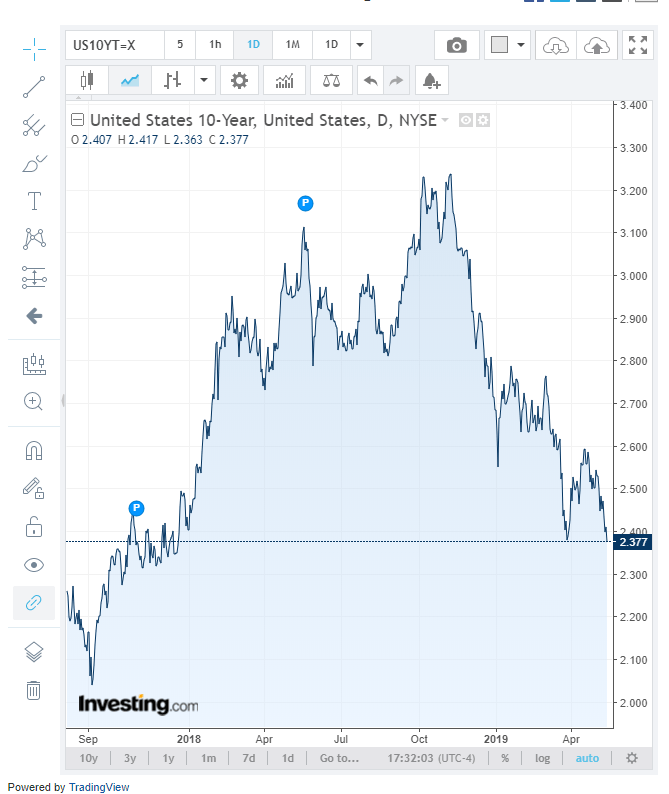

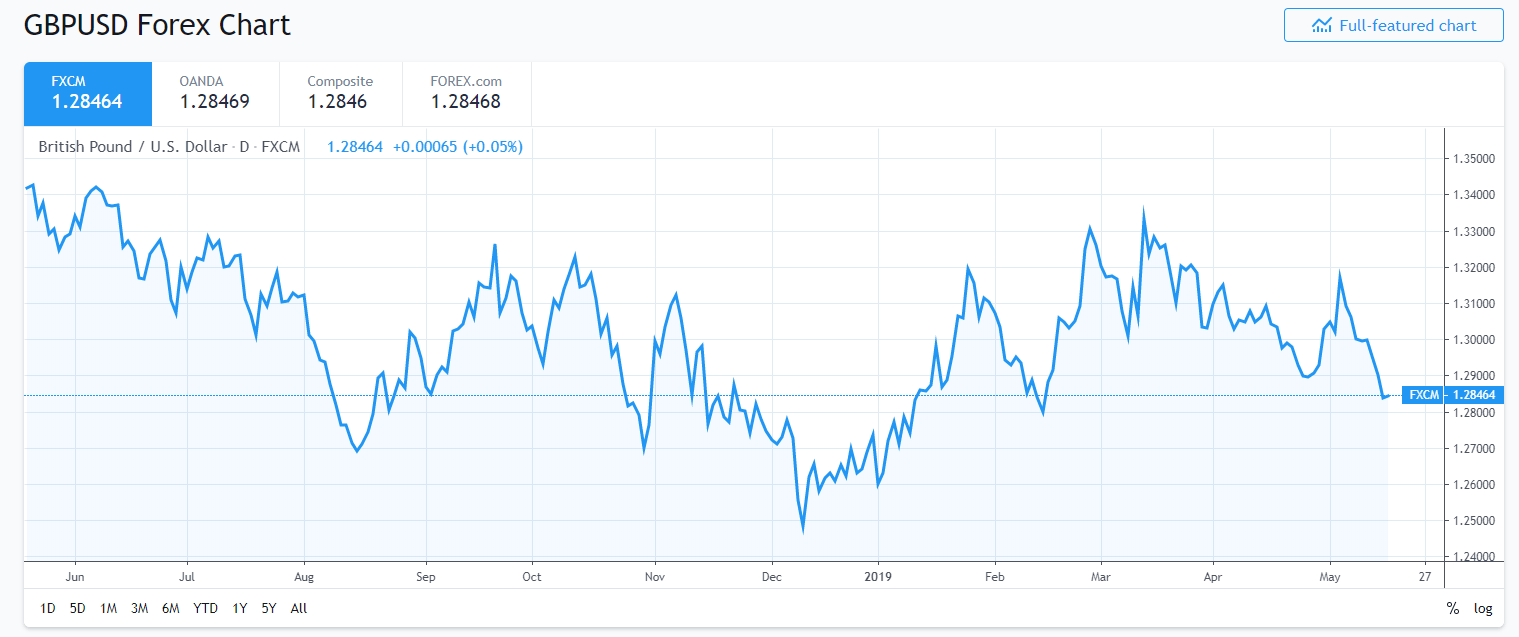

Summary: The Dollar Index (USD/DXY) closed little changed at 97.578 (97.558) despite a slump in US bond yields. The benchmark 10-year yield fell to 2.37%, about 4 basis points from 2019 lows. Core US April Retail Sales dropped to 0.1% from 1.3% as households cut back on purchases of autos and other goods. US Industrial Production fell 0.5% in April following a 0.2% rise in March. Earlier in the day, China’s trifecta of data missed forecasts with falls in Fixed Asset Investment (6.1% from 6.3%), Retail Sales (7.2% from 8.7%) and Industrial Production (5.4% from 6.5%). USD/CNH rose to just under 6.92 before easing to settle at 6.9050 in early Sydney. The slowdown in both economies highlight the effects of the ongoing trade war. What’s even more worrying for investors was that the data preceded the latest round of trade tariffs. The Euro closed flat at 1.1205 after falling to 1.1178. US President Trump reportedly said he would delay a decision on tariffs for European auto imports. The haven Yen was little changed at 109.58 after sliding to 109.15 overnight lows. Sterling slid to 1.2845 (1.2905). 3-month lows on fears that British PM Theresa May was losing her grip on government. Current Brexit talks with the Labour party are deadlocked. The Aussie ended 0.18% lower at 0.6925 (0.6943) ahead of today’s crucial Australian Employment report.

- AUD/USD – The Australian Battler slid to an overnight and near 2019 low at 0.69148 after the release of China’s weak trifecta of data. AUD/USD rallied off its lows to close at 0.6925 ahead of today’s Jobs report.

- GBP/USD – Sterling finds itself slip sliding away once again. The stalemate between the deeply divided opposition Labour Party and ruling Conservations on Brexit talks has put pressure on PM May to step down. Failure to pass the deal by next month could open the door for a more Eurosceptic leader, resulting in a hard Brexit. GBP/USD fell to a 3-month low of 1.28264 before settling at 1.2645.

- USD/JPY – The Dollar slid to a low at 109.15 against the safe-haven Yen before rallying on Japanese corporate buying to 109.58 at the close. USD/JPY traded to a high at 109.70.

On the Lookout: The data misses yesterday from the world’s two largest economies highlight the negative effects of an all-out trade war. While the US Dollar may derive some safe-haven support, the fall in US yields will erode that prop.

Yesterday, the US released its Long-Term Treasury International Capital Data for March or TICS as traders call it. The report highlighted that China sold the largest amount of US treasuries since March 2016 (US$20.45 billion). TICS data represents the balance of domestic and foreign investment. March TIC data fell to -$28.4 billion from the previous month’s +$51.9 billion.

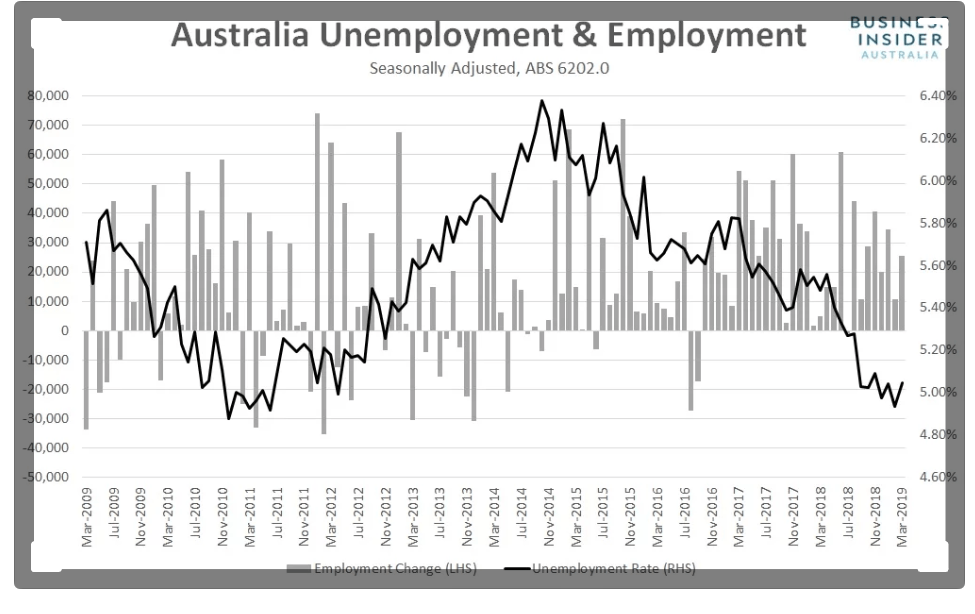

Today sees Australian Employment Change for April which are forecast to slip to 15,200 jobs created from March’s 25,700. The Unemployment Rate is forecast unchanged at 5.0%. Japan releases its Annual PPI data. Eurozone Trade Balance, Canadian Manufacturing Sales, US Building Permits, Housing Starts, Weekly Jobless Claims and Philly Fed Manufacturing round up the day’s data.

Trading Perspective: Without yield support, the Dollar will lose ground against its Rivals. While other global yields fell, the extent was not the same as that of the US. The US TICS data also warns of more erosion of US support. Weaker than forecast Retail Sales and Industrial Production data has seen more predictions of a Fed rate cut in 2019. While this is still unlikely, the thought will weigh on markets.

We highlighted that market positioning from the latest COT/CFTC report saw a small reduction of USD longs from its biggest since December 2015. Speculative USD long bets remain against the major IMM currencies.

- AUD/USD – The oversold Aussie Dollar market will hope for a weak Australian Employment report. The Aussie has immediate support at 0.6910 followed by 0.6870 and 0.6830 (January 2016 lows). Immediate resistance can be found at 0.6950 and 0.6980. Traders will focus on the Unemployment Rate, currently at 5.0%. In its latest statement, the RBA highlighted the need to lower the unemployment rate. A rise in the unemployment rate will see 0.6900 tested before buying support emerges. While a fall in the Jobless rate will see 0.6980/0.7000. Look for a likely trading range of 0.6900-0.7000. Tin helmets on.

- USD/JPY – The Dollar remains heavy against the Yen and any topside moves will be limited today to 109.70 and 110.00. Immediate support can be found at 109.40 and 109.10. Expect Japanese importer buying support to emerge at the low 109 area which are attractive to them. Japan Inc will also be monitoring the USD/JPY pair as any big moves will alert them, specially to the downside. Likely range today 109.20-109.70. Prefer to sell rallies.

- EUR/USD – The Euro ended little changed at 1.1205. Immediate support at 1.1180 is strong and should hold. The latest COT/CFTC report for the week ended May 7 saw a modest increase in speculative EUR short bets to -EUR106,105 from -EUR 105,544. Which are at multi-year highs. Immediate resistance lies at 1.1225 followed by 1.1250. Look to trade a likely range today of 1.1185-1.1245. Prefer to buy dips.

Happy trading all.