Summary: Sterling and the Euro finished with modest gains in quiet holiday affected trade. With US markets absent for the President’s Day holiday, trading volumes were low. Sterling extended its rally from last week’s lows, ending up 0.3% at 1.2927. Markets awaited the outcome of Brexit talks between the EU and Britain. Optimism on renewed trade negotiations between China and the US in Washington this week lifted stocks in Asia. The Dollar Index (USD/DXY) drifted lower to 96.776 from 96.924 yesterday. The Australian Dollar ended little-changed into the RBA’s release of its latest policy meeting minutes later today. Meantime, Saxo Bank reported on the delayed release of the Commitment of Traders CFTC report due to the 35-day US government shutdown. The latest COT report for the week ended January 22 saw net speculative US Dollar long bets against 8 IMM currencies drop to a 6-momth low to US$ 22 billion. This was a week before the FOMC meeting on January 30.

- EUR/USD – The Single Currency posted a modest gain to 1.1315 (1.1300 yesterday) after hitting 3-month lows last week. The Euro’s rally has been mostly technical, having held the strong support at the 1.1240 level. The overnight high of 1.1334 should cap with 1.1340 containing any further gains.

- GBP/USD – Sterling extended its rally, climbing 0.3% to 1.2927. Despite the growing risk of a no-deal Brexit, the Pound has shown amazing resilience. Reuters reports hedge fund buying, most probably short-covering which is logical. Overnight high was 1.29386. The UK releases its Employment data for January later today. Further gains should be limited.

- AUD/USD – The Aussie tested 0.71607 overnight, it’s highest level in two weeks. Metals rose on the back of optimism on the resumption of China-US trade talks in Washington this week. AUD/USD drifted lower to end little-changed at 0.7132 from yesterday. The RBA releases its latest monetary policy meeting minutes today (11.30 am Sydney time). The 0.7170 resistance level is formidable as is the support at 0.7080.

On the Lookout: We can expect a slow start in Asia after last night’s quiet, thin volume trade due to the US holiday. The 24-hour trading ranges should remain intact.

Data released today start off with the RBA release of the minutes of its latest meeting. This is followed by UK Employment data and the ZEW report for German Economic Sentiment. This first-tier data will have an impact on the Pound and the Euro.

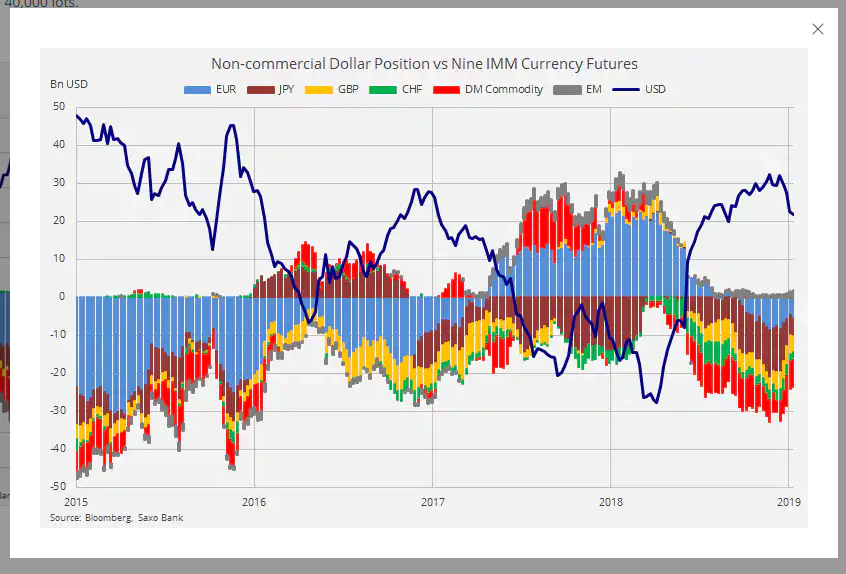

Trading Perspective: The latest Commitment of Traders report for the week into January 22 saw a large drop in net speculative Dollar longs into the January 30 FOMC meeting. Saxo Bank reported that CFTC should be rolling figures twice a week and should catch up by the week into March 5.

Market positioning is an essential tool and can be used as a guide in trading the 8 IMM listed currencies. The report suggests is that the market continued to trim their US Dollar net long positions ahead of the FOMC meeting. Net speculative JPY shorts were cut by a whopping 60% which saw the USD/JPY slip to 108.50. It has since rallied to just under 111.00.

The US Dollar rose against the Emerging Market currencies. USD/ZAR was up 0.62% (14.1274), USD/TRY up 0.57% (5.3030), USD/INR up 0.1% (71.40). This should provide the Greenback with some overall support and in the short term limit any Dollar drops.

- EUR/USD – The Euro traded to a high of 1.13339. Immediate resistance at 1.1340/50 is strong and should cap any attempts to move higher. Immediate support can be found at 1.1300 and then 1.1270/80. Look to trade a range of 1.1290-1.1330 today. Am neutral at current levels so just trade the range shag.

- GBP/USD – Sterling’s uptrend extended to 1.29386 overnight, near highs for a week. Immediate resistance can be found at 1.2950 followed by 1.2980 and 1.3000. Immediate support lies at 1.2900 and 1.2880. The UK Jobs report will be closely watched following the strong rise in Retail Sales on Friday. While the risks continue to grow on a NO-Brexit deal, the topside should be limited, for now. Likely range 1.2870-1.2950. Just trade the range shag on this little puppy too.

- USD/JPY – yesterday’s narrow trading range will see a similar start in Asia today. Immediate resistance lies at 110.60 (110.613 overnight high). The next resistance level can be found at 110.80 and then 111.10. Immediate support lies at 110.40 (overnight low 110.437) and then 110.25. Look to trade a range today between 110.30-110.80. Just trade the range shag.

- AUD/USD – The Aussie was lifted by the risk-on sentiment brought about by renewed optimism in the China-US trade talks. Gains in Metals and resources also buoyed the Australian Dollar. The RBA’s latest meeting minutes should continue to show a neutral stance from the Aussie central bank. Immediate resistance at 0.7160/70 is strong with the next level at 0.7200. Immediate support can be found at 0.7120 and then 0.7090. Look to trade between 0.7110/60. Short term topside should be limited today.

Happy trading all.