Asian markets finished lower today and fell to a three-and-a-half month low approaching oversold levels as China announced it would impose higher tariffs on $60 billion of U.S. goods. The Nikkei225 lost 0.75 percent to 21,033. The Hang Seng benchmark in Hong Kong finished 1.43 percent lower at 28,135. The Shanghai Composite lost 0.19 percent to 2,898, while in Singapore, the FTSE Straits Times index finished 0.84 percent lower at 3,207. Australian stocks slipped 57 points or 0.9% to 6,239.

US markets fell sharply overnight with the Dow Jones dropping more than 600 points, and the NASDAQ plunged by 3.4%, its worst daily loss in 2019 so far. European session also started lower mirroring Asian indices, the DAX30 is 1.52 percent lower to 11,876 and CAC40 is 1.22 percent lower at 5,262 while the FTSE MIB in Milan is trading 1.35 percent lower at 20,593. The London Stock Exchange is giving up 0.55 percent to 7,163.

In commodities markets, crude oil trades lower for the second day at 61.18 as investors eyes turn to China-US trade war. Brent oil also trades lower at $70,40 per barrel. Gold breaks higher above 1300 as investors turn to safe assets amid escalation in US-China trade war. XAUUSD’s technical picture is now bullish as the precious metal broke above the 50 and 100-day moving average. Gold will find support at 1290, the 50-hour moving average, and on the upside, resistance stands at 1307 the high from April 10th, 2019.

In cryptocurrencies market, Bitcoin (BTCUSD) continues with another leg higher for the sixth straight day and managed to break above the 8,000 resistance. The daily low for BTC was at 7,554 and the daily high at 8,158. BTCUSD’s immediate support stands at the 50-hour moving average at 7,073. While next strong support stands at the $6,515 level, the 100-hour moving average, and then at the 7,000 round figure, on the upside, strong resistance stands at 8,158 the high from the Asian session. Yesterday, the CME Bitcoin futures reached an all-time record high of 33.7k contracts. Ethereum (ETHUSD) mirrors BTC higher and adds another 15 dollars to 207. On the upside, the immediate resistance stands at 213 while the support stands at 187, the 50-hour moving average. Litecoin (LTCUSD) trades higher at 90.40. The crypto market cap holds above $175.0B.

On the Lookout: Moody’s warns on the consequences of a breakdown in US-China trade talks. The Bank of Japan Governor Kuroda said on Tuesday that there is a good chance of interest rates staying low beyond spring 2020. He also added that forward guidance does not mean the central bank will immediately re-evaluate policy in the spring of 2020. The National Australia Bank’s Business Conditions came in at 3, below expectations (4) in April. Also, the Australia National Australia Bank’s Business Confidence came in below forecasts (1) in April, Actual (0).

In the North Atlantic economic calendar, the US data on export and import prices is issued with the NFIB business optimism index and weekly chain store sales data.

Trading Perspective: In forex markets, the US dollar consolidates at 97,16 as traders digest the developments in US-Sino trade war. A stronger US dollar will likely increase the US trade deficit, adding risk that Trump administration continues to target those nations with a significant trade surplus with the US (China – Germany – Europe). The Aussie dollar continues its trip south to 0.6952 after the disappointing business surveys. Kiwi trades flat today at 0.6580 as it continues its corrective bounce.

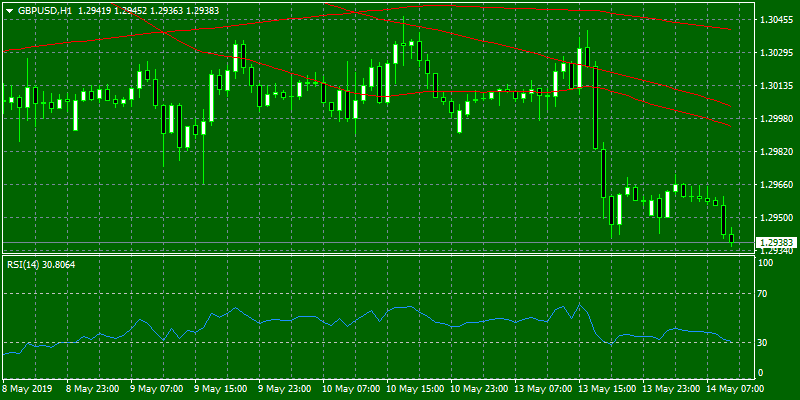

GBPUSD failed to follow euro higher and broke the 1.30 level after two weeks of consolidation amid Brexit uncertainty. The pair hit the daily low at 1.2942 and the daily high at 1.2970. On the downside, major support will be found at 1.2865 the low from 25th April. On the upside, immediate resistance stands at 1.30 and then at the 100-day moving average around 1.3015.

In Pound futures markets, the open interest added around 1.5K contracts on Monday vs. Friday’s final 153,763 contracts. Volume also went up by just 206 contracts.

EURUSD trades flat around 1.1230. The pair made the Asian high at 1.1240 and the low at 1.1219. Immediate support can be found at 1.1180, the 200 hours moving average, while more solid support can be found at the yearly low at 1.1115. On the upside, the immediate resistance stands at 1.1236, the bottom of the horizontal resistance line from the three-month trading range, while more offers will emerge at 1.1268 at the 50-day moving average.

In the euro futures market, open interest rose by more than 3K contracts on Monday, while volume increased by around 13.5K contracts with both readings reversing the previous drop.

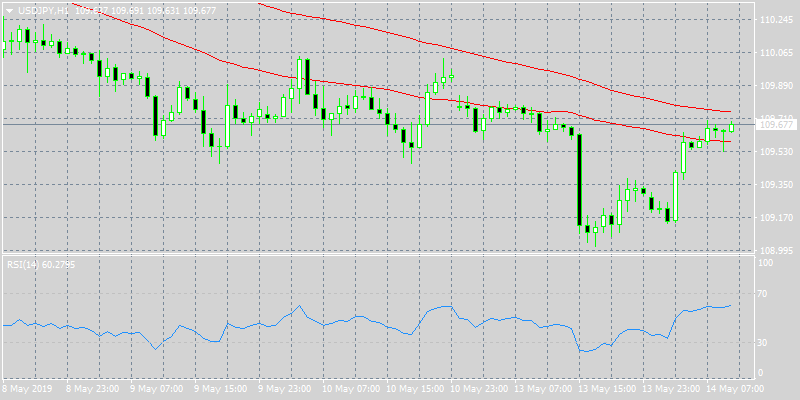

USDJPY is trading below the 110 level for the fourth day as traders turn their eyes to safe assets amid renewed China-USA trade. Today the pair hit the low at 109.14 (a new low) and the high at 109.70 (lower high). The pair will find support at 109.14 the Asian session low. On the upside, immediate resistance for the pair stands at the 110 round figure and then at 110.50, the 100-day moving average, and then at 111.17 the 50-day moving average.

In Yen futures, the open interest shrunk for the third session in a row, this time by nearly 5.5K contracts and volume dropped by around 41.1K contracts.

USDCAD is trading rebounds from yesterdays low at 1.3468 as sellers look exhausted below the 1.3420 zone and weaker prices in crude oil, Canada’s main export item seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at the 100-day moving average around 1.3335 while extra support stands at 1.3300 round figure. On the upside, immediate resistance stands at 1.3486, the Asian session high while a break above can escalate the rebound towards the 1.35 round figure.