Asian markets managed to rebound today from a three-and-a-half month low and oversold levels as President Trump continued his tweets on Tuesday, claiming tariffs had rebuilt America’s steel industry and criticizing Beijing for walking away from a deal. China on Monday announced it would impose higher tariffs on $60 billion of U.S. goods. The Nikkei225 added 0.58 percent to 21,188 the Hang Seng benchmark in Hong Kong finished 0.98 percent higher at 28,396. The Shanghai Composite was the best performer in the region adding 1.91 percent to 2,938, while in Singapore, the FTSE Straits Times index finished 0.04 percent higher at 3,219. Australian stocks closed 44 points higher or 0.7% to 6,284.

European session started lower failing to follow Asian indices, the DAX30 is 0.27 percent lower to 11,959 and CAC40 is 0.48 percent lower at 5,315 while the FTSE MIB in Milan is trading 0.66 percent lower at 20,755. The London Stock Exchange is giving up 0.05 percent to 7,242.

In commodities markets, crude oil trades lower for the second day at 61.24 after the American Petroleum Institute reported bigger-than-expected build in crude oil inventory. Brent oil, on the other hand, trades higher at $71,06 per barrel. Gold retreats from the high at 1303 as investors turn to safe assets amid escalation in US-China trade war and trades at 1295. XAUUSD’s technical picture is bullish as the precious metal holds above the 50 and 100 day moving averages. Gold will find support at 1290, the 50-hour moving average, and on the upside, resistance stands at 1307 the high from April 10th, 2019.

In cryptocurrencies market, Bitcoin (BTCUSD) holds recent gains at 7,980 and continues as yesterday also managed to break above the 8,000 resistance. The daily low for BTC was at 7,616 and the daily high at 8,140. BTCUSD’s immediate support stands at the 50-hour moving average at 7,073 while the next strong support stands at the $6,515 level, the 100-hour moving average, and then at the 7,000 round figure. On the upside, strong resistance stands at 8,158, the high from the Asian session. On Monday the CME Bitcoin futures reached an all-time record high of 33.7k contracts. Ethereum (ETHUSD) continues higher for the fourth day in a row and adds another 20 dollars to 227. On the upside, the immediate resistance stands at 234 while the support stands at 200, Litecoin (LTCUSD) mirrors major cryptocurrencies higher at 92.40. The crypto market cap holds above $175.0B.

On the Lookout: Italy’s deputy prime minister said the country is ready to break European Union budget rules on debt levels if necessary to spur employment.

The Chinese retail spending growth has hit a 16-year low. In the US, the small business optimism improved throughout the month of April, increasing by 1.7 points to 103.5, with one index component falling, another unchanged and the remaining eight improving. US import prices edged higher last month on the back of dearer fuel imports. According to the Department of Labor, import prices rose at a 0.2% month-on-month clip (consensus: 0.7%) in April but were lower 0.2% year-on-year.

Trading Perspective: In forex markets, the US dollar adds 20 cents at 97,35 as traders digest the developments in US-Sino trade war. A stronger US dollar will likely increase the US trade deficit, adding risk that Trump administration continues to target those nations with a significant trade surplus with the US (China – Germany – Europe). The Aussie dollar continues its trip south for another day to 0.6923 after the disappointing macro figures from China. Kiwi also trades lower today at 0.6560.

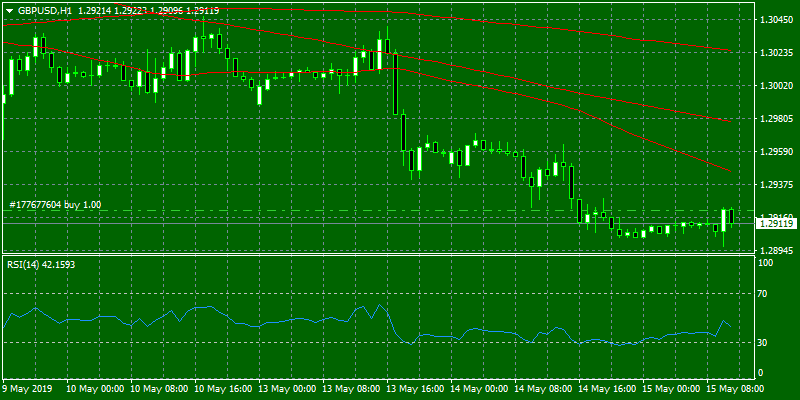

GBPUSD trades lower for one more day after the pair broke yesterday below the 1.30 figure to 1.2914 amid Brexit uncertainty. The pair hit the daily low at 1.2897 and the daily high at 1.2921. On the downside, major support will be found at 1.2865, the low from 25th April. On the upside, immediate resistance stands at 1.30 and then at the 100-day moving average around 1.3015.

In Pound futures markets, the open interest increased for the second consecutive session, this time by around 2.6K contracts on Tuesday. The volume went up once again, this time by nearly 2.5K contracts.

EURUSD trades lower at 1.1207; the pair made the Asian high at 1.1215 and the low at 1.1197. Immediate support can be found at 1.1180, the 200 hours moving average, while more solid support can be found at the yearly low at 1.1115. On the upside, the immediate resistance stands at 1.1236, the bottom of the horizontal resistance line from the three-month trading range, while more offers will emerge at 1.1268 at the 50-day moving average.

In the euro futures market, open interest shrunk by 3.5K contracts on Tuesday from Monday’s final 509,005 contracts. Volume, rose for the second session in a row, this time by just 820 contracts.

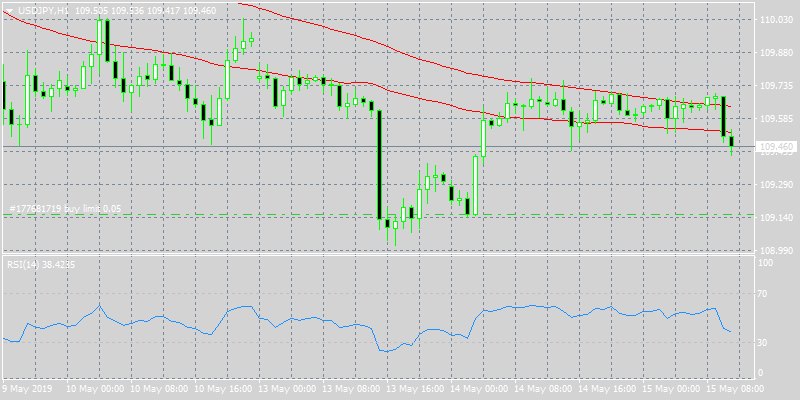

USDJPY consolidates in mid 109 as traders turn their eyes to safe assets amid renewed China-USA trade worries. Today the pair hit the low at 109.47 and the high at 109.69. The pair will find support at 109.14 yesterday’s low. On the upside, immediate resistance for the pair stands at 110 round figure and then at 110.50, the 100-day moving average and then at 111.17, the 50-day moving average.

In Yen futures, the open interest shrunk for the fourth straight session on Tuesday, this time by almost 5.7K contracts. Volume was also down for another session and by around 37.5K contracts.

USDCAD is trading higher at 1.3472 as the retreat in crude oil prices, Canada’s main export item, seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at the 100-day moving average around 1.3335, while extra support stands at 1.3300 round figure. On the upside, immediate resistance stands at 1.3476 the Asian session high while a break above can escalate the rebound towards the 1.35 round figure.