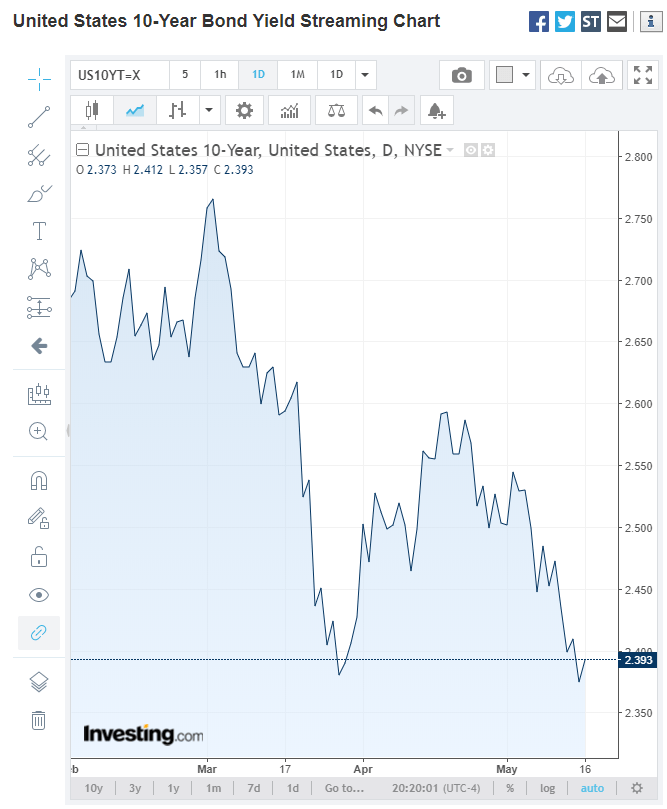

Summary: The Australian Dollar dropped to 4-month lows at 0.6892 on the back of a mediocre labour report. Sterling slumped to mid-February lows as repeated failure from UK political parties to provide any Brexit solution sees growing pressure for PM May to resign. A May departure is seen as increasing the chances of a no-deal Brexit. The Euro fell to one-week lows at 1.1175 after repeated failure to break above the 1.1250 level. The US Dollar once again benefitted from the relative weakness of its Major rivals. US bond yields rebounded off their lows with the 10-year yield up 2 basis points to 2.39%. This lifted USD/JPY to 109.85 from 109.55, 0.34% higher. Data releases were also US Dollar supportive. Although Australia saw a total of 28,400 jobs created last month, beating forecasts of 15.200, full-time employment fell 6,300. The Unemployment rate rose to 5.2% from 5%. The Euro-zone’s trade surplus narrowed to EUR 17.9 billion against a forecast surplus of EUR 19 billion. US Housing Starts, Building Permits and the Philly Fed Manufacturing Index in April all beat forecasts while Unemployment Claims improved to 212,000 from 228,000.

Wall Street stocks rallied for the 3rd-day running. The DOW was up 0.76% to 25,878 while the S&P 500 added 0.87% to 2,878 (2,858 yesterday).

- AUD/USD – slip sliding away, the Aussie Battler dropped to January lows following a disappointing labour report. AUD/USD dipped to 0.68865 before settling currently at 0.6892. Traders now see an RBA rate cut in June as imminent.

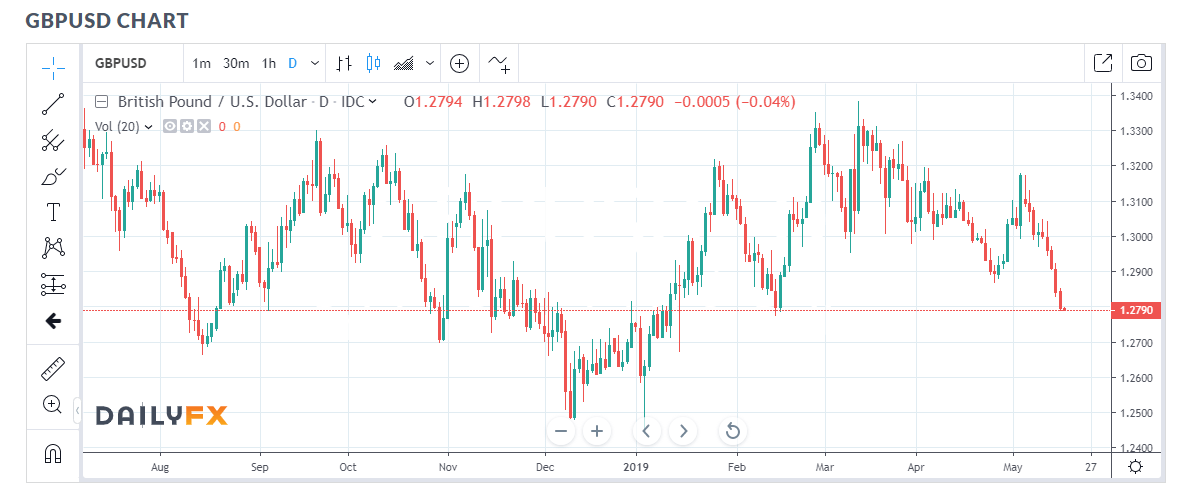

- GBP/USD – Sterling continued its recent downtrend as the failure of UK lawmakers to agree on a Brexit strategy weighed. PM May continues to resist pressure to resign insisting she will remain in office until Parliament sign her Withdrawal bill. The toll of Brexit was seen in this week’s weaker UK wages and rising jobless claims. GBP/USD slumped to 1.27878, settling at 1.2795.

- USD/JPY – The Dollar grinded back higher against the haven Yen boosted by a rise in the US 10-year bond yield. The presence of Japanese importer buying of USD/JPY at lower level also forced this currency pair higher. USD/JPY closed at 109.85, up 0.34%.

On the Lookout: The Dollar’s rally came at the expense of the weakness of its Rivals. This has been the pattern for most of last month. US economic data released yesterday were all better-than-expected. However, the surprisingly weak US retail sales report has changed the wide economic outlook for the world’s largest economy. Worsening trade tensions and the fall of close to 3% in US equities this week make it difficult to see an improvement in sentiment.

Today’s economic reports begin with New Zealand’s Business NZ Manufacturing Index, Q1 PPI Output and Input. Japan sees its Tertiary Industrial Activity for April. Eurozone Final Headline and Core Annual CPI for April follow next. US reports on its Preliminary University of Michigan Consumer Sentiment, Inflation Expectations, Conference Board’s Composite Leading Index. The US Treasury Currency report rounds up the days event.

The Australian Parliamentary Election is on Saturday (May 18).

Trading Perspective: The rebound of the US bond yields from their lows lifted the Dollar back above its rivals. Global bond yields were mostly flat. However, the 2-basis point bounce in the US 10-year yield is far from impressive. Without yield support, the Dollar will find further gains difficult. Speculative long Dollar market positioning near multi-year highs also add to this constraint.

- AUD/USD – There seems to be no respite for the oversold Aussie Battler. Overwhelming bearish sentiment will continue to constrain the Aussie while the oversold condition supports. AUD/USD has immediate support at last nights lows around 0.6880 followed by 0.6840. Immediate resistance can be found at 0.6900 and 0.6950. Look for a likely range today of 0.6880-0.6930. Prefer to buy dips.

- GBP/USD – Sterling continues to grind lower as Brexit’s uncertainty takes it toll. The latest COT/CFTC report saw speculative net GBP shorts increase to -GBP 6,879 contracts from the previous week’s -GBP 4,668. Market positioning, while short is relatively small. This shows that no one wants to take any big risks in this currency pair during Brexit. Positioning in the British Pound is still short. Immediate support can be found at 1.2780 followed by 1.2750. Immediate resistance lies at 1.2850 followed by 1.2900. It won’t surprise me to see some gaps filled before further weakening. Likely range today 1.2780-1.2880. Just trade the range shag on this one.

- USD/JPY – The Dollar had a decent bounce after breaking through 110.00 and trading to the lower 109s (109.019). The presence of Japanese importers and a rise in risk appetite lifted the USD/JPY above lows. USD/JPY closed at 109.85 after trading to a high of 109.967. Immediate resistance lies at 110.00 and 110.30. Immediate support can be found at 109.50 followed by 109.20. Look for a likely range today of 109.50-110.00. Prefer to sell rallies.

- EUR/USD – The Euro slipped after its technical failure to lift above 1.1250. The support around 1.1180 remains strong. The Euro has traded between 1.1150 and 1.1250 since the start of this month. And there is no reason to see that change for now. Speculative market positioning remains short Euro bets at multi-year highs. This will continue to support the downside. Look for a likely range today of 1.1155-1.1215. Prefer to buy dips.

Happy Friday and trading all.