.

Trading Perspective: In forex markets, the US dollar trades higher at 97,65 as traders digest the developments in US-Sino trade war. A stronger US dollar will likely increase the US trade deficit, adding risk that Trump administration continues to target those nations with a significant trade surplus with the US (China – Germany – Europe). The Aussie dollar continues its trip south for another day breaking the 0.69 level to 0.6878 as the market is pricing in a 90 percent chance of a rate cut by December. Kiwi also gives up ten cents to 0.6539, approaching the low after the interest rate cut from RBNZ.

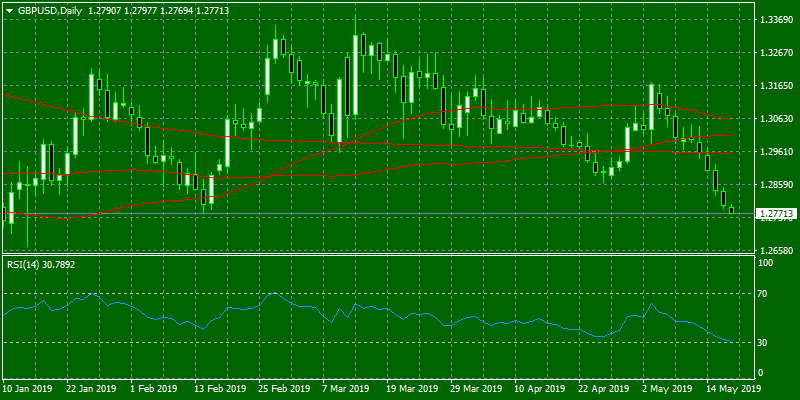

GBPUSD is the majors worst performer for one more day after the pair lost yesterday the 1.28 and trades down to 1.2778 as Prime Minister May agreed to set out the date of her departure in the first week of June after she makes one final attempt at getting her Brexit deal through parliament. The pair hit the daily low at 1.2775 and the daily high at 1.2797. Bears are in full control now, and an attempt to 1.27 looks possible scenario. On the upside, immediate resistance stands at 1.28 and then at the 50-hour moving average around 1.2830.

In Sterling futures, the open interest increased by 6.5K contracts on Thursday, reaching the fourth consecutive build, the volume went down by almost 21K contracts after three straight daily increases

EURUSD lost the 1.12 handle yesterday amid USD strength. The pair made the Asian high at 1.1183 and the low at 1.1168. The pair breached all major moving averages and now is looking for support at the yearly low down to 1.1115. On the upside, the immediate resistance stands at 1.1200, while more offers will emerge at 1.1245 the 50-day moving average.

In euro futures, the open interest increased for the first time after four consecutive drops by nearly 7.7K contracts on Thursday. Volume shrunk by around 38.5K contracts after three builds in a row.

USDJPY trades lower at 109.60 as traders turn their eyes to safe assets amid renewed China-USA trade worries. Today the pair hit the low at 109.54 and the high at 110.03. The pair will find support at 109.14 yesterdays low, and on the upside, immediate resistance for the pair stands at 110 round figure (a level where the pair rejected in early Asian session) and then at 110.50, the 100-day moving average and then at 111.17, the 50-day moving average.

In Yen futures, the open interest dropped for yet another session on Thursday, this time by around 1.2K contracts, volume resumed the downside and shrunk by nearly 31.8K contracts.

USDCAD is trading and gaining momentum in the last 24 hours and trades at 1.3490. The pair will find immediate support at the 100-day moving average around 1.3335 while extra support stands at 1.3300 round figure. On the upside now that the pair broke yesterday high (1.3476) immediate resistance stands at 1.35, while a break above can escalate the rebound towards yearly high at 1.3635.