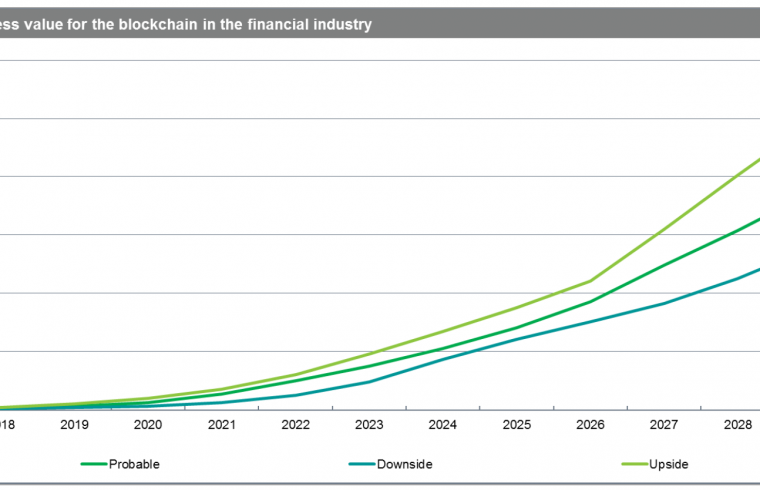

The finance industry blockchain market may reach $462 billion by 2030, according to business information provider IHS Markit. The figure represents explosive growth when compared to the value of blockchain in the financial sector in 2017, at $1.9 billion.

The expected increase in the number of blockchain projects launched and their subsequent commercial deployment in the coming years should result in the aforementioned forecast. Don Tait, principal analyst at IHS Markit, said financial watchdogs in the US, UK, and Hong Kong, among others, are reacting positively towards the technology within the financial sector, which “bolsters the credibility of blockchain technology, helping it become more mainstream.”

Seed CX, an institutional platform for trading digital assets has focused on bridging emerging products with existing infrastructure and regulation. Brian Liston, Seed CX co-founder and COO, told The Industry Spread how positive their experience with regulators has been: “Ultimately, they are interested in learning about emerging technologies and their corresponding business lines, and how they fit into existing regulatory regimes. For example, distributed ledger technology is orthogonal to the idea of centralized clearing. To fully remove a CCP’s position in a market would be a huge leap – but there are a lot of settlement flows, accounting and transfer mechanics that should be replaced with blockchain technology, and those can fit within existing CCP rules nicely.”

The IHS Markit paper projects the global financial market, which includes fintech and insurance, to continue to be the largest value market using blockchain technology as it can be leveraged for cross-border payments, share trading and syndicated lending with greater speed, auditability, and cost-reduction.

“The global financial market has the opportunity to tap into this infrastructure and unlock huge value through broader asset tokenization. The ETF, for example, is an excellent tool used to reduce the cost of trading portfolios, structured products, commodities, and other financial products. Tokenized baskets traded and settled on a blockchain could be the next stage in that evolution”, said Brian Liston, whose company targets spot, derivatives and OTC settlement of digital assets.

The study goes on to say that even a small percentage of cost savings and efficiency gains can lead to significant business value for companies and industries that introduce blockchain technology. For example, the derivatives market is worth around $544 trillion a year and the market capitalization of all the world’s stock markets is equal to $73 trillion. The team at IHS Markit estimates that applying blockchain to the clearing and settlement of cash securities, investment companies could save up to $12 billion in fees. Firms can also reduce costs by cutting out many of the traditional middlemen.

Is $462 Billion Too Far-Fetched?

In regard to the “$462 billion by 2030” projection, GMEX CEO Hirander Misra is not surprised with the seemingly high figure provided as the world prepares to store its economy on blockchain technology.

“Whilst these numbers may seem rather high given that statistics can paint whatever picture one wants to get headlines, there is no doubt that blockchain will have a transformational impact on the financial services industry. A recent survey of executives and experts by the World Economic Forum predicted that 10% of Global GDP would be stored on blockchain technology by 2027. This based on 2018 amounts to around $USD8.5 trillion.

The WEF report mentioned by Misra, dubbed “Deep Shift Technology: Tipping Points and Societal Impact”, was published in September 2015, when the cryptocurrency market was worth $4 billion. It is now valued at $120 billion after peaking near $800 billion in early 2018. The document aggregates expectations of 800 experts such as an explosion in tradable assets; better property records in emerging markets, and the ability to make everything a tradable asset. It could also drive the disintermediation of financial institutions, as new services and value exchanges are created directly on the blockchain.

“The current intermediary model will be challenged and become more efficient despite the incumbents trying to create the same processes which exist with the incumbent model. This will be applicable to banking, payments, exchanges and post-trade market infrastructure to name but a few”, Misra added.

GMEX is a provider of multi-asset exchange trading and post-trade technology through a partnership-driven approach in order to create an ecosystem with exchanges and post-trade market infrastructure operators under a hybrid system. The firm has recently partnered with MINDEX to launch the first blockchain securities exchange in Mauritius. In late 2018, GMEX acquired a 30% stake in USAVE to build a secure digital exchange for physical gold.

The IHS Markit report was published in the same week that J.P. Morgan Chase announced its very own digital coin for payments and becoming the first U.S. bank to create and successfully test a digital coin representing a fiat currency. JPM Coin was designed to enable instantaneous transfer of payments between institutional accounts and reduce clients’ counterparty and settlement risk, as well as capital requirements. The digital coin will be issued on Quorum Blockchain, the bank’s proprietary technology, but operable on all standard Blockchain networks.

The IHS Markit report was published in the same week that J.P. Morgan Chase announced its very own digital coin for payments and becoming the first U.S. bank to create and successfully test a digital coin representing a fiat currency. JPM Coin was designed to enable instantaneous transfer of payments between institutional accounts and reduce clients’ counterparty and settlement risk, as well as capital requirements. The digital coin will be issued on Quorum Blockchain, the bank’s proprietary technology, but operable on all standard Blockchain networks.